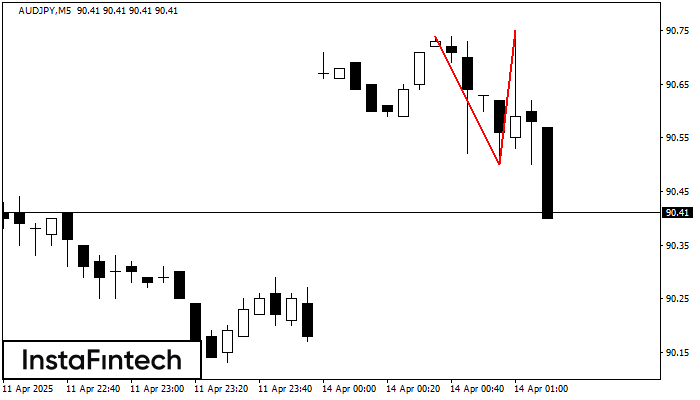

Double Top

was formed on 14.04 at 00:15:19 (UTC+0)

signal strength 1 of 5

On the chart of AUDJPY M5 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 90.75; the lower boundary 90.50; the width of the pattern 25 points. The signal: a break of the lower boundary will cause continuation of the downward trend targeting the 90.35 level.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Symmetrical Triangle

сформирован 06.06 в 16:28:47 (UTC+0)

сила сигнала 1 из 5

According to the chart of M5, GBPAUD formed the Bearish Symmetrical Triangle pattern. Trading recommendations: A breach of the lower border 2.0816 is likely to encourage a continuation

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

Bullish pennant

сформирован 06.06 в 16:08:39 (UTC+0)

сила сигнала 1 из 5

The Bullish pennant pattern is formed on the #FB M5 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

Head and Shoulders

сформирован 06.06 в 15:59:50 (UTC+0)

сила сигнала 4 из 5

The technical pattern called Head and Shoulders has appeared on the chart of AUDUSD H1. There are weighty reasons to suggest that the price will surpass the Neckline 0.6487/0.6486 after

Открыть график инструмента в новом окне