USDCHF (US Dollar vs Swiss Franc). Exchange rate and online charts.

Currency converter

04 Jul 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/CHF is one of the main currency pairs in trading. Owing to the strong US dollar and the perfectly steady Swiss franc, the trading instrument is very popular among market players. The pair’s exchange rate depends largely on the state of the US economy. For that reason, US economic indicators are of utmost importance when trading USD/CHF.

Switzerland’s economy and Swiss franc

Speaking of the Swiss franc, Switzerland’s economic strengths should also be mentioned. It is a highly-developed, wealthy, and export-oriented country. Its most advanced economic fields are the banking and insurance system.

Switzerland’s main banks, UBS and Credit Suisse, are known for their stability. Moreover, they are one the largest banks in the world.

The Swiss franc is the safe-haven asset investors turn to at the time of financial upheaval. It once again proves the reliability and strength of the Swiss economy.

There is little public data reflecting the current state of Switzerland’s economy. The monetary policy report of the Swiss National Bank is perhaps the only information available. For that reason, traders usually closely monitor reports on the Swiss economy.

Features of USD/CHF. Aspects of trading

When buying or selling USD/CHF, any trading approach can be used, depending on traders’ preferences. The pair can be traded using fundamental indicators, technical analysis, and indicator strategies.

USD/CHF is a predictable currency pair. Low volatility prevents traders from making a larger profit.

The pair’s peculiar feature is its responsiveness to changes in the global stock market. When trading the Swiss franc, it is important to remember the Swiss National Bank’s low rate policy and rare monetary policy interventions, as well as the currency’s similar behavior versus EUR and GBP.

Another interesting fact is that the Swiss franc shows an exponential increase against its counterparts at the time of crises when investors rush to transfer their capital to Switzerland. It is a distinctive feature of the Swiss economy.

At the same time, a decrease in Swiss exports to Western Europe could trigger a fall in CHF.

What is more, USD/CHF is less responsive to economic changes in Switzerland. The state of the US economy is what matters a great deal when trading the currency pair. Reports made by the US Federal Reserve are of major importance as changes in the interest rate could affect the quote.

Traders should also focus on labor market data in the US that is usually published on the first Friday of each new month.

See Also

- Technical analysis / Video analytics

Forex forecast 12/05/2025: EUR/USD, GBP/USD, USD/CHF, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CHF, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

13:37 2025-05-12 UTC+2

16828

Technical analysis / Video analyticsForex forecast 05/05/2025: EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD and BitcoinAuthor: Sebastian Seliga

10:23 2025-05-05 UTC+2

9028

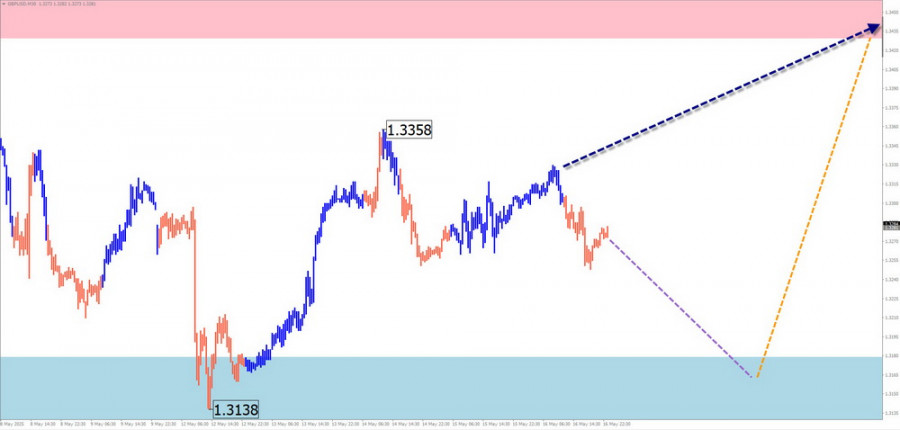

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

5383

- Technical analysis / Video analytics

Forex forecast 19/06/2025: EUR/USD, USD/CHF, GBP/USD, Oil and Bitcoin

Technical analysis of EUR/USD, USD/CHF, GBP/USD, Oil and BitcoinAuthor: Sebastian Seliga

