Vea también

24.03.2025 09:13 AM

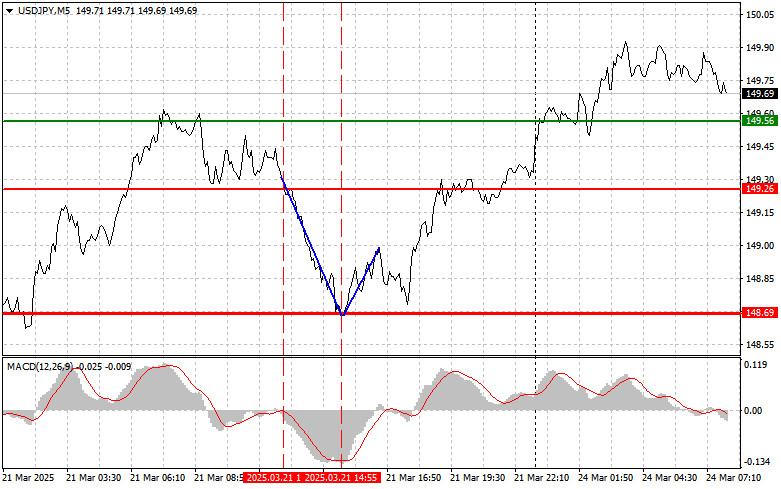

24.03.2025 09:13 AMThe test of the 149.26 level occurred when the MACD indicator had just begun to move downward from the zero line, confirming a valid entry point for selling the dollar. As a result, the pair fell toward the target level of 148.69. Buying from that level on a rebound also allowed traders to take about 30 pips of profit from the market.

Today's news that Japan's Manufacturing PMI and Services PMI came in significantly worse than economists had forecast triggered a yen sell-off and a dollar strengthening. Investors reacted instantly to the weak economic data, fearing a slowdown in Japan's economic growth and, as a result, decreased demand for the yen. Another factor that increased pressure on the yen was the expectation that the Federal Reserve would maintain its hawkish monetary policy. Confidence in the stability of the U.S. economy, supported by recent macroeconomic data, is pushing investors toward dollar purchases, making it a more attractive asset. However, despite this, there is no longer a significant divergence in the monetary policies of Japan and the U.S. The Bank of Japan continues to lean toward raising interest rates, so the current dollar rally against the yen may end quickly — especially in light of hints from the Japanese central bank regarding further monetary tightening.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

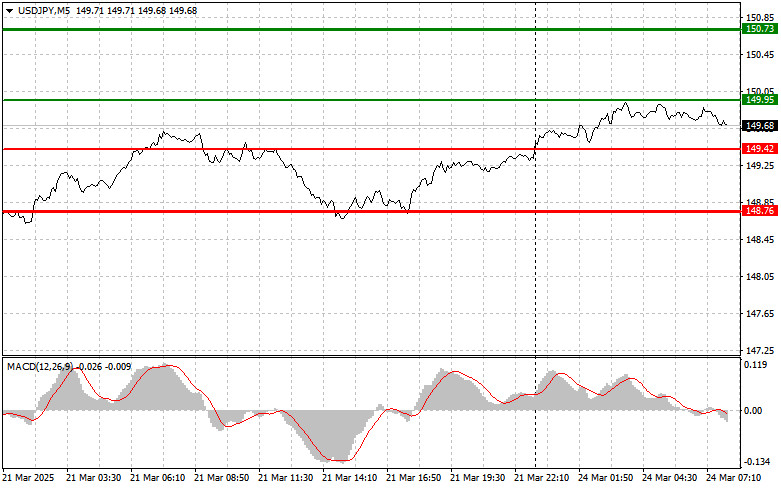

Scenario #1: Today, I plan to buy USD/JPY upon reaching the entry point of around 149.95 (green line on the chart), with a target of 150.73 (thicker green line). Around 150.73, I intend to exit the long trade and open a sell position in the opposite direction, aiming for a 30–35 pip pullback. It's best to return to buying the pair on corrections and deep pullbacks in USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero line and starting to rise.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 149.42 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal. A move toward the opposite levels of 149.95 and 150.73 can be expected.

Scenario #1: I plan to sell USD/JPY only after the 149.42 level (red line on the chart) is broken, leading to a sharp drop in the pair. The main target for sellers will be 148.76, where I intend to exit short positions and immediately open buy positions in the opposite direction, aiming for a 20–25 pip pullback. Downward pressure on the pair could return at any moment. Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 149.95 level while the MACD indicator is in the overbought zone. This would limit the pair's upside potential and trigger a downward reversal. A move toward the opposite levels of 149.42 and 148.76 can be expected.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Análisis de las operaciones y consejos para operar con el yen japonés La prueba del nivel de precio 157.98 coincidió con el momento en que el indicador MACD había descendido

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.