Lihat juga

02.08.2024 01:12 PM

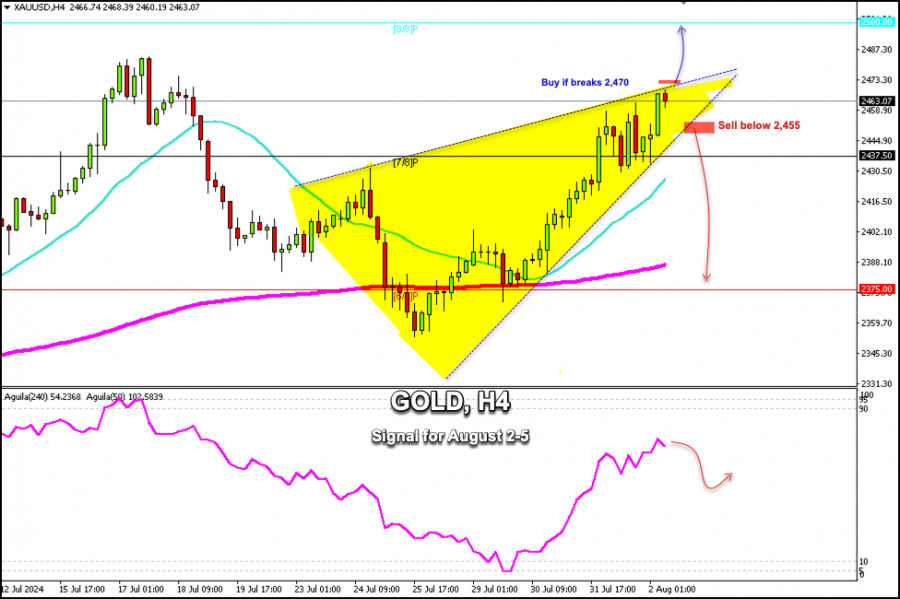

02.08.2024 01:12 PMEarly in the American session, gold is trading at 2,463 within the symmetrical triangle pattern and showing positive signals but reaching overbought levels which is likely to cause a technical correction. Then, the metal could resume its bullish cycle.

The US nonfarm payrolls will be released in a few hours. Thus, markets will be overwhelmed by strong volatility.

We believe that if the US data indicates robust employment, we could expect a strong technical correction in gold. The price could reach 2,437 and even accelerate its bearish cycle and reach 6/8 Murray at 2,375.

On the other hand, if the US data reflects weak employment, we could expect gold to continue its bullish cycle, but we should expect a break and consolidation above 2,470.

If this scenario occurs, gold could reach the high of July 17 around 2,483.48 and eventually reach 8/8 Murray around the psychological level of 2,500.

We see an exhaustion of bullish strength in gold. Only a break of the bullish trend channel and a consolidation below 2,455 could entail a technical correction for gold.

Therefore, we should pay attention to this point since below this area, we could expect a fall towards the 21 SMA located at 2,422 and finally towards the 200 EMA located at 2,385. It could be seen as a selling opportunity.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada hari Selasa, pasangan EUR/USD telah mengukuh di bawah zon 1.1374–1.1380 dan kemudiannya membuat lantunan dari bawah zon tersebut. Ini mengesahkan kesinambungan pergerakan menurun, dan penutupan di bawah paras anjakan

Pada carta jam-jam, pasangan GBP/USD terus menurun pada hari Selasa dan menguatkan di bawah tahap anjakan Fibonacci 161.8% pada 1.3520. Ini bermakna bahawa kemerosotan mungkin akan berterusan hari

Dengan kemunculan Penumpuan antara pergerakan pasangan mata wang AUD/JPY terhadap penunjuk Pengayun Stochastic dan turut disahkan oleh pergerakan harganya yang bergerak di atas WMA (21) yang condong menaik pada carta

Semalam, pasangan USD/JPY mencatatkan pertumbuhan kukuh—sebanyak 0.90% atau 149 pip—disebabkan oleh pengukuhan indeks dolar AS sebanyak 0.42%. Hasilnya, harga kini didagangkan di atas keseimbangan harian, garis indikator MACD, dan bahkan

Sebaliknya, jika emas mengekalkan momentum kenaikan harga, harga berkemungkinan melepasi rintangan pada 3,330, dan kemudian kita boleh menjangkakan satu lagi siri kenaikan harga, berkemungkinan mencapai 3,437, iaitu tahap 8/8 Murray

Jika euro menembusi saluran aliran menaik, kita boleh menjangkakan penurunan menuju EMA 200 yang terletak pada paras 1.1230 dan mungkin juga mencapai jurang yang ditinggalkan pada 15 Mei sekitar 1.1145

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.