Veja também

21.03.2022 02:28 PM

21.03.2022 02:28 PMOver the past ten years, there has been a clear sense in the global economy that the U.S. dollar is a key component of the national reserve system. As of early March, more than 70% of government reserves are held in U.S. dollars. However, the sanctions pressure on Russia has shown that the approach to the formation of reserve systems by states is outdated and will be revised.

The main reason that the U.S. dollar will cease to be quoted as the main reserve currency is the sanctions due to the military invasion of Ukraine. Namely, the freezing of Russia's dollar reserve funds. Until recently, U.S. government bonds and USD had a reputation for being risk-free. But the asset freeze showed that under certain circumstances, however exceptional, a country could lose its reserves. Despite the effectiveness of the sanctions, the U.S. has pushed the global economy to look for alternatives.

Galaxy Digital CEO Mike Novogratz believes that after the end of all geopolitical frictions, the authorities will begin to adhere to the classic investment rule of portfolio diversification. Thus, the state's reserves will be protected from permanent freezing. The entrepreneur believes that, in addition to USD and gold, cryptocurrencies can become an important part of government reserves.

Bitcoin will take on the burden of leadership here as well, as it has important properties – risk hedging and high profitability. Together with other financial instruments, the main disadvantage of BTC - volatility - will be leveled. And given the process of state regulation of the industry that has begun, Bitcoin will become more widespread among large institutional players.

Thus, we can state the fact that the terrible events on the territory of Ukraine led to macroeconomic changes that the world will carry out for another year. And cryptocurrencies are destined to take one of the key roles in this process. First of all, Bitcoin, which, in addition to its obvious advantages, is a decentralized financial instrument. This suggests that this asset may be limited in terms of sanctions, but can never be completely cut off from interaction with other elements of the economy. The Russian authorities failed to take advantage of this window, but in the future, the prospects for cryptocurrencies as a reserve capital with increased resistance to sanctions and restrictions are limitless.

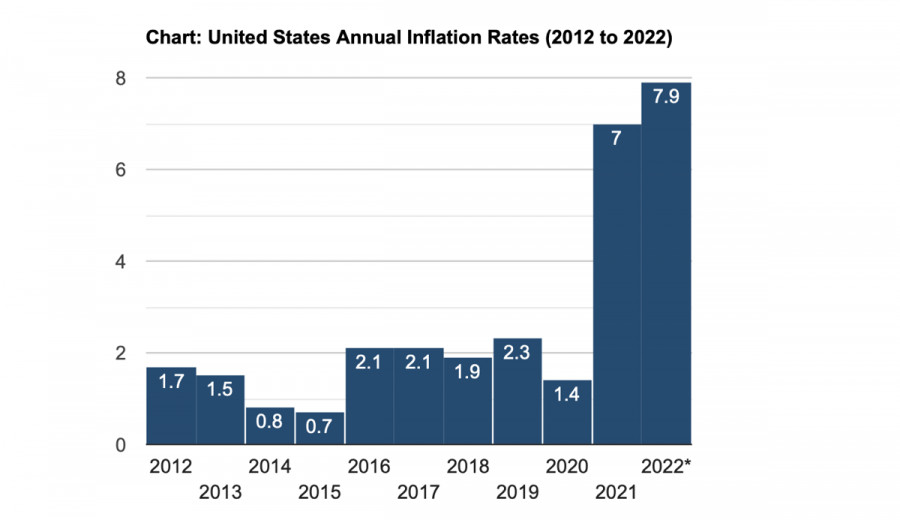

As for the direct display of the new status of Bitcoin on its quotes, we should not expect a bullish rally in 2022. The world is changing in the broadest sense of the word, and the Fed has just begun to tighten monetary policy. Ultimately, this will lead to the inability of Bitcoin to show aggressive growth within existing and future liquidity restrictions. But as interest in scarce assets grows and inflation rises in parallel, Bitcoin will become an increasingly important financial instrument.

Under the current conditions, the asset will continue to drift along the $32k-$45k range without any prerequisites for a possible exit from this area. Investors buy Bitcoin, but for long-term storage, not permanent activity. The "triangle" on the BTC/USD daily timeframe is close to its end, but taking into account the positions of the bulls at $32k and the bears at $45k, Bitcoin will not be able to make an aggressive breakout. MACD and RSI deliberately demonstrate the flat dynamics of the cryptocurrency price movement in the near future due to aggravated access to liquidity and low trading activity.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Parece que, no gráfico de 4 horas, o preço da criptomoeda Doge está se movendo acima da WMA (21), que apresenta inclinação ascendente. Além disso, o oscilador estocástico indica

No gráfico diário, o preço permanece consolidado abaixo da linha verde do canal de alta, com um nível-alvo em 5.908. Esse movimento indica uma possível preparação para romper as resistências

Em 22 de maio, o Bitcoin ultrapassou com firmeza o patamar de US$ 111.888, estabelecendo um novo recorde histórico em US$ 111.867. Diferentemente das altas anteriores, marcadas pela euforia

Se observarmos o gráfico de 4 horas, a criptomoeda Ethereum parece estar se movimentando acima da média móvel ponderada de 21 períodos (WMA 21), que atua como um suporte dinâmico

No gráfico de 4 horas, a criptomoeda Uniswap parece formar um padrão de Cunha Descendente Ampliada. Embora o preço esteja se movendo abaixo da média móvel ponderada de 21 períodos

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Gráfico de Forex

Versão-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.