Медвежий симметричный треугольник

сформирован 07.04 в 22:29:21 (UTC+0)

сила сигнала 1 из 5

По NZDJPY M5 сформировалась фигура «Медвежий симметричный треугольник». Данная фигура сигнализирует нам о продолжении нисходящего тренда в случае пробоя нижней границы 81.44, где вероятная прибыль будет являться шириной текущей фигуры -75 пунктов.

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

- Все

- Все

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- Все

- Все

- Покупка

- Продажа

- Все

- 1

- 2

- 3

- 4

- 5

Triple Bottom

was formed on 25.04 at 11:34:47 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on USDJPY M5. It has the following characteristics: resistance level 143.53/143.49; support level 143.24/143.25; the width is 29 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

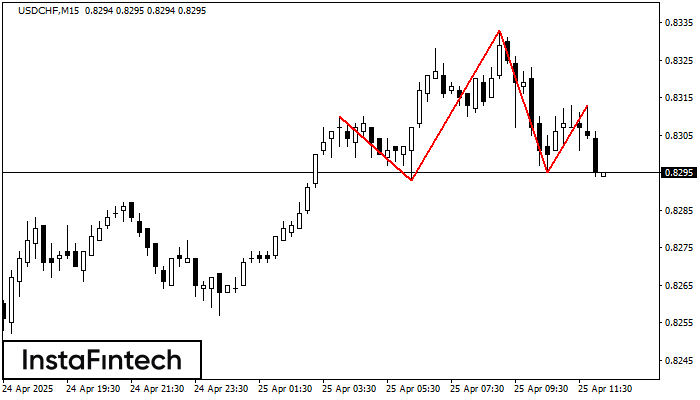

Head and Shoulders

was formed on 25.04 at 11:16:23 (UTC+0)

signal strength 2 of 5

The technical pattern called Head and Shoulders has appeared on the chart of USDCHF M15. There are weighty reasons to suggest that the price will surpass the Neckline 0.8293/0.8295 after

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Double Bottom

was formed on 25.04 at 11:00:37 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDUSD M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window