Vea también

16.06.2022 12:11 PM

16.06.2022 12:11 PMYesterday, the results of the June meeting of the US Federal Reserve System (FRS) were summed up, as a result of which the US Central Bank exceeded economists' forecasts for a rate hike by 50 basis points, raising the federal funds rate by 75 bps at once. There is a lot of information related to yesterday's events, so I propose to provide it in a more concise form, taking into account specific and most important factors. We have already identified the first one, and it was supposed to be quite positive for the US dollar. However, the market owes nothing to anyone, and we will see this once again by looking at the EUR/USD price chart a little later. In the meantime, we will continue to analyze the results of yesterday's Fed meeting and the press conference of the head of this department, Jerome Powell.

If we go back to the distribution of votes on the decision to raise the rate by 75 bp, it was adopted by almost all members of the Open Market Committee – ten to one. At the same time, only Esther George turned out to be a lonely "dovish" against this background, who voted for a rate increase by the expected 50 bps. As it was easy to assume, the Fed signaled a further rate hike to lower inflation to the regulator's target level of 2%. At the moment, this is the primary task of the Federal Reserve. At the same time, the point forecasts for interest rates were changed in the direction of their increase. Thus, the previous forecast for rates at the end of this year at 1.9%, indicated in March, has undergone significant changes and has changed towards a growth of as much as 3.4%. The long-term forecast for the change in the interest rate also changed slightly in the direction of its increase from the March 2.4% to the current 2.5%.

According to Jerome Powell, expectations of inflationary growth are growing, which is why a more aggressive tightening of monetary policy has become justified, which resulted in a rate increase of 75 bps, not 50, but 75 bps. From the main terms, it is also worth noting that the Fed head expects a gradual smoothing of inflation, and at the next meeting, a rate increase on federal funds may fluctuate between 50 and 75 bps. Naturally, the head of the Fed did not ignore the topic of careful monitoring of incoming macroeconomic data. So, to sum up, the main factor in raising the rate by 75 bps in June was increased inflation expectations, as well as the latest negative CPI data. By the way, at the previous meeting, Powell warned that in case of negative inflation data, the Fed's actions would be more aggressive, which happened.

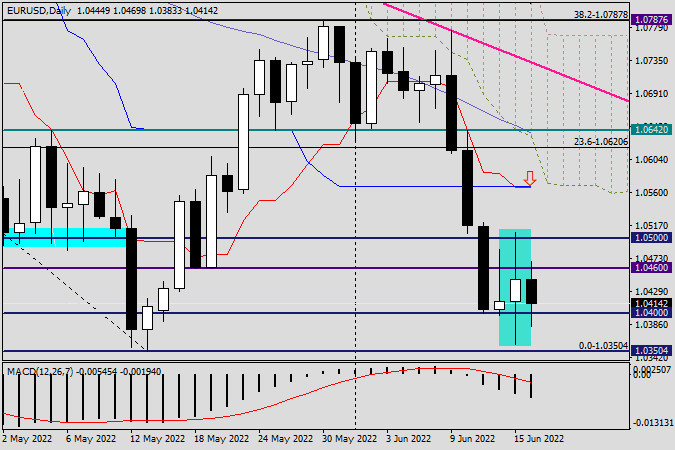

Daily

The fact that yesterday was supposed to be a volatile course of trading is demonstrated by a daily candle with quite impressive shadows. At the same time, pay attention to the technical picture. Support was received directly on the approach to the strong level of 1.0350, which has remained a key and not yet broken support. Resistance, as expected earlier, was met on the approach and attempt to pass up the iconic psychological, historical, and technical mark of 1.0500. Everything is decorous, noble – in the old way. At the same time, it is worth noting that the final body of yesterday's daily candle was formed bullish. Thus, it can be stated that the US dollar was sold again after the rate increase. That is, history repeats itself, and the author also warned about this earlier. However, the rate increase above expectations, in theory, should have had the opposite effect and led to a strengthening of the US currency.

Today, at the end of the article, the EUR/USD pair shows a downward trend, which I think is quite natural. However, current attempts to lower the quote below another significant mark of 1.0400 have so far been unsuccessful. I don't know exactly what hit the market participants yesterday and why, as a result, the US dollar weakened against the single European currency. The Fed has made a more significant step than the one that was expected and has already been included in the price. At the same time, I do not exclude that the previous and a rather aggressive strengthening of the "American" included a tougher decision of the Fed, which happened. It is difficult to give any clear recommendations on the technical picture. Since there were no actual changes following the results of yesterday's trading. Since EUR/USD continues to trade in the range of 1.0500-1.0350, I suggest waiting for the exit from this price corridor to one of its sides, then selling on a rollback to 1.0350 or buying euro/dollar on a rollback to 1.0500. This is how it will turn out. And for today, perhaps, this is all the basic and point information.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.