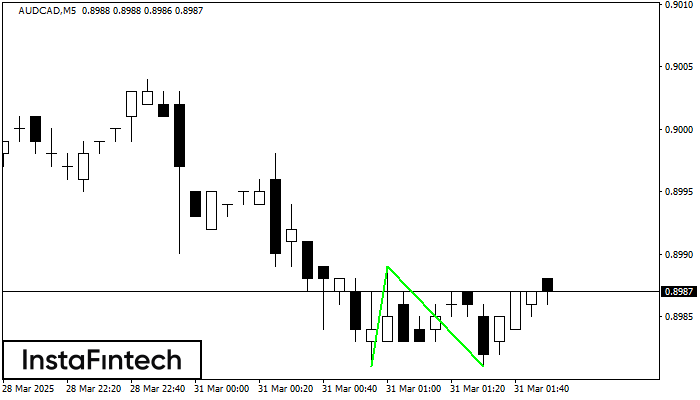

Double Bottom

was formed on 31.03 at 00:51:02 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDCAD M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.8989 is broken. The further movements will rely on the width of the current pattern 8 points.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

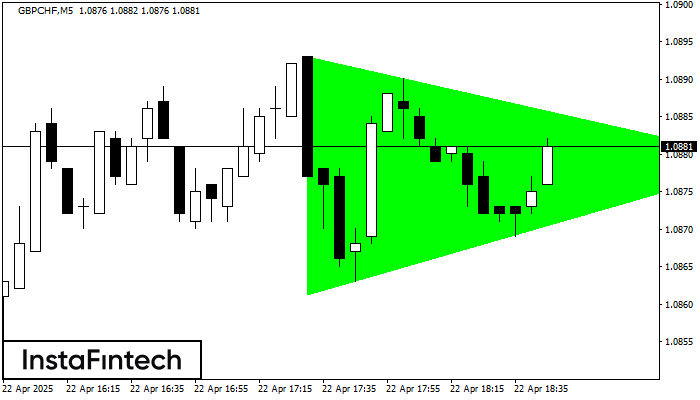

Segi Tiga Simetri Menaik

was formed on 22.04 at 17:48:58 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, GBPCHF membentuk corak Segi Tiga Simetri Menaik. Penerangan: Ini adalah corak kesinambungan aliran. 1.0893 dan 1.0861 adalah koordinat sempadan atas dan bawah masing-masing. Lebar corak diukur pada

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

Segi Empat Menaik

was formed on 22.04 at 17:40:16 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, NZDJPY telah membentuk Segi Empat Menaik. Jenis corak ini menunjukkan kesinambungan aliran. Ia terdiri daripada dua tahap: rintangan 84.40 dan sokongan 84.26. Sekiranya tahap rintangan 84.40

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

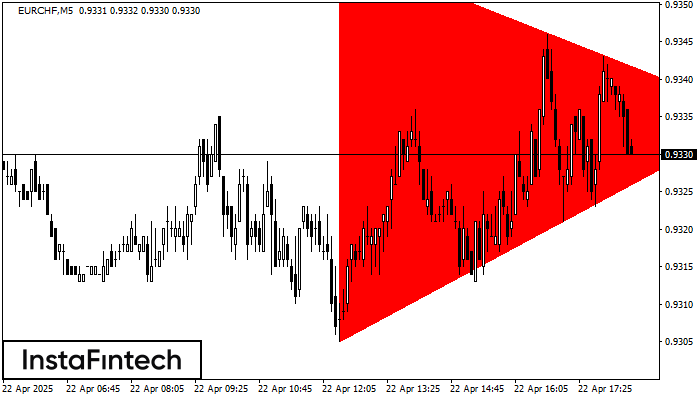

Segi Tiga Simetri Menurun

was formed on 22.04 at 17:31:26 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, EURCHF membentuk corak Segi Tiga Simetri Menurun. Cadangan dagangan: Penembusan sempadan bawah 0.9305 mungkin mendorong kepada kesinambungan aliran menurun

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window