Vea también

The Australian dollar is recovering today as the U.S. Dollar Index retreats from its yearly highs. The recent downtrend in the AUD/USD pair has largely been driven by domestic economic data from Australia. Mixed economic data from China, a key trading partner of Australia, have had minimal impact on the Australian dollar.

During a press conference, China's National Bureau of Statistics highlighted improving consumer expectations in October and announced plans to intensify policy adjustments and boost domestic demand.

Downward pressure on the Australian dollar remains limited by relatively hawkish remarks from Reserve Bank of Australia (RBA) Governor Michele Bullock. She emphasized that current interest rates are constraining inflationary pressures and will remain at this level until the central bank gains greater confidence in its inflation outlook.

Meanwhile, the U.S. Dollar Index, which tracks the greenback against six major currencies, has retreated from its yearly peak of 107.03, recorded last Thursday.

Markets are shifting focus to the release of U.S. retail sales data for October, due later, during the North American session. Comments from Federal Reserve officials are also expected to influence market sentiment.

RSI Analysis: The 14-day Relative Strength Index (RSI) hovers near oversold territory, signaling a pause in the decline and the potential for correction in the pair.

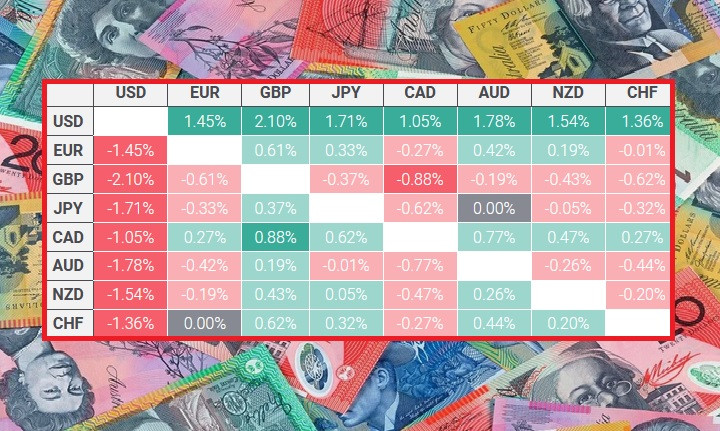

The table below shows the percentage change of the Australian dollar against major currencies this week. Notably, the Australian dollar has been the weakest performer relative to the U.S. dollar.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.