NZDCAD (New Zealand Dollar vs Canadian Dollar). Exchange rate and online charts.

Currency converter

03 Jul 2025 07:53

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/CAD is a cross rate of the New Zealand dollar to the Canadian dollar. It is the most low-liquid instrument, compared to the majors.

The exchange rate of the Canadian and the New Zealand dollars depends on the behavior of the EUR/USD, GBP/USD and USD/JPY currency pairs. They are a kind of an indicator for the NZD/CAD instrument movement.

New Zealand is the world’s largest producer of wool and it is an important fact to be monitored at the time of trading. New Zealand economy directly depends on the partners, such as the USA, Canada and Asia-Pacific regions. Their economic indicators should be taken into consideration while trading this currency pair.

Canada is one of the largest crude oil exporters. Loonie rises with the oil prices growth and vice versa. The world's crude oil prices have a great impact on the NZD/CAD currency pair. Besides, the U.S. dollar should not be underestimated in trading. It is necessary to take into account such indicators of the U.S economy as interest rate, unemployment rate, GDP and job creation index.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for July 2-8, 2025: buy above 3,325 (21 SMA - 200 EMA)

Gold could be preparing for a new bullish sequence, so as the price consolidates above 3,325 or 3,312, any technical rebound will be seen as a buying signal, with short-term targets at 8/8 Murray, located at 3,437.Author: Dimitrios Zappas

18:58 2025-07-02 UTC+2

988

GBP/USD: Strategy for the U.S. Session on July 2nd (Analysis of Morning Trades)Author: Miroslaw Bawulski

18:28 2025-07-02 UTC+2

883

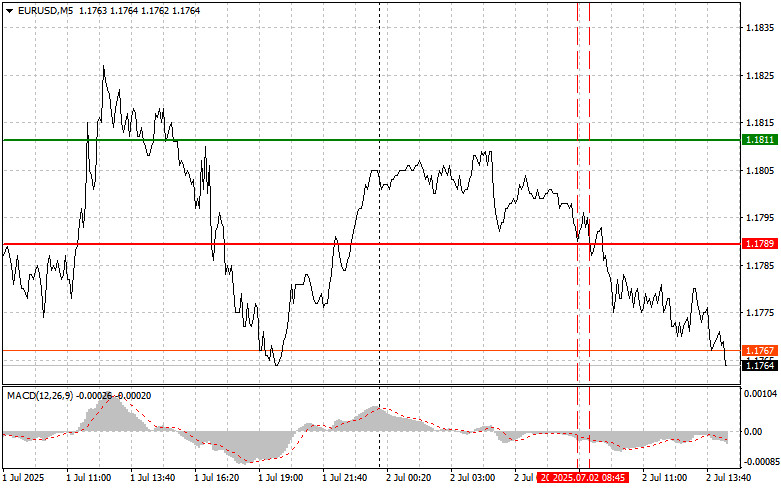

Technical analysisTrading Signals for EUR/USD for July 2-5, 2025: sell below 1.1840 (+1/8 Murray - 21 SMA)

If the euro breaks below 1.1762 and consolidates below this price zone, a bearish acceleration is likely and could reach the bottom of the trend channel around 1.1620. It could eventually reach the psychological level of 1.15 around the 200 EMA.Author: Dimitrios Zappas

19:00 2025-07-02 UTC+2

868

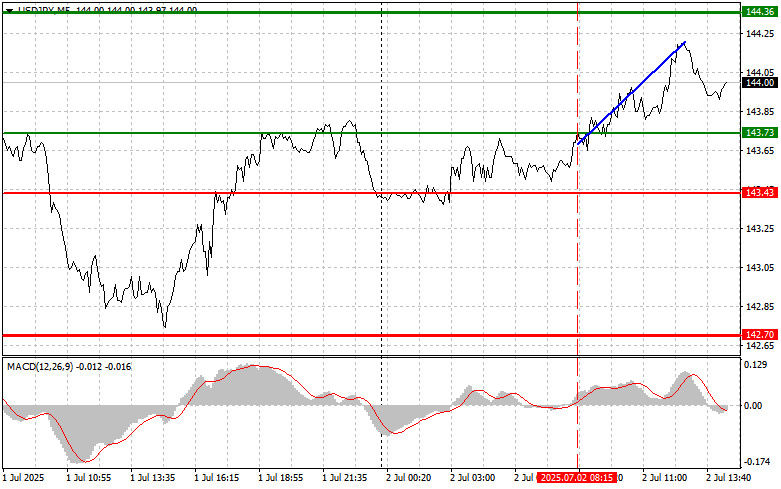

- Trump's doubts regarding the US-Japan trade agreement are undermining the yen.

Author: Irina Yanina

18:51 2025-07-02 UTC+2

823

USD/JPY: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)Author: Jakub Novak

18:46 2025-07-02 UTC+2

778

EUR/USD: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)Author: Jakub Novak

18:35 2025-07-02 UTC+2

763

- The GBP/USD pair declined by nearly 200 basis points on Wednesday.

