Lihat juga

23.01.2024 02:53 PM

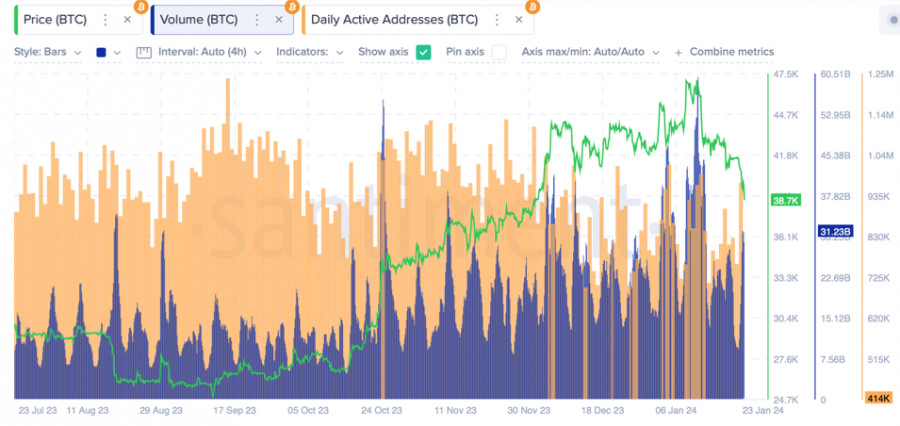

23.01.2024 02:53 PMMore than a week has passed since the spot BTC-ETF approval and the local high update. During this time, the price of the cryptocurrency has decreased from $48.9k to $40k due to the unloading of portfolios by various categories of investors. This process began last week, but due to optimistic sentiments, buyers could maintain balance and absorb the free volumes of BTC.

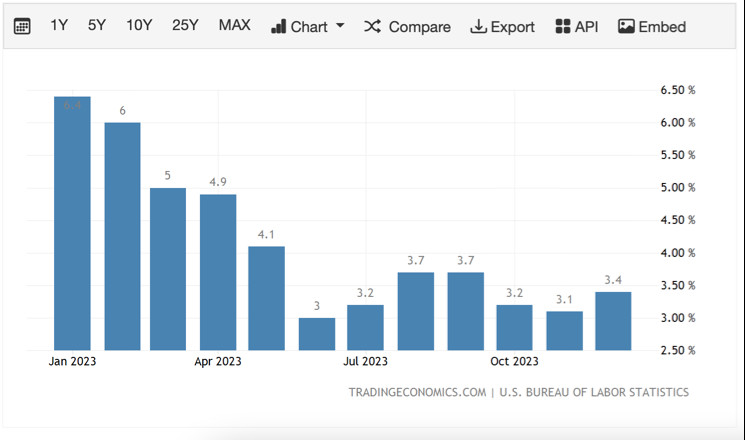

However, the pace of sales significantly intensified, including those by institutional investors and miners. Concurrently, financial markets began to realize that a quick easing of monetary policy is not anticipated due to persistent inflation and geopolitical tensions. Considering these factors, Bitcoin's quotes continued to decline, and by January 22, the cryptocurrency made a bearish breakthrough of the $40k level.

It's still early to say that the breakdown of the $40k level will be a prelude to another collapse in Bitcoin quotes. Before making any conclusions, it is necessary to wait for the end of the current trading day, when this fall may be recovered. However, the $40k level is extremely important, both from the point of view of the key support zone of the upward trend and psychologically. A breakdown and final consolidation below $40k may lead to a new wave of sales and, as a consequence, a deeper correction.

At the same time, analysts at Santiment note that large wallets are not resuming the accumulation of BTC or stablecoins. Without clear signals for the start of this process, one should not count on the resumption of a stable bullish rally. However, it is reported that individual large players continue to purchase BTC. Over the past day, BlackRock bought another 4,800 BTC, increasing the number of coins in its balance to 33,430 units.

The situation is complicated by publications in the media, where it was announced that Grayscale decided to sell BTC for $2.8 billion immediately after the approval of the spot BTC-ETF. Fundamental factors are also a significant reason for investors to refrain from buying cryptocurrency and to pay attention to the U.S. dollar and Treasury bonds. As of January 23, there are many more rational arguments in the market indicating the continuation of the downward movement of Bitcoin's price.

As of January 22, Bitcoin formed a large bearish candle after consolidation and several attempts to break through the $40.5k level. Ultimately, the key support zone fell, which means that the structure of the upward trend, which began in October 2023, is under threat. Technically, Bitcoin continues to be at the support level, but if the trading day ends below the $40k level, the likelihood of further decline will significantly increase.

Technical metrics do not show signs of buyer activation; on the contrary, they signal complete seller dominance. The Stochastic continues its downward movement in the oversold zone, and the MACD has entered the red zone, indicating total bearish dominance. If successfully consolidated below $40k and further downward movement ensues, bears will head to the next support zone near the $38k level, where there was a prolonged period of accumulation.

Despite the pessimism, one cannot rule out the possibility that the breakdown of the $40k level was necessary to collect liquidity, which reached $150 million. Therefore, there is a possibility of a pump in the BTC/USD price above $40k. In addition, it should not be forgotten that important macroeconomic statistics about the labor market and business activity in the U.S. are expected. These events can also bring back optimism to the cryptocurrency market and strengthen buying sentiments.

The current trading day could be decisive in determining the future trajectory of Bitcoin's price movement. If BTC/USD consolidates below $40k, the likelihood of a downward movement to $38k and lower will significantly increase. However, if the bulls turn the situation around and restore BTC above $40k, it could bring back confidence in Bitcoin's bullish trend and increase the volumes of purchases necessary to complete the correction.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada carta 4 jam bagi mata wang kripto Litecoin, terdapat kemunculan corak Descending Broadening Wedge yang menunjukkan kemungkinan pengukuhan dalam masa terdekat. Walaupun ketika ini terdapat potensi untuk pembetulan penurunan

Bitcoin semakin jarang mencapai $106,000 dan lebih kerap jatuh ke arah $104,000, yang merupakan petanda jangka pendek yang agak membimbangkan. Lambat laun, corak ini mungkin membawa kepada pembetulan yang lebih

Bitcoin dan Ethereum terus mencuba untuk menembusi tahap rintangan utama tetapi berdepan halangan yang sama. Di satu pihak, ini menunjukkan pendekatan berhati-hati oleh pemain pasaran utama dan sikap tunggu

Bitcoin masih tidak dapat bertahan kukuh di atas paras $106,000, yang menimbulkan kebimbangan tertentu. Walaupun altcoin dan token lain menunjukkan prestasi yang lebih baik, sekurang-kurangnya dalam beberapa hari kebelakangan

Bitcoin dan Ether melonjak dengan kukuh semasa dagangan di Asia, walaupun semalam berakhir dengan agak lesu. Walau bagaimanapun, meskipun pengukuhan pesat aset-aset ini, Bitcoin sekali lagi gagal mengekalkan kedudukannya

Walaupun terdapat pembetulan pada akhir minggu lepas, Bitcoin dan Ethereum sekali lagi menunjukkan momentum menaik, walaupun Ethereum sedikit ketinggalan. Pakar dari kumpulan perbankan juga menunjukkan kejutan bekalan dalam

Bitcoin dan Ethereum meneruskan pembetulan mereka, jatuh dengan ketara sepanjang semalam. Penurunan ini berlanjutan ke sesi dagangan Asia hari ini, dengan Bitcoin menyemak harga kepada $104,500 dan Ethereum menguji $2,560

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.