Lihat juga

07.03.2025 01:52 PM

07.03.2025 01:52 PMBitcoin and Ethereum continue their struggle for growth, though not without challenges. At the time of writing, Bitcoin rebounded from the $84,000 level and is trading at $88,000. Ethereum also saw a dip during the Asian session to around $2,100, but the decline was quickly bought up, leading to a recovery toward $2,189.

Despite the high risks of another wave of decline in the crypto market, the Bitcoin network continues to grow, even amid increased market volatility. The number of new wallets is increasing across all fronts, signaling sustained interest in cryptocurrency despite bearish sentiment. Investors may see the current conditions as an opportunity to accumulate assets at lower prices, anticipating a long-term recovery in Bitcoin.

An increase in the number of wallets may also indicate a growing user base, drawing new participants into the ecosystem. These newcomers may be attracted by decentralization prospects, inflation hedging, or simply the desire to diversify their portfolios. However, network growth alone does not guarantee protection against further declines. Cryptocurrency market volatility remains high, and external factors such as regulatory shifts or macroeconomic events can significantly impact BTC price movements.

Ethereum, on the other hand, shows strong bearish sentiment, increasing the chances of a rebound followed by another wave of decline. The only major support for ETH comes from its upcoming network upgrade. However, bearish sentiment does not necessarily indicate a trend reversal. The market may stay in an uptrend for an extended period, undergoing corrections—especially if fundamental factors continue to pressure ETH's price. While Ethereum's network upgrade is a crucial event, its success is not guaranteed. Delays or technical setbacks could negatively impact investor perception of ETH.

For now, I will continue focusing on major pullbacks in Bitcoin and Ethereum, with an expectation of further bullish momentum in the medium term. The overall uptrend has not disappeared.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin Trading Plan

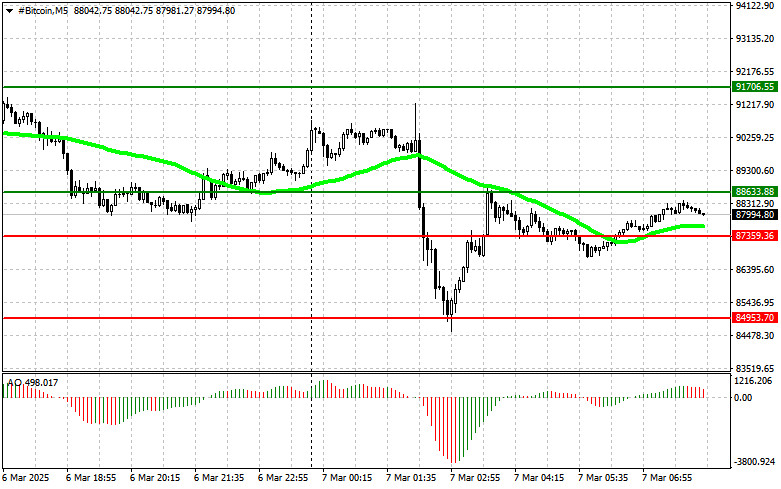

Scenario #1: Buy Bitcoin upon reaching $88,600, targeting a rise to $91,700. At $91,700, I will exit buy positions and sell on a pullback. Before buying, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buy Bitcoin from the lower boundary of $87,400, provided there is no market reaction confirming a breakout below this level. Expect a reversal toward $88,600 and $91,700.

Scenario #1: Sell Bitcoin upon reaching $87,400, aiming for a decline to $84,900. At $84,900, I will exit short positions and buy on a rebound. Before selling, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Sell Bitcoin from the upper boundary of $88,600, provided there is no market reaction confirming a breakout above this level. Expect a decline toward $87,400 and $84,900.

Ethereum Trading Plan

Scenario #1: Buy Ethereum upon reaching $2,189, targeting a rise to $2,236. At $2,236, I will exit buy positions and sell on a pullback. Before buying, confirm that the 50-day moving average is below the current price and that the Awesome Oscillator is in the positive zone.

Scenario #2: Buy Ethereum from the lower boundary of $2,148, provided there is no market reaction confirming a breakout below this level. Expect a reversal toward $2,198 and $2,246.

Scenario #1: Sell Ethereum upon reaching $2,148, aiming for a decline to $2,087. At $2,087, I will exit short positions and buy on a rebound. Before selling, confirm that the 50-day moving average is above the current price and that the Awesome Oscillator is in the negative zone.

Scenario #2: Sell Ethereum from the upper boundary of $2,189, provided there is no market reaction confirming a breakout above this level. Expect a decline toward $2,148 and $2,087.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bitcoin dan Ethereum telah mengalami kejatuhan. Bitcoin kehilangan sekitar 3.5% hanya dalam dagangan pagi sahaja, manakala Ethereum jatuh lebih daripada 10%, kemudian sedikit pulih semula. Panik melanda pasaran mata wang

Bitcoin dan Ethereum menjunam susulan serangan Israel ke atas kemudahan nuklear Iran pada waktu malam, yang mencetuskan gelombang jualan besar-besaran terhadap aset berisiko, termasuk dalam pasaran mata wang kripto. Sekiranya

Tidak banyak berbeza dengan cryptocurrency lain seperti Solana, Filecoin juga mempunyai keadaan yang hampir sama pada carta 4 jamnya di mana terdapat Divergence antara pergerakan harga Filecoin dan penunjuk Pengayun

Dengan kemunculan Perbezaan antara pergerakan harga mata wang kripto Solana pada carta 4-jam dengan penunjuk Pengayun Stochastic serta disahkan oleh penandaan pergerakan harganya yang membentuk corak Higher Low dan Lower

Bitcoin dan Ethereum mengalami penurunan yang ketara selepas satu lagi percubaan gagal untuk meningkat. Bitcoin tidak dapat menguji semula paras tertinggi sepanjang masanya, dan Ethereum tidak dapat melepasi paras $2900

Bitcoin sedang menunjukkan pertumbuhan yang kukuh dan hampir mencapai paras tertinggi baharu. Walau bagaimanapun, adalah penting untuk memahami bahawa langkah terakhir ini akan menjadi agak mencabar dan memerlukan pemangkin yang

Bitcoin sedang melalui pembetulan selepas kenaikan mendadak semalam ke kawasan $110,500, manakala Ethereum terus bertenaga—dengan kenaikan melebihi 6% semalam dan kini didagangkan pada $2,785. Dengan lonjakan pasaran yang begitu kukuh

Bitcoin telah menyambung semula pergerakan ke atasnya, menarik aset mata wang kripto lain bersamanya. Kenaikan hari ini semasa sesi Asia jelas menunjukkan penembusan beberapa tahap rintangan teknikal utama merentasi beberapa

Bitcoin akhirnya berjaya menembusi paras $107,000, dan dalam sesi dagangan Asia hari ini, ia melonjak pantas ke sekitar $110,000, hanya satu langkah lagi untuk memperbaharui paras tertinggi sepanjang masanya. Namun

E-mel/SMS

pemberitahuan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.