Vea también

18.03.2025 05:04 AM

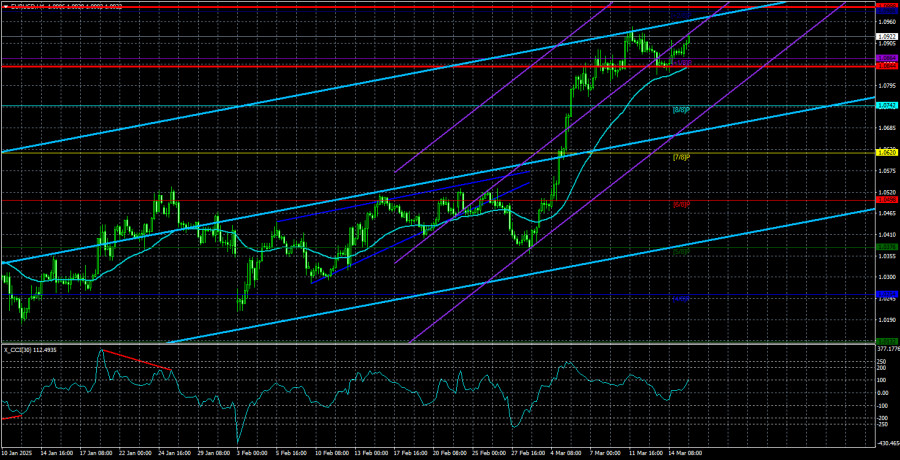

18.03.2025 05:04 AMThe EUR/USD currency pair has resumed its upward movement. Since there was very little news on this day, and none of it was significant, volatility remained quite low, preventing the euro from making any sharp moves. More precisely, the euro has been trading within the sideways range of 1.0800–1.0935 for over a week. This range is not a classic flat pattern but rather a defined area where the price has remained for an extended period. The movement is more sideways than upward, but the uptrend remains intact.

Most of this trend occurred over three days two weeks ago when the euro surged by 400 pips. Over the past two months, the remaining movement has been just 350 pips from minimum to maximum. The market continues to ignore everything—lack of news, the need for a downward correction, strong dollar-positive news, and the global fundamental background. The only factor that remains significant is Donald Trump's tariff policies. Their impact on the economy is difficult to predict. Many experts suggest that the U.S. economy is headed for a slowdown, with some expecting a recession. Others believe the Federal Reserve will accelerate rate cuts in the coming years. Either way, the discussion revolves around worsening fundamentals for the dollar.

However, now, the U.S. economy is not facing any real problems—these are merely market participants' fears. Last year, the market prematurely priced in 6–7 rate cuts in advance, expecting at least four reductions in 2025. In reality, things turned out very differently. The same could happen now. The market is preparing for the worst-case scenario and the most dovish stance from the Fed, but that doesn't mean it will happen.

It is important to remember that the dollar has been rising for 16 years. Every trend ends eventually, but are Trump's tariffs enough to break the U.S. economy? Are they sufficient to end the dollar's 16-year rally? We strongly doubt it. However, the market is panicking, expecting the worst and uninterested in the dollar.

The biggest challenge for traders is that no one knows how long the dollar's decline due to Trump will continue or how much longer all other news will be ignored. On higher timeframes, the technical picture still indicates a downtrend. The macroeconomic background does not justify such a substantial rise in the euro, especially since the Eurozone economy remains stagnant. However, nothing prevents the market from continuing to sell off the U.S. currency, even though this movement does not align with the broader context of the EUR/USD pair.

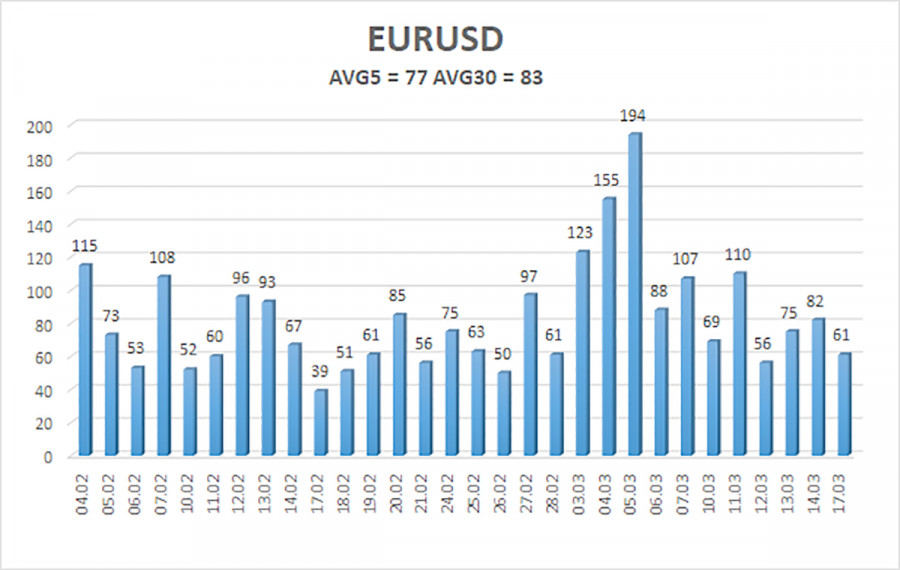

The average volatility of the EUR/USD pair over the past five trading days, as of March 18, is 77 pips, which is considered "moderate." On Tuesday, we expect movement between the levels of 1.0844 and 1.0998. The long-term regression channel has turned upward, but the overall downtrend remains intact, as higher timeframes indicate. The CCI indicator previously entered the oversold area, signaling the start of a new upward correction, which no longer resembles a correction.

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

R1 – 1.0986

The EUR/USD pair has exited the sideways channel and continues to rise. For months, we have maintained that the euro will likely decline in the medium term, and this outlook has not changed. The dollar still has no fundamental reasons for a sustained downtrend—except for Donald Trump. Short positions remain much more attractive, with targets at 1.0315 and 1.0254. However, predicting when this somewhat irrational rise will end is difficult. If you are trading purely based on technicals, long positions can be considered if the price remains above the moving average, with targets at 1.0986 and 1.0998.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El par GBP/USD se corrigió ligeramente a la baja después de subir el lunes sin motivo aparente. Sin embargo, llamar a este movimiento mínimo hacia abajo un «crecimiento del dólar»

El par de divisas GBP/USD también se negoció el lunes con baja volatilidad y prácticamente en una dirección lateral, aunque la libra esterlina mantiene una ligera inclinación alcista. A pesar

El par de divisas GBP/USD el viernes también se negoció con baja volatilidad y sin ningún entusiasmo. Sin embargo, la libra esterlina todavía mantiene una ligera inclinación alcista

El par de divisas EUR/USD el jueves continuó negociándose de manera bastante tranquila, aunque la volatilidad sigue siendo bastante alta. El dólar estadounidense mostró esta semana al menos alguna recuperación

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.