Lihat juga

25.03.2025 09:12 AM

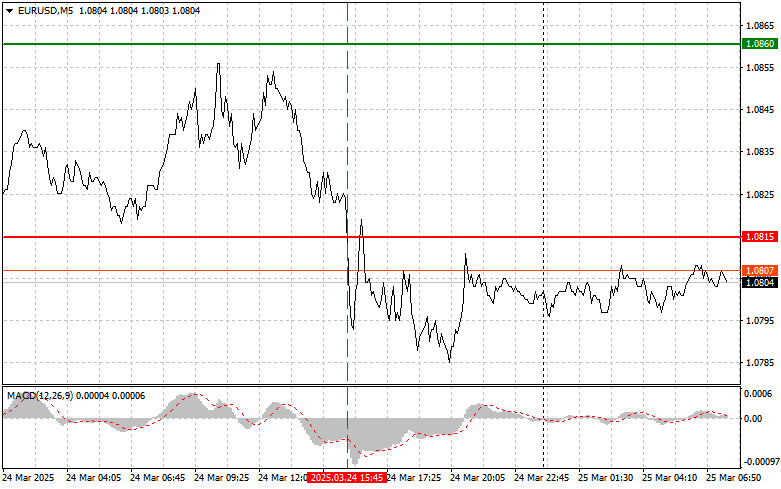

25.03.2025 09:12 AMThe test of the 1.0815 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For this reason, I did not sell the euro. I also did not see any other valid entry points.

Demand for the dollar returned in the second half of the day, even though the U.S. economy showed mixed signals: the services sector is experiencing a strong upswing, while the manufacturing sector, on the contrary, is facing a downturn. The Manufacturing PMI has fallen below the critical 50 mark, indicating a negative outlook for the economy. This creates a mixed impression of the current state of the U.S. economy. Steady growth in services indicates strong consumer demand and overall economic activity, while the decline in manufacturing may signal weakening global demand, supply chain disruptions, or the impact of high interest rates. The divergence between these two sectors could also reflect structural shifts in the U.S. economy, where services are increasingly dominant. Over the coming months, the key question will be whether this trend will continue or whether the manufacturing sector will recover. The answer will significantly affect U.S. growth prospects and the dollar's strength.

Today, the IFO Business Climate Index, Current Conditions Index, and Expectations Index from Germany are expected. Traders closely watch these indicators as they are important barometers of Germany's economic health. Positive IFO results could boost confidence in the recovery of the German economy and increase the euro's appeal. On the other hand, weak data could spark concerns over slowing growth and pressure on the euro.

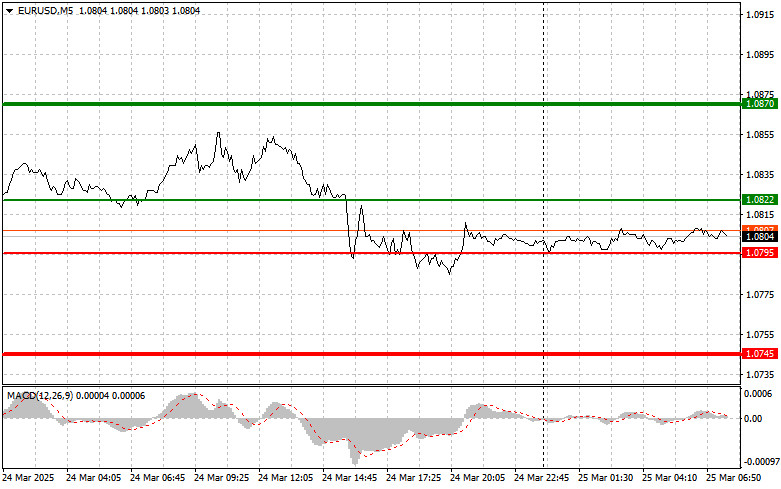

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Scenario #1: I plan to buy the euro today upon reaching the 1.0822 area (green line on the chart), targeting a rise to 1.0870. At the 1.0870 mark, I intend to exit the market and sell the euro in the opposite direction, expecting a 30–35 pip move from the entry point. A bullish outlook for the euro in the first half of the day is valid only if the data is strong. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.0795 level when the MACD is in the oversold zone. This will limit the pair's downside potential and trigger an upward reversal. A rise toward the opposite levels of 1.0822 and 1.0870 can be expected.

Scenario #1: I plan to sell the euro after reaching the 1.0795 level (red line on the chart). The target will be 1.0745, where I plan to exit the market and buy immediately in the opposite direction, expecting a 20–25 pip move from the level. Selling pressure on the pair will likely return if the data disappoints. Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.0822 level while the MACD is in the overbought zone. This will limit the pair's upside potential and trigger a downward reversal. A drop toward the opposite levels of 1.0795 and 1.0745 can be expected.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Ujian pada tahap harga 142.77 berlaku apabila penunjuk MACD telah bergerak jauh di bawah garis sifar, yang mengehadkan potensi penurunan pasangan ini. Oleh sebab itu, saya tidak menjual dolar. Hari

Ujian pertama pada tahap harga 1.3553 pada separuh kedua hari berlaku ketika penunjuk MACD sudah bergerak ketara di bawah paras sifar, yang menghadkan potensi penurunan pasangan mata wang ini. Tidak

Ujian pertama pada tahap harga 1.1374 pada separuh kedua hari tersebut berlaku ketika penunjuk MACD sudah bergerak jauh di bawah garis sifar, yang mengehadkan potensi penurunan pasangan ini. Tidak lama

Pembeli euro dan pound telah mengambil pendekatan tunggu dan lihat, kerana kenyataan Trump semata-mata tidak lagi mencukupi untuk membenarkan pembelian berterusan aset berisiko. Namun begitu, data ekonomi hari ini mungkin

Ulasan Dagangan dan Petua untuk Berdagang Yen Jepun Ujian paras 142.85 berlaku apabila penunjuk MACD telah pun bergerak jauh di atas garisan sifar, sekali gus mengehadkan potensi kenaikan pasangan mata

Ulasan Dagangan dan Petua untuk Dagangan Pound British Ujian paras 1.3567 pada separuh pertama hari ini berlaku serentak dengan penunjuk MACD yang baru sahaja mula bergerak ke bawah dari garis

Ulasan Dagangan dan Petua untuk Berdagang Euro Ujian harga pada paras 1.1397 berlaku ketika penunjuk MACD baru sahaja mula bergerak menurun dari tanda sifar, mengesahkan titik kemasukan jualan yang

Memandangkan penurunan mendadak euro dan pergerakan sederhana dalam pound, penggunaan strategi Pembalikan Min (Mean Reversion) untuk mana-mana daripadanya adalah tidak wajar. Hanya yen yang menunjukkan reaksi jelas terhadap strategi Momentum

Dolar terus kehilangan nilai berbanding yen sebagai reaksi terhadap kenyataan Trump bahawa beliau bersedia untuk membuat konsesi dalam tarif perdagangan, kerana matlamat utamanya adalah untuk memuktamadkan perjanjian perdagangan dan bukannya

Pound British terus mengukuh. Para pelabur memberi respons optimistik terhadap pelonggaran retorik Washington terhadap rakan perdagangan utamanya, sekali gus mengurangkan kebimbangan terhadap kemungkinan perang perdagangan global. Keadaan ini secara langsung

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.