Bearish Symmetrical Triangle

was formed on 21.04 at 13:29:27 (UTC+0)

signal strength 1 of 5

According to the chart of M5, AUDCHF formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 0.5164/0.5181 and upper border is 0.5203/0.5181. The pattern width is measured on the chart at -39 pips. The formation of the Bearish Symmetrical Triangle pattern evidently signals a continuation of the downward trend. In other words, if the scenario comes true and AUDCHF breaches the lower border, the price could continue its move toward 0.5166.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

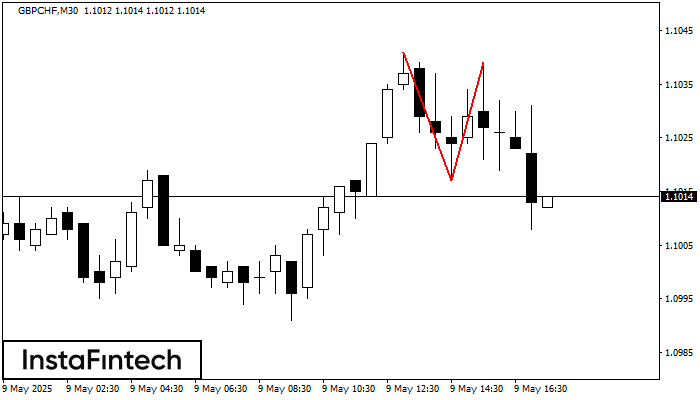

Double Top

was formed on 09.05 at 16:30:11 (UTC+0)

signal strength 3 of 5

Corak pembalikan Double Top telah dibentuk pada GBPCHF M30. Ciri-ciri: sempadan atas %P0.000000; sempadan bawah 1.1041; sempadan bawah 1.1017; lebar corak adalah 22 mata. Dagangan menjual adalah lebih baik untuk

Open chart in a new window

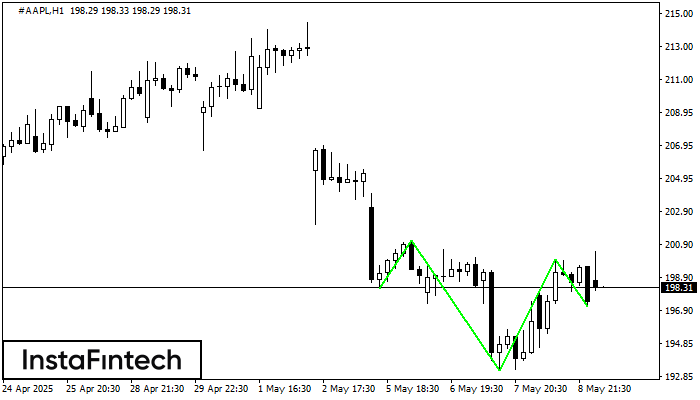

Inverse Head dan Shoulder

was formed on 09.05 at 16:29:45 (UTC+0)

signal strength 4 of 5

Berdasarkan carta H1, #AAPL membentuk corak Inverse Head dan Shoulder. Bahagian atas Head ditetapkan pada 200.00 manakala garisan median Neck didapati pada 193.24/197.13. Pembentukan corak Inverse Head dan Shoulder jelas

Open chart in a new window

Double Bottom

was formed on 09.05 at 16:20:05 (UTC+0)

signal strength 1 of 5

Corak Double Bottom telah dibentuk pada GBPAUD M5. Ciri-ciri: tahap sokongan 2.0676; tahap rintangan 2.0752; lebar corak 76 mata. Sekiranya tahap rintangan ditembusi, perubahan aliran boleh diramalkan dengan titik sasaran

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window