Vea también

14.04.2025 06:08 AM

14.04.2025 06:08 AMOn Friday, the GBP/USD pair also continued its upward movement. The reasons are the same as for the EUR/USD pair. The entire macroeconomic backdrop on Friday once again had virtually no relevance for traders, although it must be acknowledged that, for once, the macroeconomic data from the UK was strong. February's GDP rose by 0.5%, significantly higher than expected, and industrial production increased by 1.5%, well above forecasts. As a result, the British pound received an additional bullish factor early in the day. Whether it was needed is unclear—sterling has been rising nearly every day for three months now. Further movement in the currency pair will continue to depend on the state of the global trade war—especially the relationships between the U.S. and the EU and the U.S. and China.

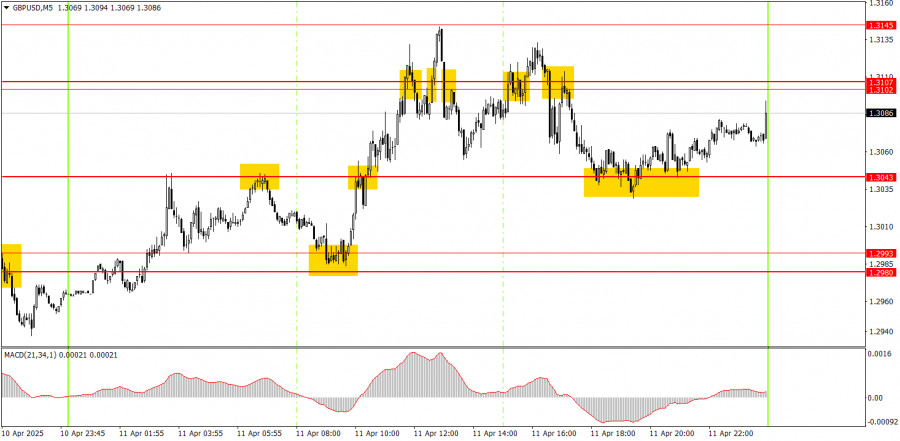

On the 5-minute timeframe Friday, the price also frequently changed direction, and volatility remained high. As a result, a large number of trading signals were generated, about half of which were less than ideal. As previously mentioned, current market movements are emotional and erratic. While some signals can yield solid profits, the percentage of false signals is also quite high.

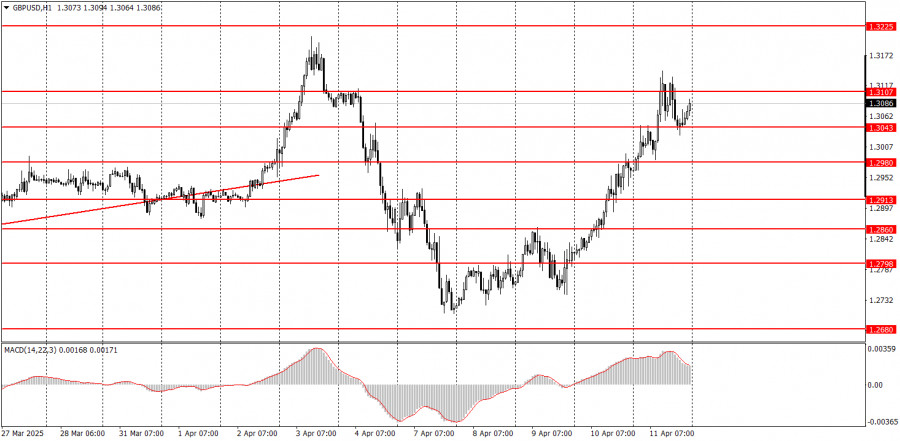

On the hourly chart, the GBP/USD pair should have entered a downtrend long ago, but Trump continues to do everything he can to push the dollar lower. Since the official start of the global trade war, we've refrained from making long-term projections for currency pairs. The market remains under the control of Trump and his decisions: He announces new tariffs, and the dollar drops. He raises tariffs, and the dollar drops again. When escalation pauses, the market moves sideways.

On Monday, GBP/USD may remain in a stormy state. Predicting how the pound and the dollar will move today is practically impossible. The pair continues to rise logically at the moment, but no one knows what new headlines might emerge from Beijing, Brussels, or Washington.

On the 5-minute timeframe, the following levels are valid for trading: 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3225, 1.3272.

No significant events are scheduled for Monday in the UK or the U.S., but that doesn't mean important developments won't occur throughout the day. The trade war continues and is gaining momentum. So far, Trump's "discounts" have had no positive effect on the dollar.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.3282

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel 1.1320

GBP/USD: plan para la sesión europea del 30 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra se prepara para un nuevo salto, pero

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que sucedió allí. En mi pronóstico de a mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel de 1.3342

Ayer no se formaron puntos de entrada al mercado. Propongo echar un vistazo al gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico matutino, presté atención

GBP/USD: plan para la sesión europea del 28 de abril. Informes Commitment of Traders COT (análisis de las operaciones de ayer). La libra formó un nuevo canal, manteniendo las posibilidades

El pasado viernes no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué ocurrió. En mi pronóstico matutino presté atención al nivel 1.1391

Ayer se formaron varios puntos excelentes de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino presté atención al nivel

Ayer no se formaron puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos qué pasó allí. En mi pronóstico matutino presté atención al nivel de 1.1358

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.