Vea también

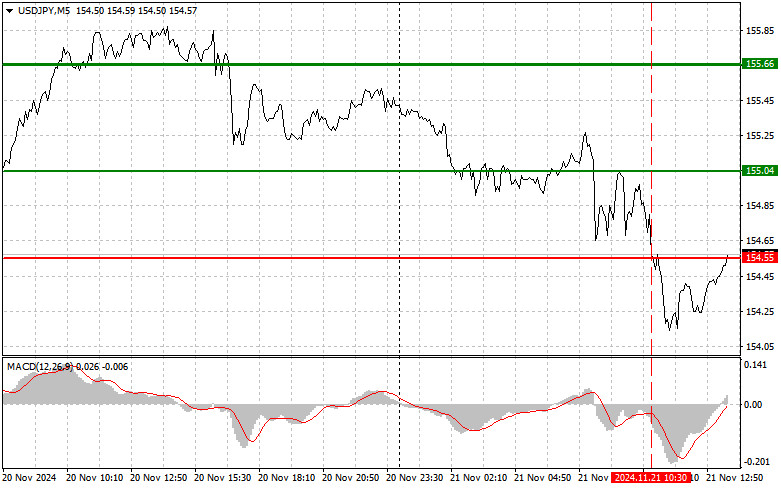

The price test at 154.55 during the first half of the day coincided with the MACD indicator moving significantly below the zero mark, limiting the pair's bearish potential. For this reason, I did not sell the dollar, even considering recent statements from the Governor of the Bank of Japan, Kuroda. The narrowing gap between the policies of the US Federal Reserve and the Bank of Japan continues to affect market volatility. However, the US dollar remains dominant, despite Japanese policymakers' efforts to counteract its strength.

The growing correlation between the Federal Reserve's and the Bank of Japan's policies is prompting investors to reassess their expectations. As the Fed shows confidence in its rate decisions and Japan maintains monetary stimulus, uncertainty increases. This leads to volatility in financial markets as traders adapt to rapidly changing conditions. The yen's strength is largely indicated by statements from Japanese officials emphasizing their commitment to a more hawkish monetary policy. However, despite Japan's ambitions to strengthen its currency, the yen continues to weaken, creating additional opportunities for the US dollar. High inflation in the US and the Fed's potential decision to maintain current monetary policy further increase the dollar's appeal among investors. Fresh US labor market data should highlight the strength of the US economy, supporting further dollar gains. For intraday strategy, I will focus on scenarios #1 and #2.

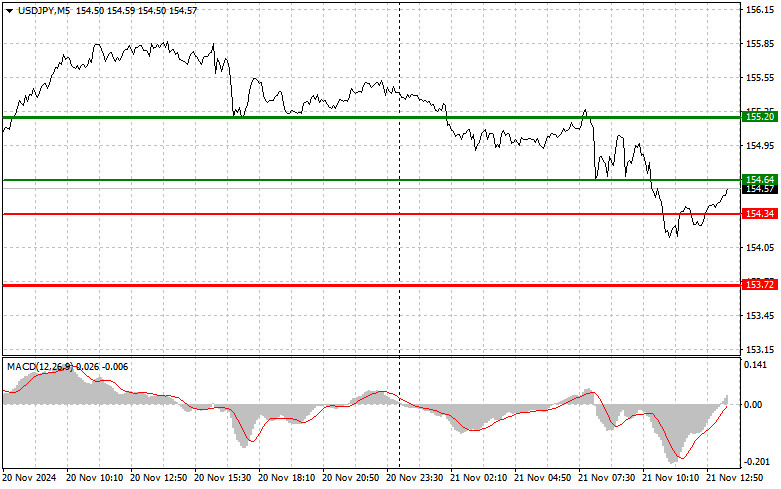

Scenario #1:I plan to buy USD/JPY today if the price reaches 154.64 (green line on the chart), targeting a rise to 155.20 (thicker green line on the chart). At 155.20, I will close long positions and initiate short positions, targeting a 30-35 point reversal. The pair may continue rising as part of a new upward trend.Note: Before buying, ensure the MACD indicator is above the zero mark and beginning to rise.

Scenario #2:I will also buy USD/JPY today if there are two consecutive tests of the 154.34 price, with the MACD indicator in the oversold area. This should limit the pair's downward potential and trigger an upward reversal toward resistance levels at 154.64 and 155.20.

Sell Signal

Scenario #1:I plan to sell USD/JPY today after the price breaks below 154.34 (red line on the chart), triggering a quick decline in the pair. The key target for sellers will be 153.72, where I will close short positions and immediately open long positions, targeting a 20-25 point reversal. Sellers are likely to respond if the Fed adopts a hawkish stance.Note: Before selling, ensure the MACD indicator is below the zero mark and beginning to decline.

Scenario #2:I will also sell USD/JPY today if there are two consecutive tests of the 154.64 price, with the MACD indicator in the overbought area. This should limit the pair's upward potential and trigger a downward reversal toward support levels at 154.34 and 153.72.

For beginners in Forex trading, it is crucial to make careful entry decisions. Before the release of key fundamental reports, it is advisable to stay out of the market to avoid sharp fluctuations. If trading during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss orders, you risk depleting your capital, especially when trading large volumes without proper money management. A clear trading plan, like the one above, is essential for success. Spontaneous trading decisions based on current market conditions often lead to losses for intraday traders.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.