Veja também

17.01.2025 09:14 AM

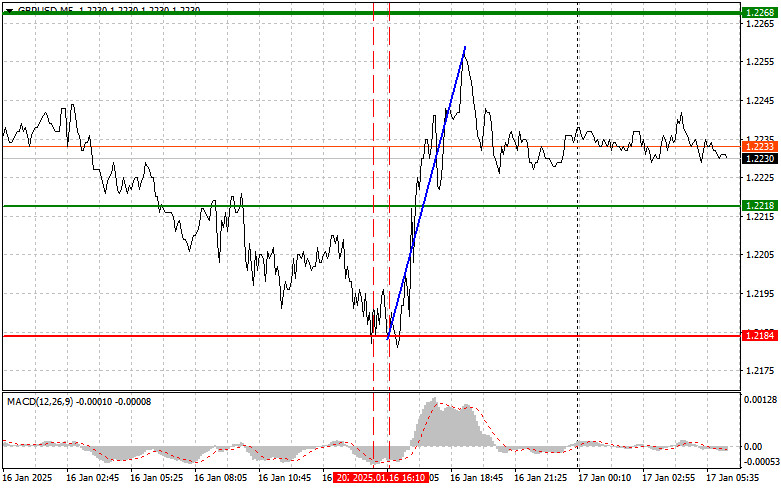

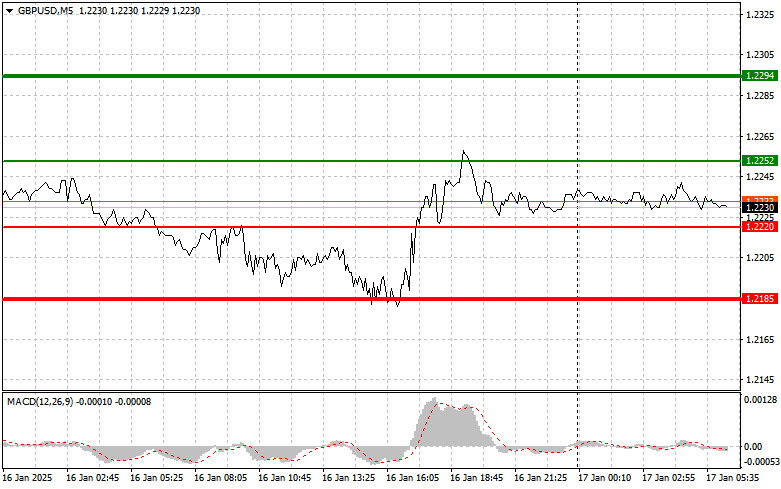

17.01.2025 09:14 AMThe first test of the 1.2184 price level in the afternoon coincided with the MACD indicator dropping significantly below the zero line, which limited the pair's downside potential. For this reason, I decided against selling the pound. The second test of this range occurred when the MACD was in the oversold zone, allowing for Scenario #2 to buy to materialize. As a result, the pair rose by more than 50 pips.

Yesterday's weak GDP and industrial production data from the UK negatively impacted the pound, but a major sell-off was avoided due to a disappointing U.S. retail sales report. These weak economic reports caused volatility in the pound, particularly against the U.S. dollar. Now, investors are focusing on upcoming economic reports that could provide a clearer understanding of the economic conditions in both countries. The release of UK retail sales data is anticipated and could be crucial in determining the pound's trajectory. A decline in this indicator, especially considering fuel costs, would suggest weakening consumer demand, raising concerns among economists and analysts about the future growth rates of the UK economy. These figures could exert additional pressure on the pound and lead to further market fluctuations. Conversely, positive data could enable GBP/USD to continue trading within the horizontal channel established this week.

For intraday strategies, I will rely primarily on implementing Scenario #1 and Scenario #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point near 1.2252 (green line on the chart) with a target of 1.2294 (thicker green line on the chart). At the 1.2294 level, I plan to exit long positions and open short positions in the opposite direction, aiming for a movement of 30–35 pips from the entry-level. Expect the pound to rise following strong retail sales data. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2220 price level when the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger an upward market reversal. A rise toward the opposite levels of 1.2252 and 1.2294 can be expected.

Scenario #1: I plan to sell the pound today after breaking below the 1.2220 level (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be 1.2185, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a movement of 20–25 pips in the opposite direction from the level. Selling the pound is better done at higher levels in continuation of the forming bearish trend. Important! Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2252 price level when the MACD indicator is in the overbought zone. This will limit the pair's upside potential and trigger a market reversal downward. A decline to the opposite levels of 1.2220 and 1.2185 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

O teste do nível de preço em 143,75 na primeira metade do dia ocorreu justamente quando o indicador MACD já havia se afastado significativamente da linha zero, o que limitou

O teste de preço em 1,1441 coincidiu com o momento em que o indicador MACD começou a subir a partir da linha zero, confirmando o ponto de entrada ideal para

Petróleo de volta aos holofotes Os contratos futuros do Brent ultrapassaram a marca de US$ 67,5 por barril nesta quarta-feira, atingindo o maior nível em oito semanas. Vários fatores contribuíram

O teste do nível de 1,1440 ocorreu quando o indicador MACD já havia subido significativamente acima da linha zero, limitando o potencial de alta do par. Por esse motivo

O teste do nível de 144,21 ocorreu quando o indicador MACD começou a subir a partir da linha zero. Isso confirmou um ponto de entrada válido para a compra

O teste do nível de 1,3562 na segunda metade do dia coincidiu com o início do movimento de queda do indicador MACD a partir da linha zero, o que confirmou

O teste de preço em 1,1420 ocorreu exatamente quando o indicador MACD começou a se mover para baixo a partir da marca zero, confirmando um ponto de entrada válido para

Análise das operações e dicas para negociar a libra britânica O teste de preço em 1,3567, ocorrido durante a primeira metade do dia, aconteceu quando o indicador MACD já havia

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.