Lihat juga

04.02.2025 12:09 PM

04.02.2025 12:09 PMCrude oil prices are falling for the second consecutive day, hitting a more-than-one-month low, undermining the commodity-linked Canadian dollar. This provides a tailwind for the USD/CAD pair amidst rising demand for the U.S. dollar.

U.S. President Donald Trump's decision to postpone the recently imposed tariffs on imports from Canada and Mexico has eased concerns over potential supply disruptions from these two major oil suppliers to the U.S.

Additionally, the outlook for reduced fuel demand, particularly due to the expected ripple effects of Trump's trade policies, is exerting further pressure on oil prices. Expectations that Trump's policies could push inflation higher and reduce the need for the Federal Reserve to cut interest rates have also contributed to a modest rebound in the U.S. Treasury yields. This, in turn, offers additional support to the USD/CAD pair. Moreover, the dovish outlook from the Bank of Canada suggests that the path of least resistance for the USD/CAD pair remains upward.

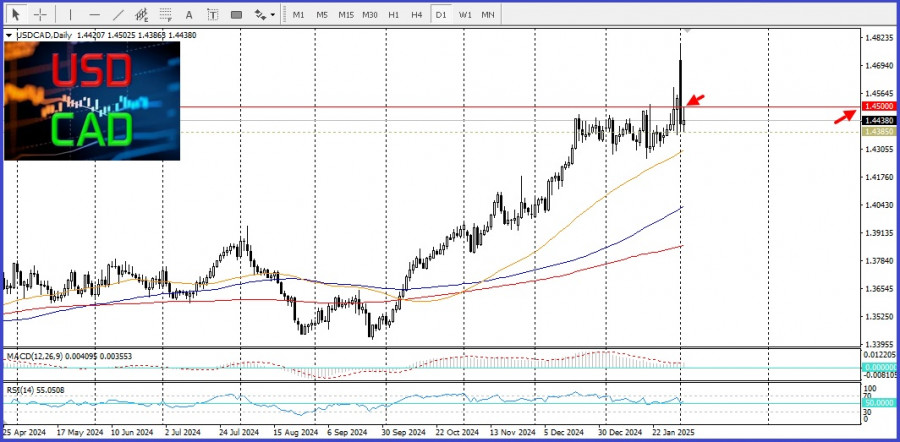

From a technical perspective, oscillators on the daily chart remain in positive territory, indicating that the pair is not yet ready for a significant decline. This setup suggests the potential for further gains in the near term, with the psychological 1.4500 level acting as the next target for bulls.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Minggu hadapan bakal menyaksikan pelbagai penerbitan data ekonomi penting yang berpotensi memberi kesan ketara terhadap dinamik pasaran — namun, sejauh mana data ini mampu mengubah keadaan? Dalam suasana geopolitik yang

Tiada peristiwa makroekonomi dijadualkan pada hari Isnin. Jika pasaran hampir tidak memberi reaksi kepada data makroekonomi minggu lalu, tiada apa yang diharapkan pada hari Isnin. Sudah tentu, Donald Trump boleh

Pound British berada dalam keadaan yang lebih baik berbanding euro. Pasaran terus menemui pelbagai sebab tambahan untuk meningkatkan permintaan terhadap pound, walaupun euro kekal statik. Oleh demikian, untuk mengharapkan gelombang

Dolar A.S. mengukuh berbanding sejumlah mata wang global, begitu juga pasaran saham A.S., selepas laporan bahawa kerajaan China sedang mempertimbangkan untuk menggantung tarif 125% terhadap beberapa jenis import A.S. Langkah

Permulaan rundingan sebenar boleh menyebabkan penurunan ketara dalam harga emas dalam masa terdekat. Dalam artikel-artikel terdahulu, saya mencadangkan bahawa harga emas yang sebelum ini meningkat dengan ketara boleh mengalami pembetulan

Pada hari Khamis, pasangan mata wang GBP/USD diniagakan lebih tinggi, kekal berhampiran paras tertinggi 3 tahun. Walaupun pound British menaik kukuh dalam beberapa bulan kebelakangan ini, pembetulan masih jarang berlaku

Pasangan mata wang EUR/USD meneruskan dagangan secara tenang pada hari Khamis, meskipun tahap volatiliti kekal agak tinggi. Minggu ini, dolar AS menunjukkan beberapa tanda pemulihan—sesuatu yang boleh dianggap sebagai satu

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.