Triple Top

was formed on 15.04 at 20:05:22 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the AUDCHF M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 0.5198/0.5212 with the upper limit 0.5223/0.5226; the projection of the width is 25 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 0.5198, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Triple Bottom

was formed on 01.05 at 17:39:48 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on #KO M5. It has the following characteristics: resistance level 71.64/71.57; support level 71.39/71.35; the width is 25 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

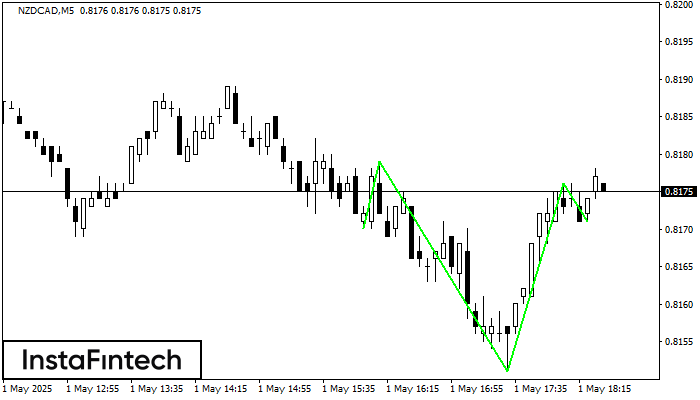

Inverse Head and Shoulder

was formed on 01.05 at 17:30:04 (UTC+0)

signal strength 1 of 5

According to M5, NZDCAD is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.8179/0.8176 is broken out, the instrument is likely to move toward

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

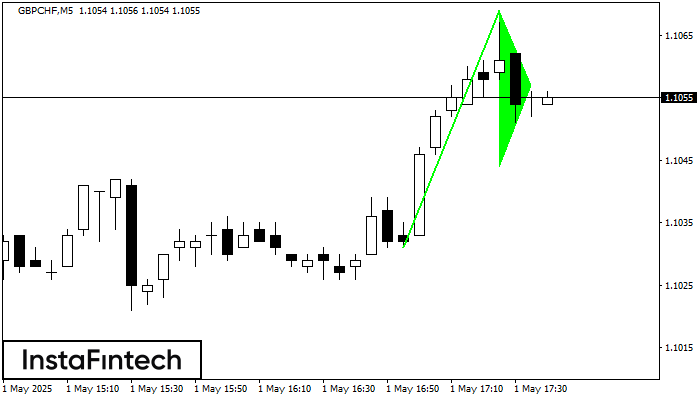

Bullish pennant

was formed on 01.05 at 16:40:46 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument GBPCHF M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 1.1069, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window