Veja também

18.11.2024 09:16 AM

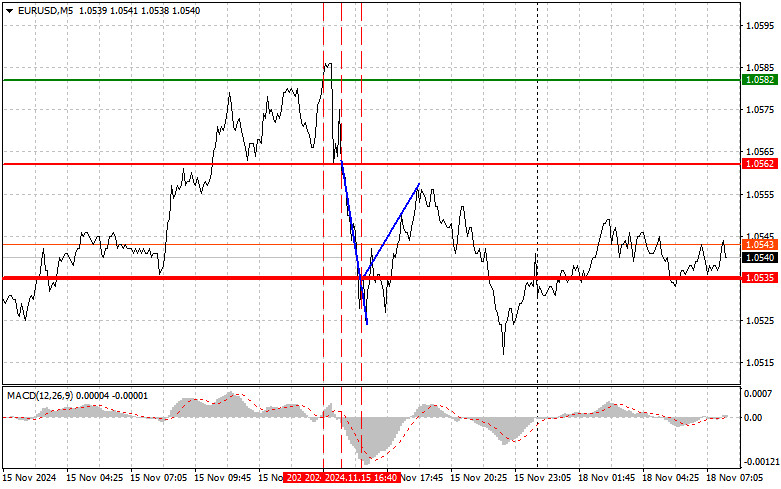

18.11.2024 09:16 AMThe 1.0582 price test occurred when the MACD indicator had just started moving upward from the zero level, confirming a correct entry point for buying the euro at the end of the week in anticipation of a larger upward correction. However, as seen on the chart, no significant growth occurred. After strong U.S. retail sales data were released, pressure returned to the pair, resulting in a stop-loss exit. During the euro's decline, the 1.0562 price test aligned with the MACD, starting its downward movement from the zero mark and confirming a correct entry point for selling. The pair dropped 30 pips to the target level of 1.0535, where buying on a rebound yielded about 20 pips of profit.

There are no significant economic releases today apart from the eurozone's trade balance data. The focus will shift to speeches by European Central Bank representatives, including Christine Lagarde, Philip Lane, Luis de Guindos, and Joachim Nagel. A dovish tone from policymakers may increase the likelihood of further rate cuts in the eurozone, potentially pushing the euro even lower against the U.S. dollar. I will primarily rely on implementing Scenario #1 and Scenario #2 for intraday trading.

Scenario #1:

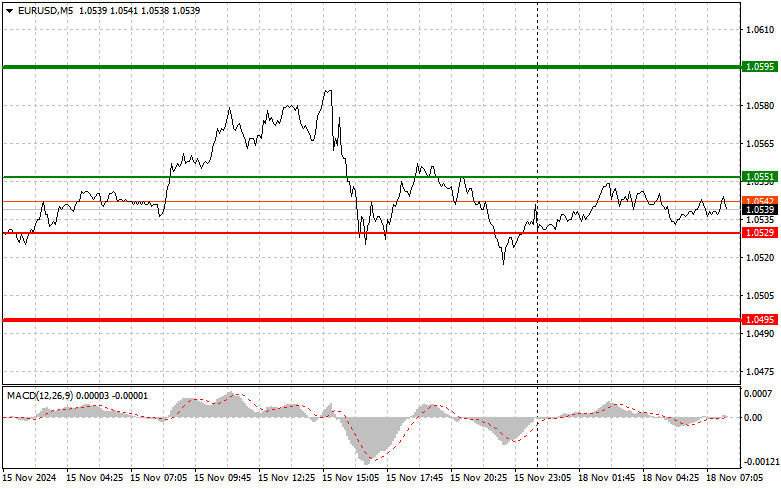

Today, I plan to buy the euro at the 1.0551 level (green line on the chart), targeting growth to 1.0595. At 1.0595, I plan to exit the market and sell the euro on a pullback, expecting a 30–35 pip move downward from the entry point. Euro growth today is only likely with positive data, primarily within a corrective framework. Important: Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario #2:

Alternatively, I will buy the euro if there are two consecutive tests of the 1.0529 level, with the MACD in the oversold area. This will limit the pair's downward potential and trigger an upward reversal. Growth is expected toward the 1.0551 and 1.0595 levels.

Scenario #1:

I plan to sell the euro after the 1.0529 level is reached (red line on the chart), targeting 1.0495. I will then exit the market and consider buying on a rebound (expecting a 20–25 pip upward move from this level). Selling is best done from higher positions if the opportunity arises. Important: Before selling, ensure the MACD indicator is below the zero mark and starting to move downward.

Scenario #2:

Alternatively, I will sell the euro if there are two consecutive tests of the 1.0551 level, with the MACD in the overbought area. This will limit the pair's upward potential and trigger a reversal downward, with targets at 1.0529 and 1.0495.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise da negociação e dicas para negociar com a libra esterlina O teste de preço em 1,3526 na primeira metade do dia ocorreu justamente quando o indicador MACD havia começado

O teste de preço em 1,3461 na segunda metade do dia coincidiu com o momento em que o indicador MACD já havia recuado significativamente a partir da linha zero

O teste de preço em 1,1306 coincidiu com o início de um movimento ascendente do indicador MACD a partir da linha zero, confirmando um ponto de entrada apropriado para compra

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.