Lihat juga

30.11.2023 12:05 PM

30.11.2023 12:05 PMOverview :

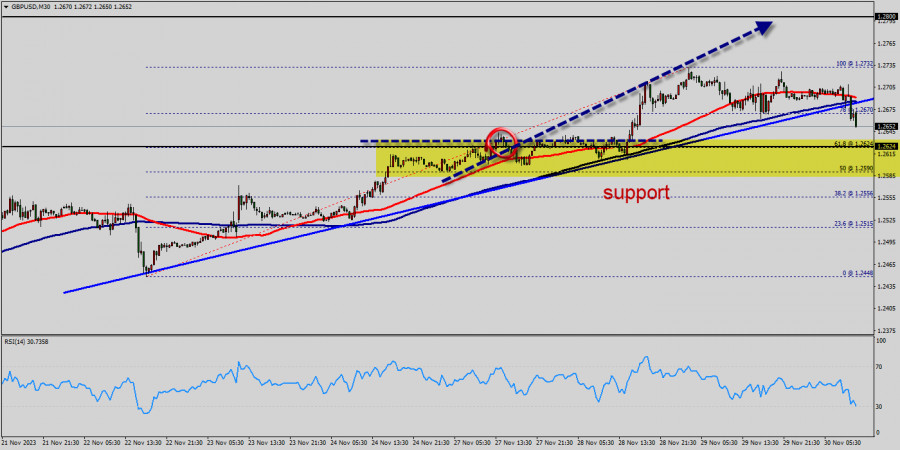

The GBP/USD pair is going to continue to rise from the level of 1.2624 in the long term. It should be noted that the support is established at the level of 1.2624 which represents the 61.8% Fibonacci retracement level on the M30 chart.

The price is likely to form a double bottom in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.2624.

The GBP/USD pair faced strong support at the level of 1.2624 because resistance became support. So, the strong support has already faced at the level of 1.2624 and the pair is likely to try to approach it in order to test it again.

The level of 1.2624 represents a weekly pivot point for that it is acting as major support this week. Furthermore, the GBP/USD pair is continuing to trade in a bullish trend from the new support level of 1.2624. It should be noted that the RSI is still above 30.

Currently, the price is in a bullish channel. According to the previous events, we expect the GBP/USD pair to move between 1.2624 and 1.2800.

So, buy above the level of 1.2624 with the first target at 1.2732 in order to test the daily resistance 1 and further to 1.2800. Also, it might be noted that the level of 1.2800 is a good place to take profit because it will form a double top.

On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2624, a further decline to 1.2556 can occur which would indicate a bearish market.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada hari Khamis, pasangan EUR/USD meneruskan pergerakan kenaikannya dan berjaya membuat pengukuhan di atas paras 100.0% anjakan semula Fibonacci pada 1.1574. Namun, sepanjang malam, berlaku pembalikan mendadak memihak kepada dolar

Selamat sejahtera, para pedagang yang dihormati! Pada hari Rabu, pasangan EUR/USD meneruskan pergerakan menaik setelah melantun semula dari zon sokongan 1.1374–1.1380. Ia berjaya disokong di atas tahap pemulihan semula Fibonacci

Jika kita melihat carta harian bagi instrumen komoditi Minyak Mentah, terdapat Perbezaan di antara pergerakan harga #CL dan penunjuk Pengayun Stochastic, yang menunjukkan kemungkinan #CL akan mengalami pembetulan penyusutan dalam

Pada carta 4 jam indeks Nasdaq 100, terdapat perbezaan antara pergerakan harga dan penunjuk Pengayun Stochastic, terutamanya dengan pengesahan pergerakan harga semasa #NDX yang bergerak di bawah EMA (21), maka

Jika harga euro jatuh di bawah 1.1500 dalam beberapa jam akan datang, ini boleh dilihat sebagai peluang untuk menjual. Dari sudut teknikal, ia kelihatan terlebih belian pada carta

Aliran XAU/USD kekal dalam fasa kenaikan selagi harga terus membuat pengukuhan di atas paras 3,331. Oleh demikian, adalah wajar untuk membeli emas selagi harga terus membuat pengukuhan di atas paras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.