Triple Top

was formed on 23.04 at 02:15:05 (UTC+0)

signal strength 1 of 5

On the chart of the AUDJPY M5 trading instrument, the Triple Top pattern that signals a trend change has formed. It is possible that after formation of the third peak, the price will try to break through the resistance level 90.75, where we advise to open a trading position for sale. Take profit is the projection of the pattern’s width, which is 20 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Segi Tiga Simetri Menaik

was formed on 23.05 at 02:01:08 (UTC+0)

signal strength 2 of 5

Berdasarkan carta M15, GBPCHF membentuk corak Segi Tiga Simetri Menaik yang menandakan aliran akan berterusan. Penerangan. Sempadan atas corak menyentuh koordinat 1.1132/1.1115 sedangkan sempadan bawah merentasi 1.1102/1.1115. Lebar corak diukur

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

Triple Bottom

was formed on 23.05 at 01:00:13 (UTC+0)

signal strength 3 of 5

Corak Triple Bottom telah dibentuk pada carta NZDUSD M30. Ciri-ciri corak: Garisan bawah corak mempunyai koordinat 0.5909 dengan had atas 0.5909/0.5906, unjuran lebar adalah 20 mata. Pembentukan corak Triple Bottom

Open chart in a new window

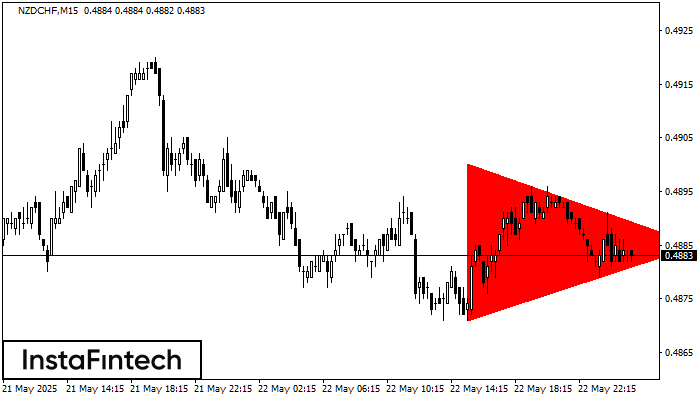

Segi Tiga Simetri Menurun

was formed on 23.05 at 00:42:21 (UTC+0)

signal strength 2 of 5

Berdasarkan carta M15, NZDCHF membentuk corak Segi Tiga Simetri Menurun. Cadangan dagangan: Penembusan sempadan bawah 0.4871 mungkin mendorong kepada kesinambungan aliran menurun

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window