Veja também

The GBP/USD pair also showed a downward move on Thursday, but the pound rose steadily on Wednesday evening—unlike the EUR/USD. Time and again, we see the British pound showing impressive resilience against the dollar. This can be explained by the Bank of England's stance, which just concluded its second policy meeting of the year.

Let's recall that the BoE initially took a more hawkish position than the European Central Bank but a less hawkish one than the Federal Reserve. This is logical: the euro tends to fall more sharply (when it falls at all), while the pound is holding up better. Of course, we must factor in Donald Trump, whose actions have recently sent the dollar tumbling. However, this factor is beyond our control, and we cannot predict Trump's next move or how the market will respond. From our point of view, the dollar has dropped too sharply.

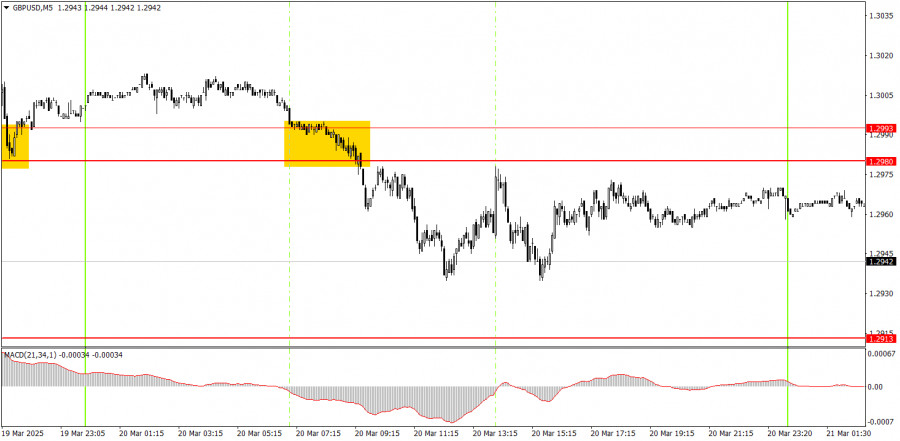

On the 5-minute chart, a sell signal appeared on Thursday. Early in the European session, the price consolidated below the 1.2980–1.2993 zone but failed to sustain a clear downward move and got stuck between 1.2913 and 1.2980. Still, novice traders could have profited from the short position, as no buy signals formed, and the trade could be closed anywhere within the range.

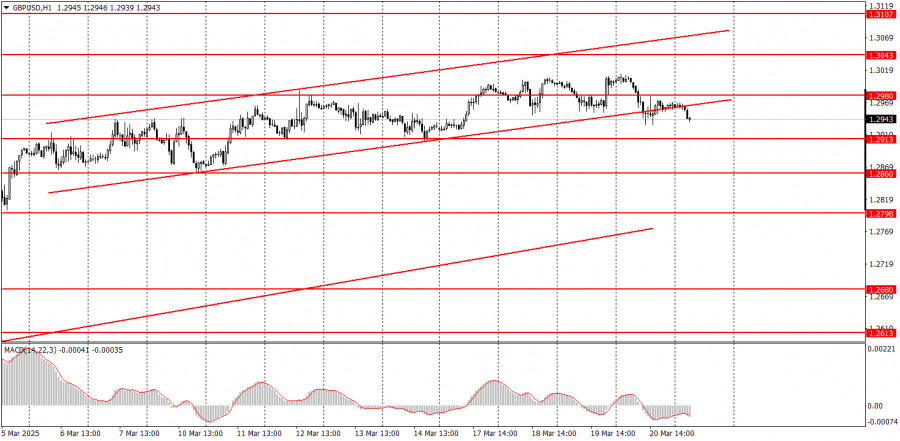

On the hourly chart, GBP/USD should have already started a downtrend, but Trump keeps preventing it. We still expect the pound to fall toward 1.1800 in the medium term, but we don't know how long the Trump-induced dollar weakness will continue. Once this movement ends, the technical picture across all timeframes may change drastically. For now, long-term trends still point south. The pound's rally isn't baseless but is too strong and irrational.

On Friday, GBP/USD may continue to rise as the market no longer needs any justification to sell the dollar. However, we are now openly expecting a downward correction.

For intraday trading on the 5-minute chart, you can use the following levels: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107. No major events are scheduled in the UK or the U.S. on Friday, so it could feel like a semi-holiday session. The pound has barely broken below the ascending channel, so a technical basis exists for a decline.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Notificações por

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.