Vea también

11.04.2025 06:22 PM

11.04.2025 06:22 PMTrade Breakdown and Tips for Trading the British Pound

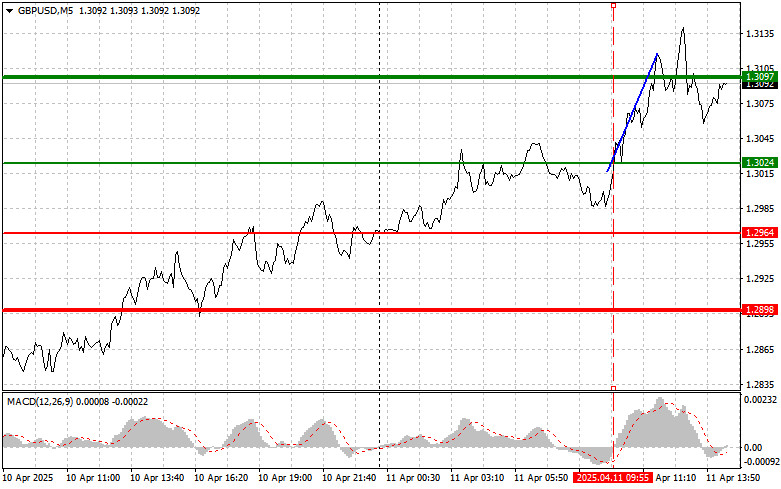

The test of the 1.3024 price level occurred just as the MACD indicator was beginning to move upward from the zero line, confirming a correct entry point to buy the pound. As a result, the pound rose by 100 points.

Strong UK GDP data triggered another wave of British pound appreciation. Investors took this as a signal of greater resilience in the UK economy, easing fears of a potential recession. The pound's strength is also supported by expectations that the Bank of England will maintain interest rates, even though inflation in the UK is gradually declining, meaning there is no urgent need for further tightening.

Today, FOMC member John Williams is scheduled to speak. Additionally, U.S. Producer Price Index (PPI) data will be released. A drop in inflation could further weaken the dollar, driving up demand for riskier assets, including the pound. As for Williams' speech, investors will be watching closely for any hints of a shift in Fed monetary policy, as his remarks could provide valuable insights into the regulator's next steps.

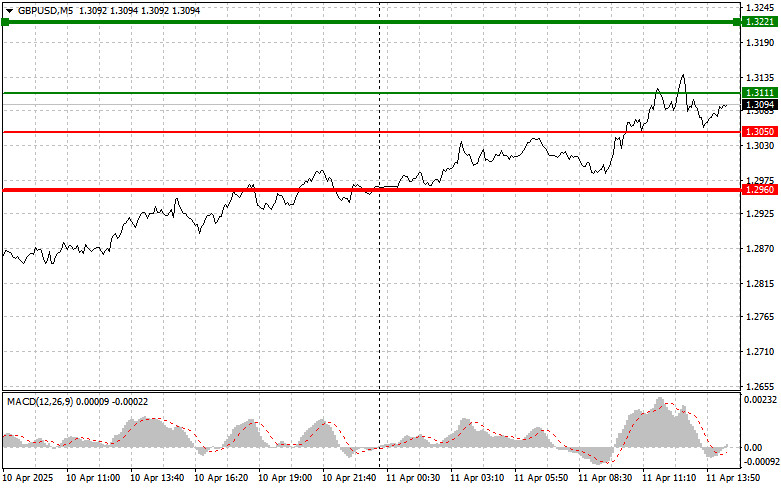

For today's intraday strategy, I will rely mainly on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches the entry point around 1.3111 (green line on the chart), targeting a rise to 1.3221 (thicker green line). At 1.3221, I will exit long positions and open short trades in the opposite direction, anticipating a 30–35 point pullback from that level. A pound rally today is possible if U.S. inflation data disappoints. Important! Before buying, make sure the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3050 twice in a row while the MACD is in the oversold zone. This should limit the pair's downward potential and trigger a reversal upward. A rise toward 1.3111 and 1.3221 may then be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the price breaks below 1.3050 (red line), which could lead to a quick drop in the pair. The main target for sellers will be 1.2960, where I plan to exit short positions and open long ones in the opposite direction (expecting a 20–25 point bounce). Sellers will become more active if the data is strong. Important! Before selling, make sure the MACD is below the zero line and just starting to decline from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3111 twice while the MACD is in the overbought zone. This should limit the pair's upward potential and trigger a downward reversal. A decline toward 1.3050 and 1.2960 may then follow.

Chart Notes:

Important for Beginners:

Forex beginners must be extremely cautious when deciding to enter the market. It is best to stay out of the market before major economic reports to avoid being caught in sharp volatility. If you decide to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you're trading large volumes without money management.

And remember, successful trading requires a clear plan, like the one presented above. Making impulsive trades based on current market conditions is an inherently losing strategy for intraday traders.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Análisis de las operaciones y consejos para operar con el yen japonés La prueba del nivel de precio 157.98 coincidió con el momento en que el indicador MACD había descendido

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.