13:52 2025-06-19 UTC+2

4738

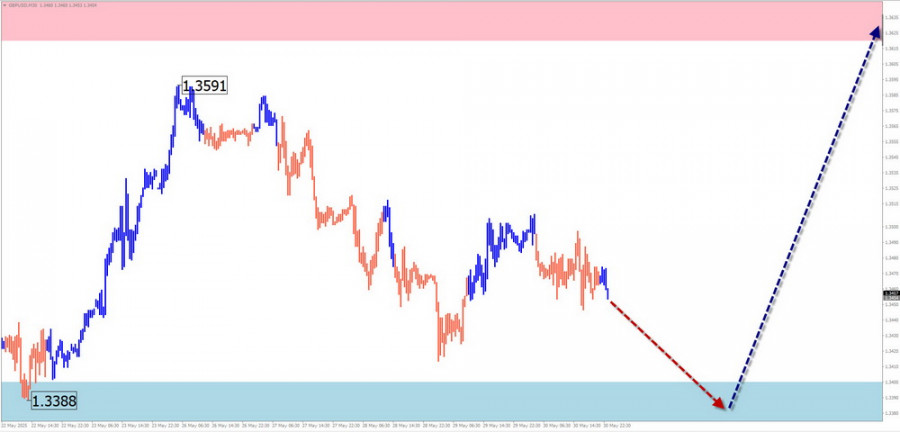

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on June 2nd

During the upcoming week, the British pound is expected to move from its current zone toward the calculated resistance area. In the early days, a downward vector with potential pressure toward the support zone is likely. The highest volatility in the pair is expected in the second half of the week.Author: Isabel Clark

11:53 2025-06-02 UTC+2

4363

The USD/CHF pair is struggling to gain meaningful momentum amid a combination of opposing forces.Author: Irina Yanina

14:36 2025-06-20 UTC+2

4288

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and US Dollar Index – May 5th

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and US Dollar Index – May 5thAuthor: Isabel Clark

10:43 2025-05-05 UTC+2

4168

Wave analysisWeekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26thAuthor: Isabel Clark

11:23 2025-05-26 UTC+2

4093

USD/CHF. Analysis and ForecastAuthor: Irina Yanina

18:38 2025-05-21 UTC+2

3808

- Technical analysis / Video analytics

Forex forecast 12/05/2025: EUR/USD, GBP/USD, USD/CHF, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/CHF, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

13:37 2025-05-12 UTC+2

16828

- Technical analysis / Video analytics

Forex forecast 05/05/2025: EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD and BitcoinAuthor: Sebastian Seliga

10:23 2025-05-05 UTC+2

9028

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on May 19thAuthor: Isabel Clark

11:43 2025-05-19 UTC+2

5383

- Technical analysis / Video analytics

Forex forecast 19/06/2025: EUR/USD, USD/CHF, GBP/USD, Oil and Bitcoin

Technical analysis of EUR/USD, USD/CHF, GBP/USD, Oil and BitcoinAuthor: Sebastian Seliga

13:52 2025-06-19 UTC+2

4738

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index on June 2nd

During the upcoming week, the British pound is expected to move from its current zone toward the calculated resistance area. In the early days, a downward vector with potential pressure toward the support zone is likely. The highest volatility in the pair is expected in the second half of the week.Author: Isabel Clark

11:53 2025-06-02 UTC+2

4363

- The USD/CHF pair is struggling to gain meaningful momentum amid a combination of opposing forces.

Author: Irina Yanina

14:36 2025-06-20 UTC+2

4288

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and US Dollar Index – May 5th

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and US Dollar Index – May 5thAuthor: Isabel Clark

10:43 2025-05-05 UTC+2

4168

- Wave analysis

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26th

Weekly Forecast Using Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, Ethereum, and U.S. Dollar Index on May 26thAuthor: Isabel Clark

11:23 2025-05-26 UTC+2

4093

- USD/CHF. Analysis and Forecast

Author: Irina Yanina

18:38 2025-05-21 UTC+2

3808