Lihat juga

19.09.2023 03:47 PM

19.09.2023 03:47 PMActivity in the cryptocurrency market is gradually increasing amid investors' strong confidence that the key interest rate will not be raised at the upcoming Fed meeting. The market is becoming more positive, which could lead to a strong upward movement in the near future. Yesterday, Bitcoin managed to make an upward leap above the $27k level thanks to growing buying activity.

As the date of the Fed meeting approaches, volatility in the crypto market will continue to rise, so we can expect an increase in such impulsive movements. It's quite likely that BTC will respond to the positive news in advance, and the reaction on September 20th will be minimal. However, the more interesting question is whether Bitcoin can use this positive period to establish a sustainable upward trend.

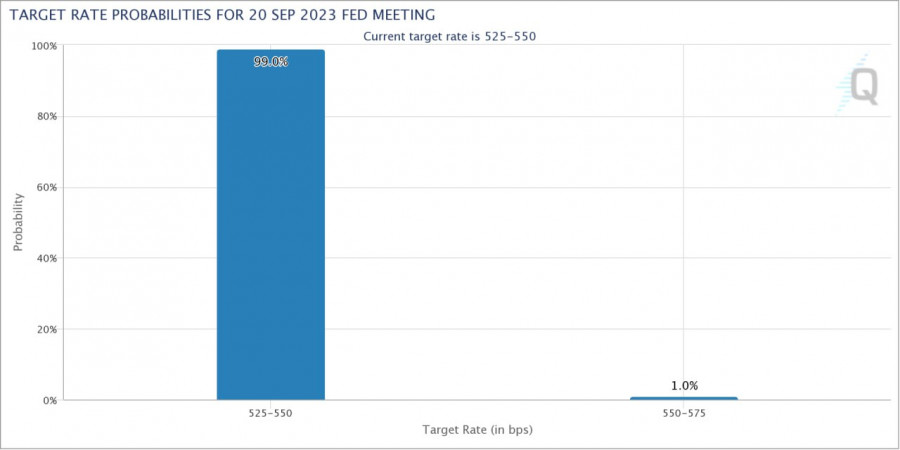

The Fed meeting is already scheduled for tomorrow, so today, on September 19th, the level of volatility in the crypto market will continue to grow by leaps and bounds. According to CME data, 99% of investors are confident that the interest rate will remain at the current level. These surveys, along with statements from analysts at leading U.S. banks, form the basis of positivity in the markets. Recently, JPMorgan reported that the Fed had completed its rate hike cycle, and yesterday, Goldman Sachs analysts assured that the regulator would leave the rate unchanged both this time and in November.

Even without the Fed's decisions, the U.S. dollar feels great, exerting pressure on risky assets, including digital ones. It is reported that net foreign investments in long-term and short-term U.S. Treasury bonds, as well as banking products, amounted to a net inflow of $140.6 billion by the end of July. This is one of the highest figures in the last three years, and the U.S. dollar responded to the news by strengthening close to the 105 level.

At the same time, there are rumors that SEC Chairman Gary Gensler wants to approve one or more BTC spot ETFs and remain the head of the regulatory agency. Despite being rumors, they are supported by Bloomberg's statements about a 75% chance of approving a spot crypto product in the U.S. in October–November. Taken together, these factors have a positive impact on market sentiment and contribute to increased buying activity.

Santiment notes that the outflow of BTC and ETH coins from cryptocurrency platforms has resumed. As of September 19th, long-term investors already control 75.8% of the total BTC volume. In addition, the circulation of USDT has significantly increased, and stablecoin volumes have continued to grow over the past two weeks. This is a positive signal indicating a high probability of another upward period in the cryptocurrency market and for Bitcoin.

