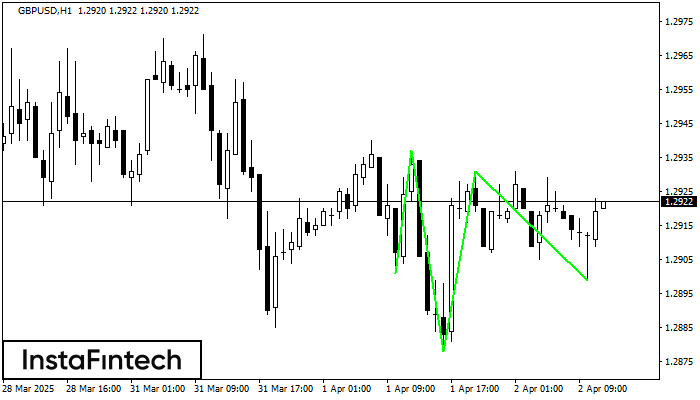

Inverse Head and Shoulder

was formed on 02.04 at 11:00:29 (UTC+0)

signal strength 4 of 5

According to H1, GBPUSD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 1.2937/1.2931 is broken out, the instrument is likely to move toward 1.2971.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

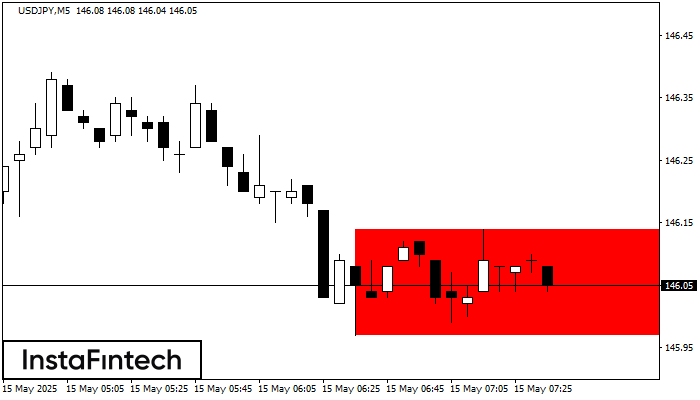

Bearish Rectangle

was formed on 15.05 at 06:36:51 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDJPY formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 146.14, the lower border is 145.97. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish pennant

was formed on 15.05 at 06:03:56 (UTC+0)

signal strength 2 of 5

The Bearish pennant pattern has formed on the USDJPY M15 chart. This pattern type is characterized by a slight slowdown after which the price will move in the direction

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

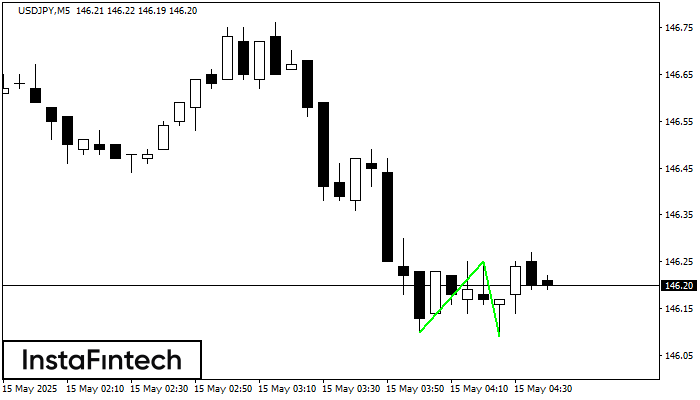

Double Bottom

was formed on 15.05 at 03:40:41 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on USDJPY M5; the upper boundary is 146.25; the lower boundary is 146.09. The width of the pattern is 15 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window