Triple Bottom

was formed on 25.04 at 11:34:47 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has been formed on USDJPY M5. It has the following characteristics: resistance level 143.53/143.49; support level 143.24/143.25; the width is 29 points. In the event of a breakdown of the resistance level of 143.53, the price is likely to continue an upward movement at least to 143.42.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

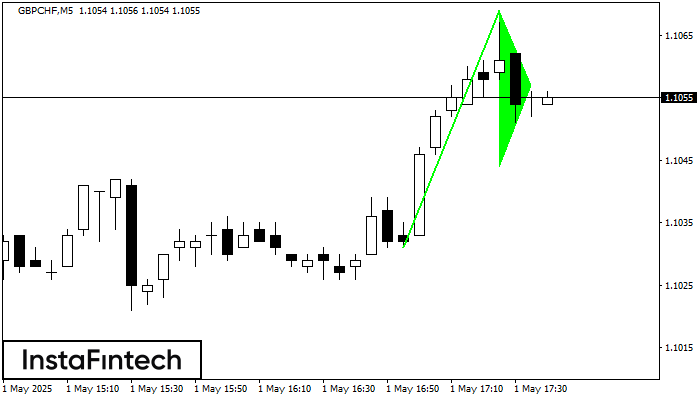

Bullish pennant

was formed on 01.05 at 16:40:46 (UTC+0)

signal strength 1 of 5

The Bullish pennant signal – Trading instrument GBPCHF M5, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 1.1069, with the prospect

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

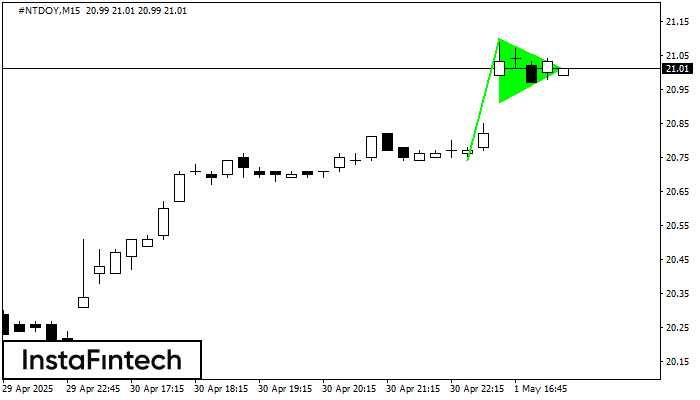

Bullish pennant

was formed on 01.05 at 16:30:54 (UTC+0)

signal strength 2 of 5

The Bullish pennant graphic pattern has formed on the #NTDOY M15 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

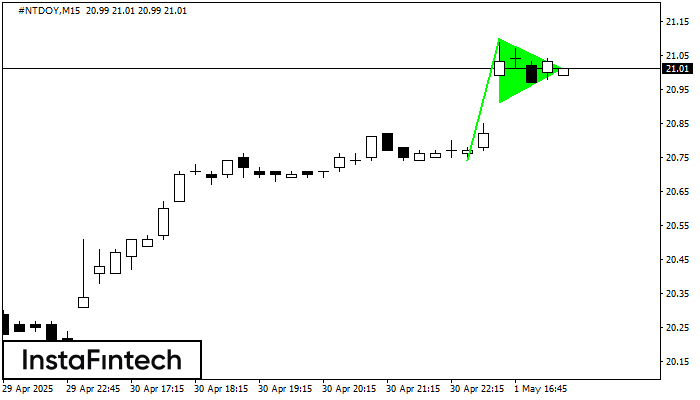

Bullish pennant

was formed on 01.05 at 16:30:34 (UTC+0)

signal strength 2 of 5

The Bullish pennant graphic pattern has formed on the #NTDOY M15 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

The M5 and M15 time frames may have more false entry points.

Open chart in a new window