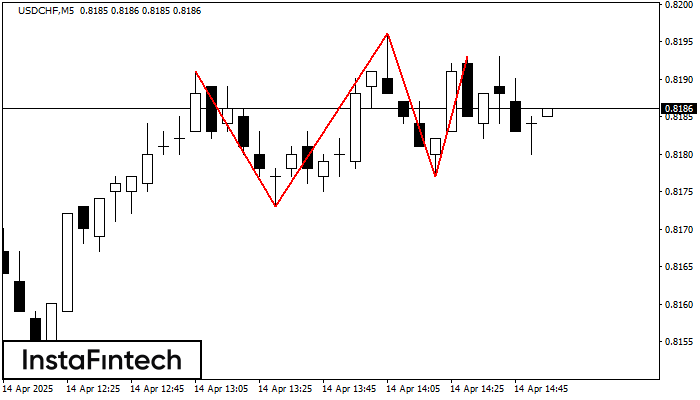

Triple Top

was formed on 14.04 at 13:55:08 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the USDCHF M5 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -2, support level -4, and pattern’s width 18. Forecast If the price breaks through the support level 0.8173, it is likely to move further down to 0.8181.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

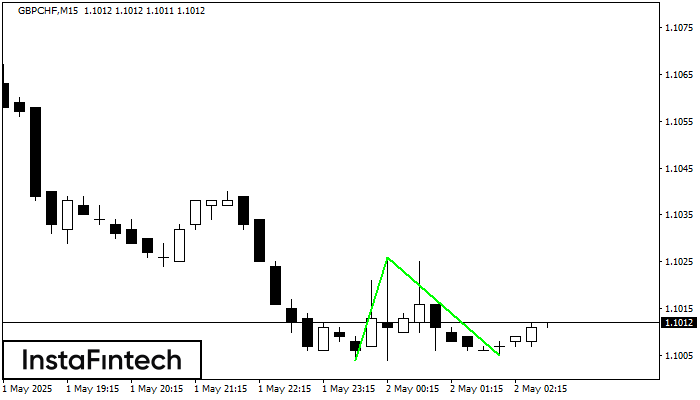

Double Bottom

was formed on 02.05 at 01:45:41 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on GBPCHF M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 02.05 at 01:44:53 (UTC+0)

signal strength 1 of 5

According to the chart of M5, GOLD formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 3230.87/3238.10 whereas the upper border goes across 3242.94/3238.10

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

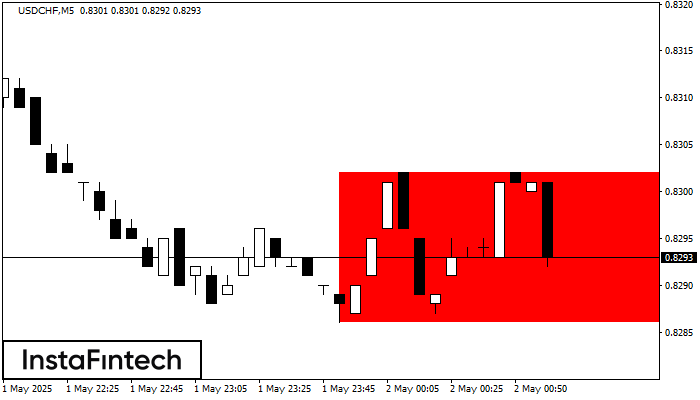

Bearish Rectangle

was formed on 02.05 at 00:00:47 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDCHF formed the Bearish Rectangle which is a pattern of a trend continuation. The pattern is contained within the following borders: lower border 0.8286

The M5 and M15 time frames may have more false entry points.

Open chart in a new window