Lihat juga

26.02.2025 12:09 PM

26.02.2025 12:09 PMSince Donald Trump's victory in the presidential race last November, the majority of significant cryptocurrency tokens have either sharply corrected downward or entered a consolidation phase within a sideways range.

One might have expected that the return of President Trump would provide strong support for the cryptocurrency market. His previous favorable statements about the future of this financial sector, along with the launch of a Trump family token, should have sparked a renewed demand for these popular financial assets. However, this did not occur. On the contrary, the enthusiastic growth seen earlier has diminished, and for many assets, it has been completely erased.

This situation once again demonstrates the artificial nature of the factors driving demand for these financial instruments, making trading them a much more complex endeavor compared to the stock and forex markets, which were previously considered the most high-risk.

Returning to the crypto market situation—what prevents token demand from rising? The primary factor is the uncertainty surrounding the future state of the U.S. economy amid Trump's domestic and foreign policies. The threats—and, in some cases, already implemented—tariff increases on Chinese imports create uncertainty about their actual impact on the U.S. In this environment, crypto investors are unsure whether demand for these assets will grow.

Trump's protectionist policies, which have already begun taking effect in the U.S., could become a strong catalyst for increased demand in the stock market, particularly for shares of companies that may surge in the short and medium term. For example, today's 4% rise in copper prices, driven by higher import tariffs on the metal, is expected to support stocks of mining and metallurgical companies. In such a scenario, many token investors may start questioning whether it makes sense to take risks with cryptocurrencies when they could simply buy stocks of these companies and, in addition to potential price appreciation, receive dividends—which isn't a bad deal. This trend could spread across the entire market.

Investors previously accumulated capital in crypto assets, which could easily be shifted to stocks. The role of the U.S. dollar should not be overlooked. Although the dollar is currently facing pressure, the gradual stabilization of the American market, along with Trump's efforts to strengthen the dollar's global position, could lead to increased demand for it.

What about gold? The sharp profit-taking in gold observed yesterday suggests that a potential resolution of tensions between Russia and the West, particularly the U.S., could significantly reduce geopolitical risks—or even neutralize them temporarily. In this scenario, investors may start seeking assets that can generate some interest income, which is something gold cannot provide.

History tells us that the U.S. stock market experienced rapid growth after World War II. A similar situation could unfold in America soon—provided Trump manages to strike a deal with Putin and put the U.S. economy on a growth trajectory.

If this scenario unfolds, the crypto market could be pushed to the sidelines, leading to a significant drop in token demand and, consequently, a decline in their value—especially against the U.S. dollar.

The U.S. and crypto stock markets will likely consolidate within sideways ranges. As for the dollar, a temporary rebound in the ICE dollar index to 106.75 is possible, but this should not yet be interpreted as a change in the current trend. This week, the market's primary focus is the PCE index report, a key indicator for Fed rate decisions, and the second estimate of U.S. GDP for Q4 2024.

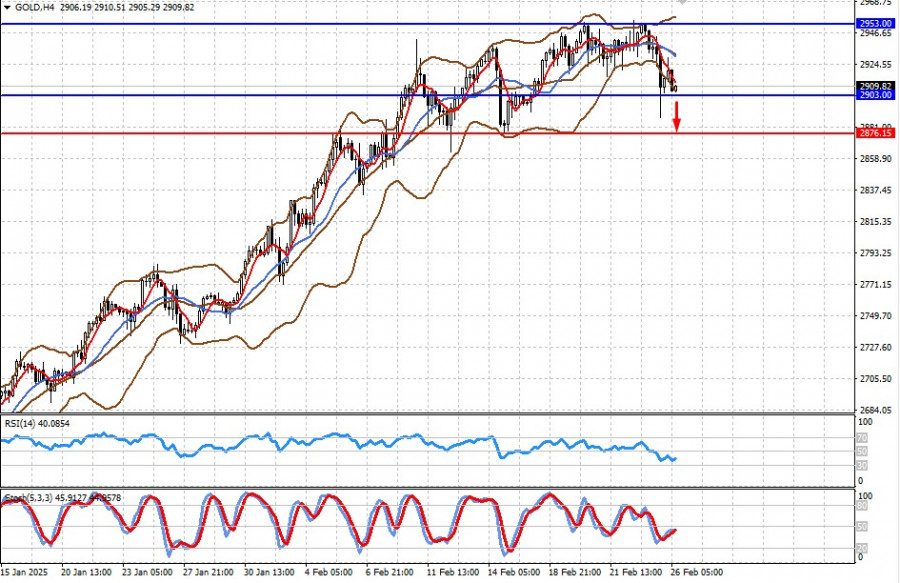

Gold

Gold has reached our previous target level of 2,903.00. A break below this level could lead to further demand weakness and a decline to 2,876.15.

