Vea también

03.12.2024 07:30 AM

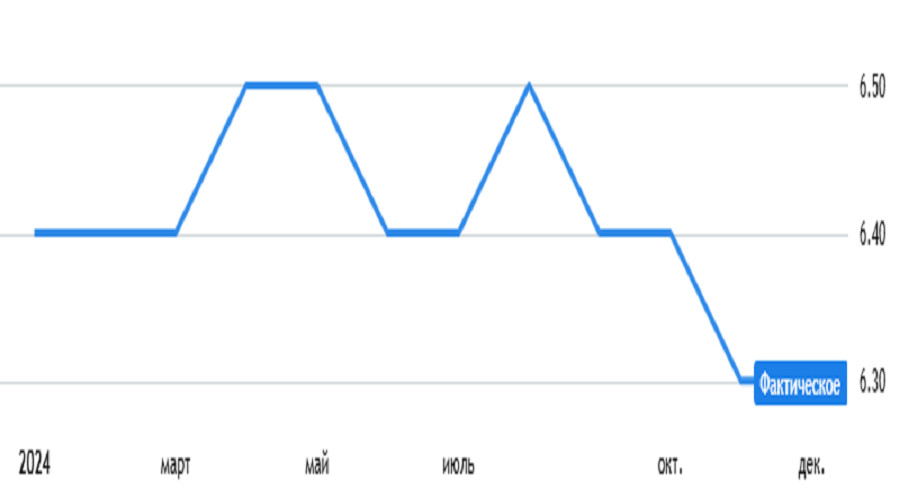

03.12.2024 07:30 AMInstead of rising from 6.3% to 6.4%, the Eurozone unemployment rate remained unchanged. However, this did not impact the market, and prices stayed flat. This is partly due to news from France, where a full-fledged political crisis is emerging. After the prime minister bypassed parliament to push through a law on additional social spending, left- and right-wing parties are ready to unite and issue a vote of no confidence in the government, which naturally does not add optimism for the euro.

Developments in France will be a key factor in today's trading. This is mainly because the only noteworthy macroeconomic data will come from the United States, specifically the report on job openings. Otherwise, the economic calendar is empty. However, the job openings data is unlikely to impact the market significantly, as it provides limited insights for long-term conclusions.

The expected reduction in job openings by 63,000 doesn't convey much information. This decline could result either from higher employment or from reduced job opportunities.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.