Double Bottom

was formed on 07.04 at 19:15:15 (UTC+0)

signal strength 2 of 5

The Double Bottom pattern has been formed on #AAPL M15. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 194.07 is broken. The further movements will rely on the width of the current pattern 1920 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Segi Tiga Simetri Menaik

was formed on 13.05 at 14:24:44 (UTC+0)

signal strength 4 of 5

Berdasarkan carta H1, AUDCHF membentuk corak Segi Tiga Simetri Menaik yang menandakan aliran akan berterusan. Penerangan. Sempadan atas corak menyentuh koordinat 0.5423/0.5395 sedangkan sempadan bawah merentasi 0.5355/0.5395. Lebar corak diukur

Open chart in a new window

Segi Tiga Simetri Menaik

was formed on 13.05 at 14:24:15 (UTC+0)

signal strength 3 of 5

Berdasarkan carta M30, AUDCHF membentuk corak Segi Tiga Simetri Menaik yang menandakan aliran akan berterusan. Penerangan. Sempadan atas corak menyentuh koordinat 0.5423/0.5395 sedangkan sempadan bawah merentasi 0.5355/0.5395. Lebar corak diukur

Open chart in a new window

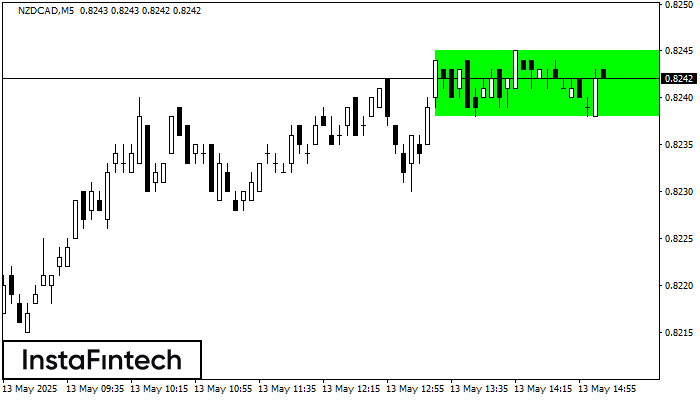

Segi Empat Menaik

was formed on 13.05 at 14:10:32 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, NZDCAD telah membentuk Segi Empat Menaik. Jenis corak ini menunjukkan kesinambungan aliran. Ia terdiri daripada dua tahap: rintangan 0.8245 dan sokongan 0.8238. Sekiranya tahap rintangan 0.8245

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window