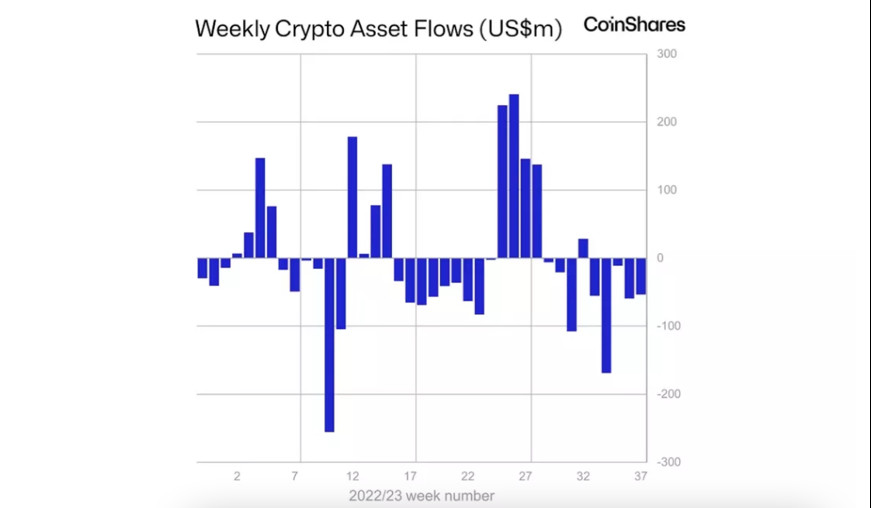

CoinShares points out yet another week of outflows from crypto products. The total amount of funds withdrawn over the past week reached $54 million. At the same time, the dominance of BTC has risen above 50% again, indicating a resurgence of buying interest and, consequently, the potential for cryptocurrency price growth in the near future.

As of September 19th, daily trading volumes for BTC have increased to $15 billion, which is quite unusual. On September 18th, Bitcoin made a bullish move towards the $27.4k level, but after gathering liquidity, the asset's price returned to the $26.5k–$26.8k range. However, this impulsive movement confirmed the presence of strong buying pressure in the BTC market and significantly increased the likelihood of further movement towards the $27.5k–$28k range.

Among the immediate targets on the way to $28k, it is worth highlighting the $27k–$27.5k range as a key platform for further upward movement. If market positivity continues and is supported by news of the end of the rate hike cycle or approval of a spot ETF on BTC, the range of bullish targets may expand. However, Bitcoin is within a downward trend, and a rapid return of quotes to the $26.5k level confirms the strong bearish positions.

The market has been engulfed by a wave of positivity, supported by growing buying activity and the activation of large capital. In the near future, we can expect a retest of the $27k level and an attempt to move even further. At this stage, it is important to see growing buying volumes since seller pressure will not diminish. Based on the movement from yesterday, we have not seen increasing bullish volumes, so it's still too early to talk about even a local reversal.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bitcoin secara beransur-ansur menghampiri paras tertinggi sepanjang masanya dan, menurut beberapa penganalisis, bersedia untuk mencipta rekod baru. Paras semasa sekitar $105,000 adalah lebih daripada sekadar angka ia menandakan bahawa aset

Jika kita melihat carta 4 jam, mata wang kripto Ethereum kelihatan bergerak di atas WMA (21) yang bertindak sebagai sokongan dinamik, di mana cerun WMA tersebut sedang menaik. Berdasarkan maklumat

Pada carta 4 jam, mata wang kripto Uniswap kelihatan mempunyai corak Descending Broadening Wedge, jadi walaupun pergerakan harga Uniswap berada di bawah WMA (21) yang mempunyai kecenderungan menurun, dengan kemunculan

Bitcoin telah melepasi $100,000, manakala Ethereum sedang cuba untuk mengukuh di atas $2,000. Selepas kenaikan mendadak semalam, yang berterusan semasa sesi Asia hari ini, Bitcoin kini didagangkan pada $103,000, setelah

Jika kita melihat carta 4 jam bagi mata wang kripto Ethereum, kelihatan bahawa pergerakan harga berada di atas Purata Bergerak Berwajaran (WMA) dengan tetapan (30 Shift 2), yang turut menunjukkan

Pada carta 4-jam untuk mata wang kripto Bitcoin, penunjuk pengayun Stochastic berada dalam keadaan Terlebih Beli dan kini bersedia untuk Cross SELL dan melepasi bawah paras 80 (Terlebih Beli)

Bitcoin mencapai harga di bawah $100,000, manakala Ethereum mencecah $1,900. Peningkatan besar dalam pasaran mata wang kripto ini sekali lagi mengesahkan pandangan optimis terhadapnya, yang telah banyak dibincangkan kebelakangan

Harga Bitcoin kini berada berhampiran paras psikologi penting, manakala para peserta pasaran sedang bersedia untuk satu lagi lonjakan menaik atau sebaliknya, satu pembalikan mendadak yang mampu menghapuskan jangkaan kenaikan jangka

Niaga hadapan indeks saham AS melonjak dengan ketara pada pembukaan sesi dagangan hari ini susulan berita bahawa wakil-wakil dari AS dan China telah menyambung semula rundingan mengenai perkara perdagangan. Laporan

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.