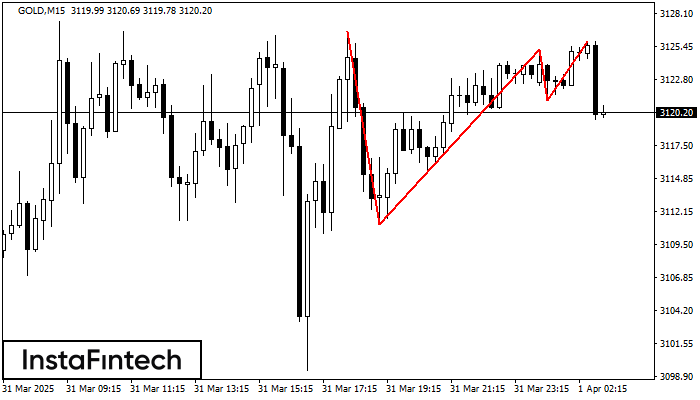

Triple Top

was formed on 01.04 at 02:00:23 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the GOLD M15 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 76, support level -995, and pattern’s width 1554. Forecast If the price breaks through the support level 3111.14, it is likely to move further down to 3124.98.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bearish Symmetrical Triangle

was formed on 11.04 at 10:00:19 (UTC+0)

signal strength 3 of 5

According to the chart of M30, NZDJPY formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 82.22 is breached. Here

Open chart in a new window

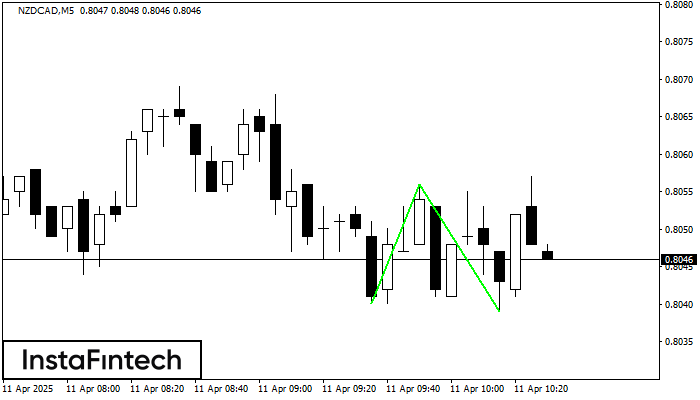

Double Bottom

was formed on 11.04 at 09:29:56 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on NZDCAD M5. Characteristics: the support level 0.8040; the resistance level 0.8056; the width of the pattern 16 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bearish Symmetrical Triangle

was formed on 11.04 at 09:13:08 (UTC+0)

signal strength 2 of 5

According to the chart of M15, NZDJPY formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 82.22 is breached. Here

The M5 and M15 time frames may have more false entry points.

Open chart in a new window