Author: Chin Zhao

20:33 2025-07-02 UTC+2

748

GBP/USD: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)Author: Jakub Novak

18:39 2025-07-02 UTC+2

718

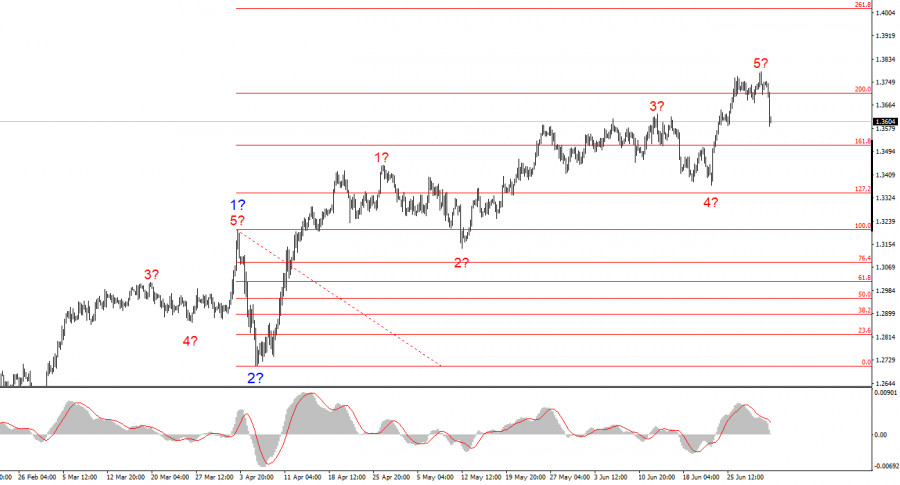

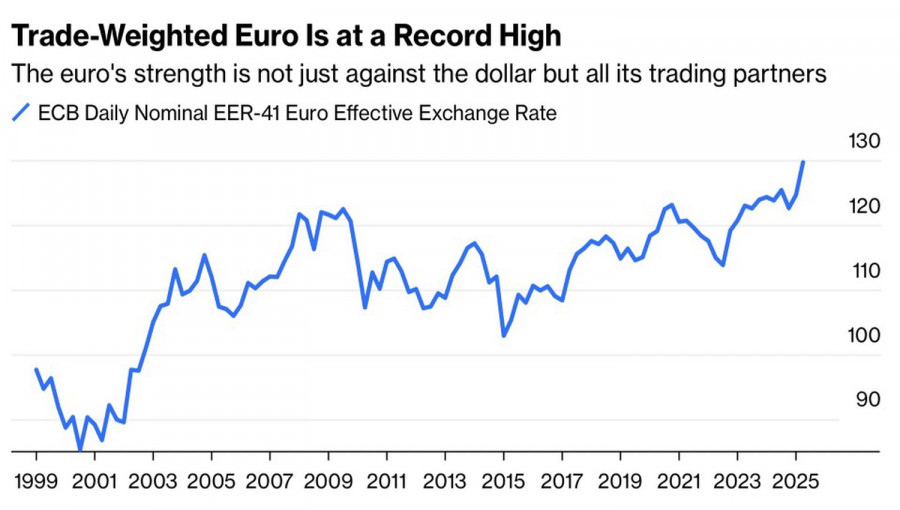

What used to be EUR/USD's strength is now becoming a vulnerabilityAuthor: Marek Petkovich

00:38 2025-07-03 UTC+2

718

- Technical analysis

Trading Signals for GOLD (XAU/USD) for July 2-8, 2025: buy above 3,325 (21 SMA - 200 EMA)

Gold could be preparing for a new bullish sequence, so as the price consolidates above 3,325 or 3,312, any technical rebound will be seen as a buying signal, with short-term targets at 8/8 Murray, located at 3,437.Author: Dimitrios Zappas

18:58 2025-07-02 UTC+2

988

- GBP/USD: Strategy for the U.S. Session on July 2nd (Analysis of Morning Trades)

Author: Miroslaw Bawulski

18:28 2025-07-02 UTC+2

883

- Technical analysis

Trading Signals for EUR/USD for July 2-5, 2025: sell below 1.1840 (+1/8 Murray - 21 SMA)

If the euro breaks below 1.1762 and consolidates below this price zone, a bearish acceleration is likely and could reach the bottom of the trend channel around 1.1620. It could eventually reach the psychological level of 1.15 around the 200 EMA.Author: Dimitrios Zappas

19:00 2025-07-02 UTC+2

868

- Trump's doubts regarding the US-Japan trade agreement are undermining the yen.

Author: Irina Yanina

18:51 2025-07-02 UTC+2

823

- USD/JPY: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)

Author: Jakub Novak

18:46 2025-07-02 UTC+2

778

- EUR/USD: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)

Author: Jakub Novak

18:35 2025-07-02 UTC+2

763

- The GBP/USD pair declined by nearly 200 basis points on Wednesday.

Author: Chin Zhao

20:33 2025-07-02 UTC+2

748

- GBP/USD: Simple Trading Tips for Beginner Traders – July 2nd (U.S. Session)

Author: Jakub Novak

18:39 2025-07-02 UTC+2

718

- What used to be EUR/USD's strength is now becoming a vulnerability

Author: Marek Petkovich

00:38 2025-07-03 UTC+2

718