Bullish Symmetrical Triangle

was formed on 15.04 at 23:01:57 (UTC+0)

signal strength 4 of 5

According to the chart of H1, AUDJPY formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 91.35 and 90.50 are the coordinates of the upper and lower borders respectively. The pattern width is measured on the chart at 85 pips. Outlook: If the upper border 91.35 is broken, the price is likely to continue its move by 91.40.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

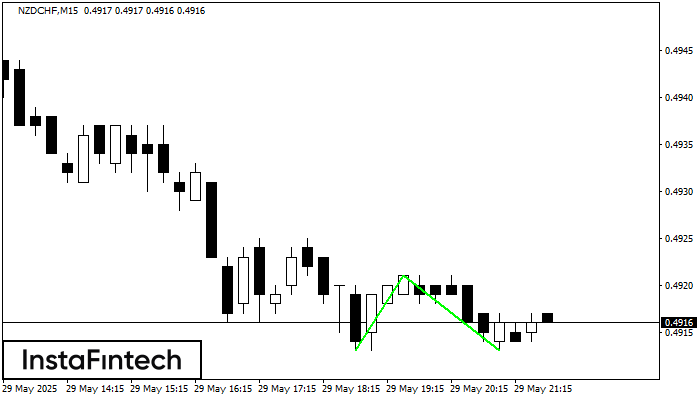

Double Bottom

was formed on 29.05 at 20:45:23 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on NZDCHF M15. Characteristics: the support level 0.4913; the resistance level 0.4921; the width of the pattern 8 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Symmetrical Triangle

was formed on 29.05 at 20:41:53 (UTC+0)

signal strength 1 of 5

According to the chart of M5, #EBAY formed the Bullish Symmetrical Triangle pattern, which signals the trend will continue. Description. The upper border of the pattern touches the coordinates 72.94/72.51

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

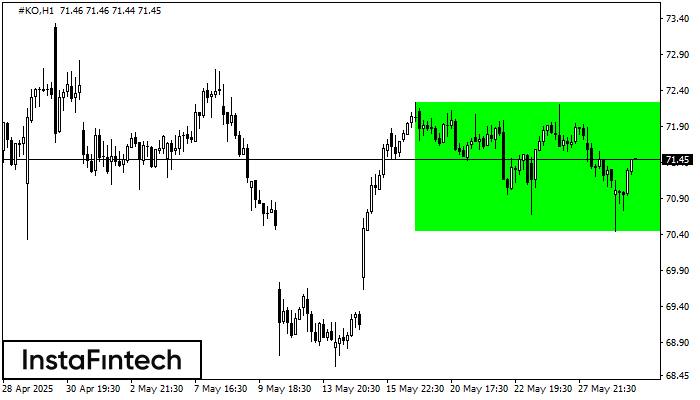

Bullish Rectangle

was formed on 29.05 at 20:30:23 (UTC+0)

signal strength 4 of 5

According to the chart of H1, #KO formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 72.24 and support 70.45

Open chart in a new window