Lihat juga

06.05.2024 02:59 PM

06.05.2024 02:59 PMThe government data on the US labor market published on Friday interrupted the victorious pace of robust employment in the US economy since the end of last year. Strong NFPs previously became one of the reasons for the Federal Reserve's actual refusal to start cutting interest rates this year.

The April report for the number of new jobs released on Friday turned out to be way lower than predicted. Thus, the consensus assumed the increase in new jobs to 238,000, as well as maintaining the unemployment rate at the previous level of 3.8%. In practice, the nonfarm payrolls turned out to be not so optimistic. In April, the US economy added just 175,000 new jobs, and the unemployment rate rose to 3.9%. Besides, average hourly earnings slowed the pace of annual growth to 3.9% from 4.1%, and in monthly terms wages slipped to 0.2% from 0.3%.

How markets respond to such news

The US dollar weakened, which came as no surprise in such situations, when lower-than-expected employment figures come out. The greenback either rises sharply against major currencies or falls. On Friday, as expected, growth was limited, and its weakening in trading on Monday morning was not supported, at least not yet. The US dollar index is currently trading below 105.00 points.

But stock markets reacted to this news with notable optimism, which seems to be based on two pillars. The first is the assurance of Fed Chairman Jerome Powell that the central bank does not plan to raise interest rates, and the second is the revival of hopes that the growth curve in the number of new jobs and everything that accompanied it has reached a certain point. As a result, we can expect a slowdown in the upward trend, which could lead to a decline in inflation. In turn, the Federal Reserve will again raise the issue of rate cuts in the second half of this year.

Is it a good idea to price in these scenarios?

I guess not yet. The weakening of the US dollar, the decline in Treasury yields, and growing demand for stocks may turn out to be temporary. Most likely, market is likely to revise its sentiment only when data on consumer inflation shows lower figures. Meanwhile, growth or decline in inflation will be based only on expectations and nothing more.

What market sentiment will prevail today

I believe the odds are that market participants will maintain Friday's trend. The empty economic calendar today will hardly contribute to this. Markets are going to shape sentiment based on internal stories rather than strong external factors.

Intraday outlook

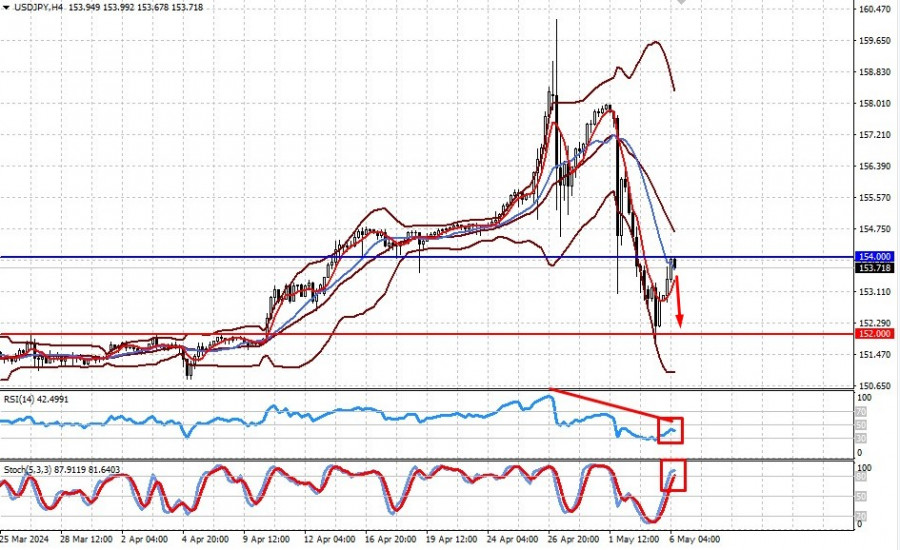

USD/JPY

The currency pair remains under strong pressure in the wake of currency interventions from the Bank of Japan. If the instrument does not rise above 154.00, then the price may fall to 152.00 due to a temporary weakening of interest in the US dollar.

XAU/USD

Spot gold price may find support after breaking through the resistance level of $2,325.00 and rebound towards $2,353.25.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pasaran global sangat dipengaruhi oleh acara yang berlaku di Amerika Syarikat, di mana kedua-dua bidang politik dan ekonomi terus berayun seperti bandul. Awal minggu ini, selepas Mahkamah Perdagangan Antarabangsa A.S

Walaupun euro sedang berusaha untuk mendapatkan semula paras tertinggi bulanannya selepas pembetulan yang agak ketara minggu ini, tinjauan terhadap beberapa ahli ekonomi menunjukkan bahawa Bank Pusat Eropah dijangka akan menurunkan

Analisis Laporan Makroekonomi: Beberapa laporan makroekonomi dijadualkan untuk diterbitkan pada hari Jumaat, namun tiada satu pun dianggap benar-benar penting. Di Jerman, laporan inflasi bagi bulan Mei akan dikeluarkan, dengan jangkaan

Pada hari Khamis, pasangan mata wang GBP/USD ditutup di bawah garisan purata bergerak, dan dolar mengukuh selama tiga hari berturut-turut. Walau bagaimanapun, segala-galanya berubah pada separuh kedua hari itu. Seperti

Pasangan mata wang EUR/USD meneruskan pergerakan menurun ringan pada pagi Khamis, namun melonjak dengan ketara pada sebelah petang. Kami menyaksikan reaksi emosional yang kuat daripada pedagang susulan keputusan Mahkamah Perdagangan

Minit mesyuarat FOMC yang dikeluarkan pada hari Rabu tidak menarik perhatian pedagang EUR/USD, menyebabkan pembeli dan penjual tidak terkesan. Minit tersebut mencerminkan perkara utama dari kenyataan yang disertakan serta mesej

Jangan cari kucing hitam dalam bilik gelap—terutamanya jika ia memang tiada. Keputusan Mahkamah Perdagangan Antarabangsa AS yang mengisytiharkan tarif sejagat Rumah Putih sebagai tidak sah telah mengejutkan pasaran kewangan. Para

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.