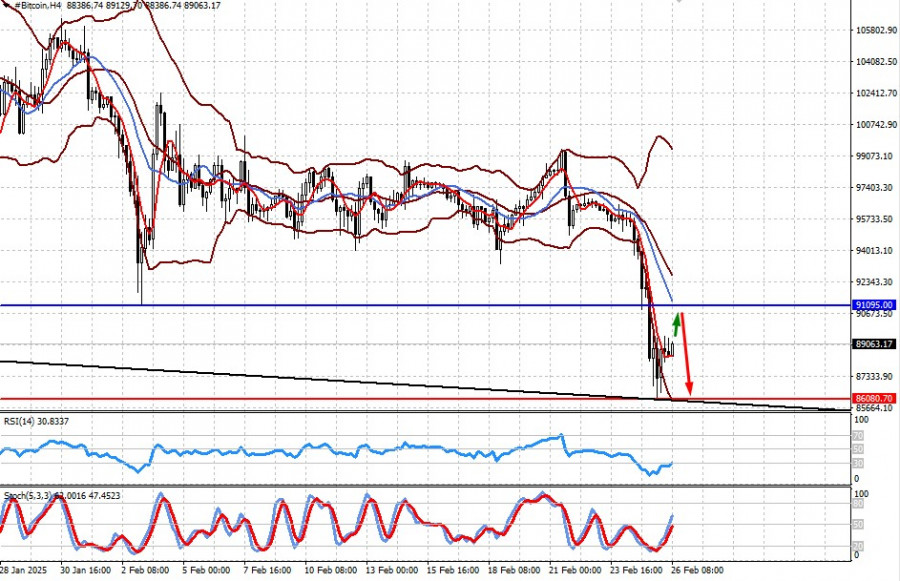

Bitcoin

Bitcoin remains under significant pressure due to waning interest amid global and U.S. economic developments. The price may correct upwards toward 91,095.00, from which it could rebound and retest the support level of 86,080.70.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dalam ucapannya, Pengarah Urusan IMF, Kristalina Georgieva menyatakan bahawa beliau melihat potensi untuk euro memainkan peranan yang lebih luas di peringkat global. Kenyataan beliau dibuat ketika ketidaktentuan geopolitik semakin memuncak

Enam bulan selepas Donald Trump menjadi presiden, nampaknya beliau telah meletihkan dunia secara menyeluruh dengan inisiatif "cemerlang" beliau, tindakan pecah tanah yang bertujuan menjadikan Amerika hebat semula, dan penjelmaan jelas

Euro menyaksikan pemulihan sederhana selepas Presiden Bank Pusat Eropah Christine Lagarde menyatakan bahawa pengembangan perdagangan dalam rantau itu boleh membantu mengimbangi kerugian akibat pemecahan global. Kenyataan optimis beliau dibuat

Pasangan mata wang GBP/USD didagangkan secara relatif tenang pada hari Rabu, meskipun sehari sebelumnya ia mencatatkan kejatuhan ketara pada separuh kedua sesi—melebihi 100 pip. Seperti yang telah dinyatakan sebelum

Pasangan mata wang GBP/USD didagangkan dengan agak tenang pada hari Khamis, memandangkan latar belakang fundamental yang tersedia untuk pasaran. Pada petang Rabu, Rizab Persekutuan mengumumkan keputusan mesyuarat terbarunya, yang boleh

Seperti yang dijangkakan, bank pusat Amerika Syarikat mengekalkan semua parameter utama dasar monetari tanpa perubahan, sambil sekali lagi memetik ketidaktentuan yang berterusan mengenai keadaan masa depan ekonomi negara—faktor yang menjadi

Dolar AS memberi reaksi dengan mencatatkan kenaikan, manakala aset berisiko seperti euro dan pound mengalami penurunan. Susulan mesyuarat semalam, pegawai Rizab Persekutuan menyatakan bahawa mereka menjangkakan dua kali pemotongan kadar

Pasangan mata wang EUR/USD didagangkan dengan lebih tenang pada hari Rabu berbanding hari sebelumnya. Bagaimanapun, pergerakan ketara hari sebelumnya juga bermula lebih dekat ke petang. Ia tidak berkaitan dengan latar

Analisis Laporan Makroekonomi: Hanya sedikit laporan makroekonomi yang dijadualkan untuk hari Jumaat. Satu-satunya laporan yang akan diterbitkan ialah laporan jualan runcit UK. Tiada data ekonomi akan dikeluarkan hari

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.