Vea también

10.04.2025 08:05 AM

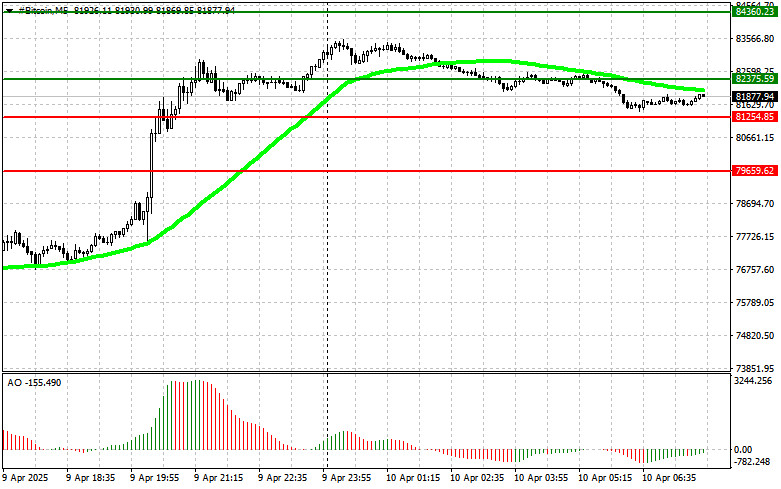

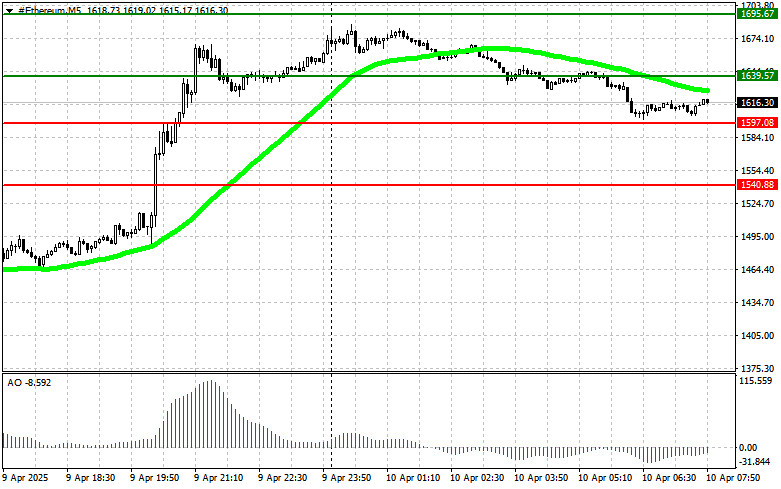

10.04.2025 08:05 AMBitcoin and Ethereum both surged, gaining between 6% and 10% on news that Trump had suddenly changed his mind.

A strong wave of FOMO is evident in BTC following news of a 90-day pause on U.S. reciprocal tariffs. However, this is no time for euphoria or panic buying. It's important to understand that the trade war issue remains unresolved. Moreover, historical analysis shows that such "pauses" often provide only temporary relief, usually followed by renewed tensions and subsequent sell-offs of risk assets. Investors are advised to remain cautious and not be swayed by short-term market swings.

Instead of impulsive purchases driven by fear of missing out, it's better to stick to a well-crafted trading strategy. Asset diversification, prudent capital allocation, and stop-loss levels help reduce risks and protect long-term investments. One must remember that the crypto market is highly volatile, and caution remains the trader's best ally.

On the crypto market, I will continue to operate based on major pullbacks in Bitcoin and Ethereum, expecting a bullish trend to resume in the medium term, which is still intact.

As for short-term trading, the strategy and conditions are described below.

Scenario #1:

Buy Bitcoin today at the entry point near $82,350, with a target of $84,400. I plan to exit long positions around $84,400 and open short positions on the pullback.

Important: Before entering on a breakout, confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2:

Buy Bitcoin from the lower boundary of $81,200 if there's no reaction to a downward breakout, targeting a rebound toward $82,350 and $84,400.

Scenario #1:

Sell Bitcoin today at the entry point near $81,200, targeting a drop to $79,600. Exit shorts and consider buying at the bounce from $79,600.

Important: Before entering on a breakout, make sure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2:

Sell Bitcoin from the upper boundary of $82,400 if there's no breakout reaction, targeting a move back to $81,200 and $79,600.

Scenario #1:

Buy Ethereum today at the entry point near $1,639, aiming for a rise to $1,695. Exit long positions at $1,695 and switch to shorts on the pullback. Important: Confirm that the 50-day moving average is below the current price, and the Awesome Oscillator is in positive territory.

Scenario #2:

Buy Ethereum from the lower boundary of $1,597 if there's no breakout response, targeting a rebound to $1,639 and $1,695.

Scenario #1:

Sell Ethereum today at the entry point near $1,597, targeting a fall to $1,540. Exit shorts at $1,540 and open long positions on the bounce.

Important: Ensure the 50-day moving average is above the current price, and the Awesome Oscillator is in negative territory.

Scenario #2:

Sell Ethereum from the upper boundary of $1,639 if there's no breakout reaction, targeting a return to $1,597 and $1,540.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Los compradores de el Bitcoin y Ethereum continúan aprovechando bien los momentos de caída del mercado y lo compran bastante rápido, como se demostró hoy durante la sesión asiática

El Bitcoin no mostró ningún movimiento interesante ni el sábado ni el domingo. Sin embargo, el viernes el precio retiró liquidez del último Lower High. Recordemos que la retirada

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.