Triple Bottom

was formed on 15.04 at 20:50:28 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on EURJPY M5. It has the following characteristics: resistance level 161.42/161.39; support level 161.27/161.29; the width is 15 points. In the event of a breakdown of the resistance level of 161.42, the price is likely to continue an upward movement at least to 161.41.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

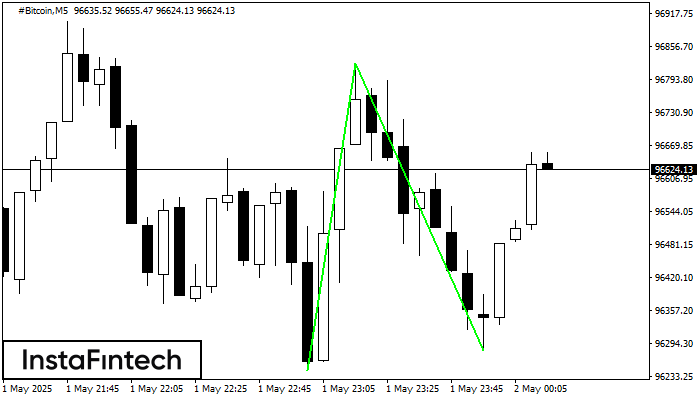

Double Bottom

was formed on 01.05 at 23:15:27 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on #Bitcoin M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Head and Shoulders

was formed on 01.05 at 23:15:24 (UTC+0)

signal strength 1 of 5

The technical pattern called Head and Shoulders has appeared on the chart of NZDJPY M5. There are weighty reasons to suggest that the price will surpass the Neckline 85.80/85.81 after

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

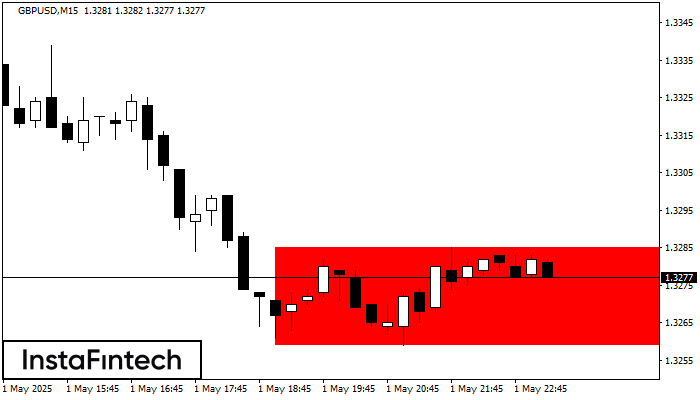

Bearish Rectangle

was formed on 01.05 at 22:26:57 (UTC+0)

signal strength 2 of 5

According to the chart of M15, GBPUSD formed the Bearish Rectangle. The pattern indicates a trend continuation. The upper border is 1.3285, the lower border is 1.3259. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window