Triple Bottom

was formed on 04.04 at 01:30:32 (UTC+0)

signal strength 2 of 5

The Triple Bottom pattern has formed on the chart of EURJPY M15. Features of the pattern: The lower line of the pattern has coordinates 161.64 with the upper limit 161.64/161.42, the projection of the width is 69 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 160.95, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

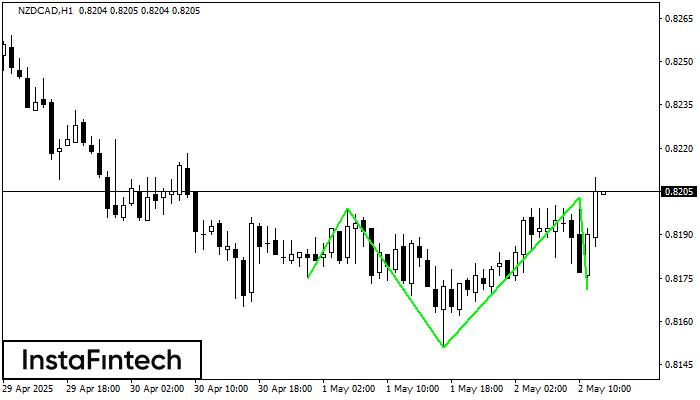

Inverse Head and Shoulder

was formed on 02.05 at 12:00:11 (UTC+0)

signal strength 4 of 5

According to the chart of H1, NZDCAD produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 0.8151 while the median line of the Neck

Open chart in a new window

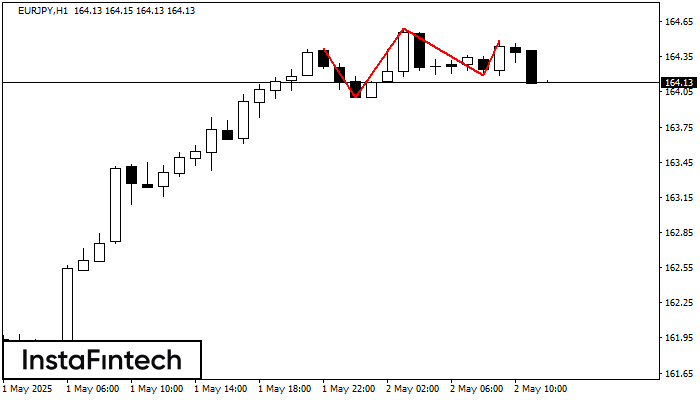

Triple Top

was formed on 02.05 at 11:00:30 (UTC+0)

signal strength 4 of 5

The Triple Top pattern has formed on the chart of the EURJPY H1 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -7, support level -19

Open chart in a new window

Triple Top

was formed on 02.05 at 11:00:11 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the EURJPY M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -7, support level -19

Open chart in a new window