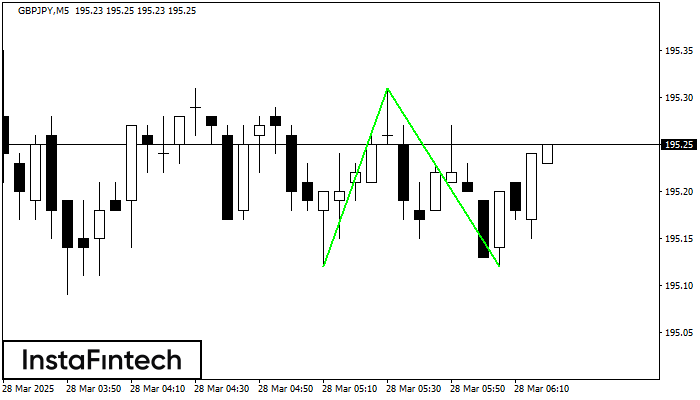

Двойное дно

сформирован 28.03 в 06:20:05 (UTC+0)

сила сигнала 1 из 5

Сформирована фигура «Двойное дно» на графике GBPJPY M5. Данное формирование сигнализирует об изменении тенденции с нисходящего на восходящее движение. Сигнал: Торговую позицию на покупку следует открывать после пробоя верхней границы фигуры 195.31, где перспектива будущего хода будет являться шириной текущей фигуры - 19 пунктов.

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

- Все

- Все

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- Все

- Все

- Покупка

- Продажа

- Все

- 1

- 2

- 3

- 4

- 5

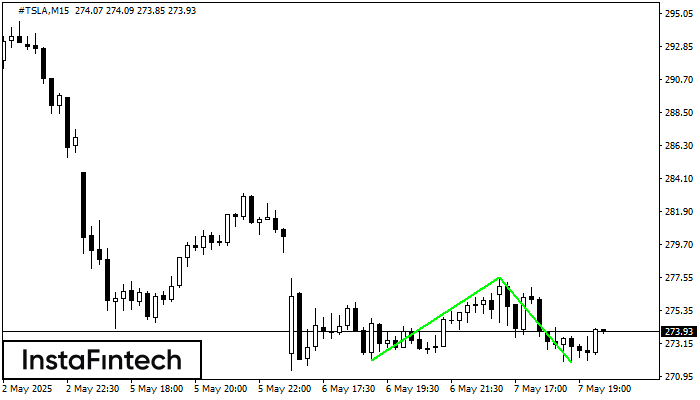

Double Bottom

was formed on 07.05 at 18:45:20 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on #TSLA M15. Characteristics: the support level 272.03; the resistance level 277.52; the width of the pattern 549 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

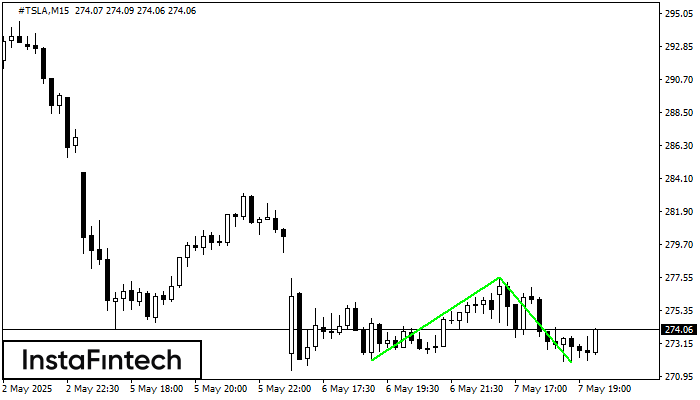

Double Bottom

was formed on 07.05 at 18:45:11 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on #TSLA M15; the upper boundary is 277.52; the lower boundary is 271.92. The width of the pattern is 549 points. In case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish pennant

was formed on 07.05 at 18:40:15 (UTC+0)

signal strength 1 of 5

The Bullish pennant pattern is formed on the EURNZD M5 chart. It is a type of the continuation pattern. Supposedly, in case the price is fixed above the pennant’s high

The M5 and M15 time frames may have more false entry points.

Open chart in a new window