Bullish Symmetrical Triangle

was formed on 27.03 at 01:21:01 (UTC+0)

signal strength 1 of 5

According to the chart of M5, USDCHF formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 0.8847 and 0.8835 are the coordinates of the upper and lower borders respectively. The pattern width is measured on the chart at 12 pips. Outlook: If the upper border 0.8847 is broken, the price is likely to continue its move by 0.8855.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Segi Tiga Simetri Menurun

was formed on 14.05 at 01:53:00 (UTC+0)

signal strength 1 of 5

Berdasarkan carta M5, NZDCAD membentuk corak Segi Tiga Simetri Menurun. Corak ini menandakan aliran menurun lagi dalam situasi sempadan rendah 0.8265 ditembusi. Di sini, keuntungan andaian akan sepadan dengan lebar

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

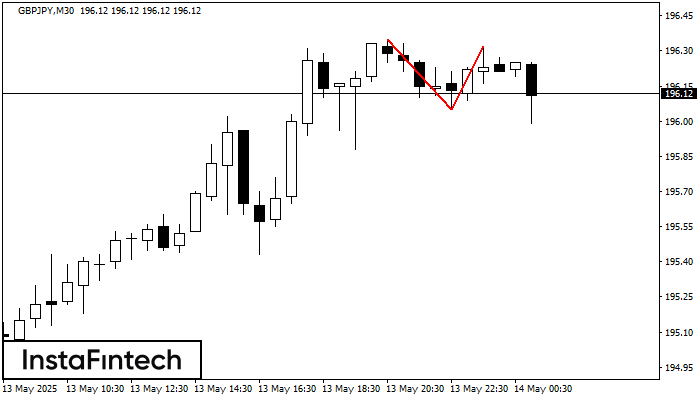

Double Top

was formed on 14.05 at 00:30:22 (UTC+0)

signal strength 3 of 5

Pada carta GBPJPY M30 corak pembalikan Double Top telah terbentuk. Ciri-ciri: sempadan atas 196.32; sempadan bawah 196.05; lebar corak 27 mata. Isyarat: penembusan sempadan bawah akan menyebabkan kesinambungan arah aliran

Open chart in a new window

Triple Bottom

was formed on 14.05 at 00:00:30 (UTC+0)

signal strength 3 of 5

Corak Triple Bottom telah dibentuk pada EURNZD M30. Ia mempunyai ciri-ciri berikut: tahap rintangan 1.8864/1.8842; tahap sokongan 1.8820/1.8815; lebar corak adalah 44 mata. Dalam situasi penembusan paras rintangan 1.8864, harga

Open chart in a new window