Lihat juga

14.02.2023 11:56 AM

14.02.2023 11:56 AMRussia announces a 5% cut in production, the U.S. responds by saying it is ready to resume oil sales from the strategic reserve, and OPEC reassures investors by saying that the market is stable and there are no grounds for an emergency meeting of the cartel. The actions of major participants show different goals. If some of them have a need for foreign currency proceeds to finance military expenditures, others are thinking about the sustainability of the commodity market.

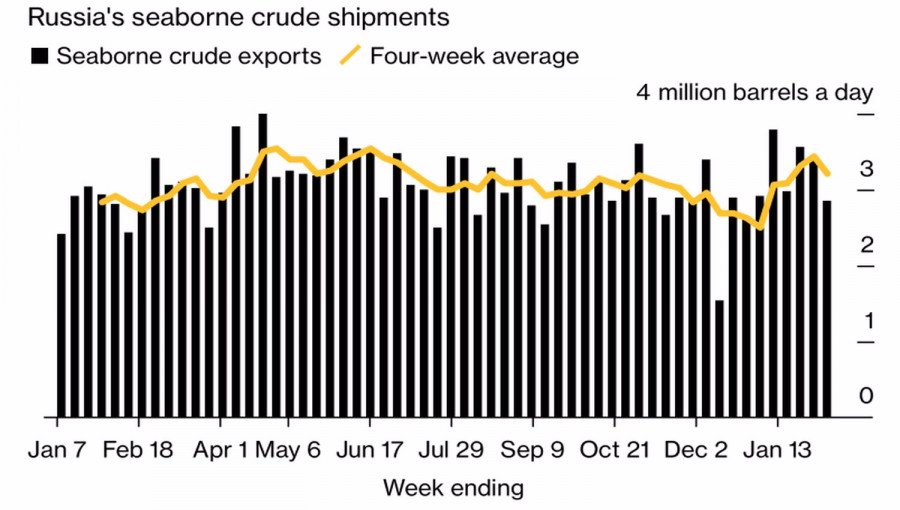

5% of Russia's oil production is about 500,000 bpd. A very decent figure that can worsen the Brent rally, which is happening now. Another thing is that such a decision by Moscow may be a forced measure. It redirects its oil flows from the West to the East, and recently more and more cracks have appeared in this process. In particular, for seven days to February 10, the total oil supply from the Russian Federation decreased by 16%, or by 562,000 bpd.

Dynamics of offshore oil supplies from Russia

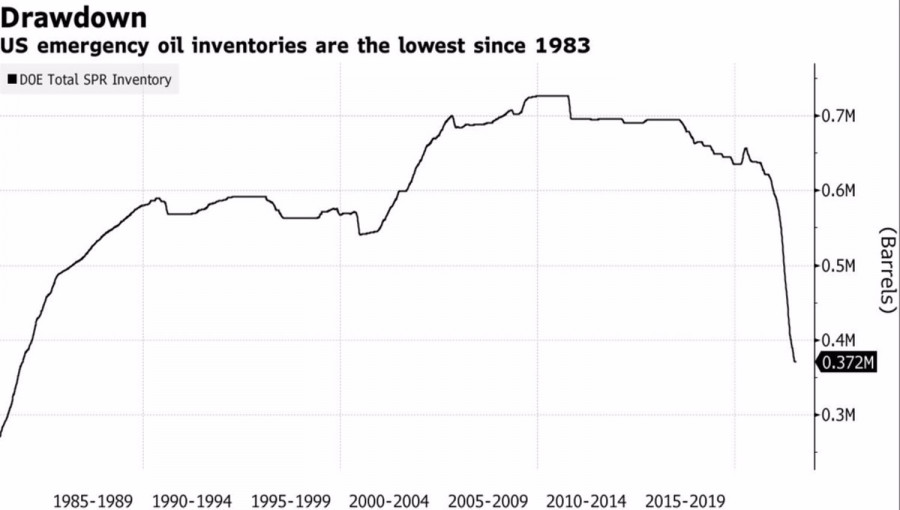

However, the U.S., unlike the EU, did not stress that the sanctions are working. Washington decided to resume sales of oil from the strategic reserves, which reached 180 million barrels in 2022. This time 26 million barrels are at stake. The figure may not seem that big, but the effect of surprise is important. Many traders thought that reserves would remain at 371 million barrels by the end of 2023. In fact, they will shrink to 345 million. We are talking about the lowest level since 1983.

If we add to this the forecast of the U.S. Energy Information Administration that shale oil production will reach a record 9.36 million bpd this year, it becomes clear that there will be no problem with supply. On paper, this should clip the wings of Brent buyers.

Dynamics of U.S. strategic reserves

In reality, the market is more concerned about the growth of demand for oil than temporary supply difficulties. In particular, the fall in the number of deaths from COVID-19 in China increases optimism about the rapid recovery of Asia's largest economy. The increase in the European Commission's forecasts for the Eurozone GDP for 2023 to 0.9% instead of the previous 0.3% suggests that there will be no recession. And hopes for a slowdown in the U.S. inflation fuel risk appetite. If this happens, the Fed will not need to raise the federal funds rate too high and will provide the U.S. economy with a soft landing.

Thus, the assurances of the UAE, an OPEC member, that the market situation is stable despite Russia's production cuts are true.

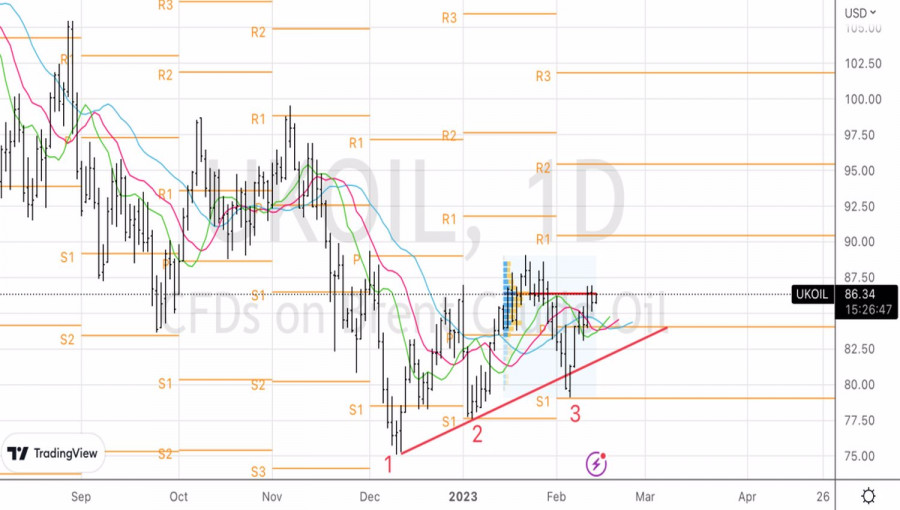

Technically, after partial profit taking on long positions on Brent, formed due to the three-touch reversal pattern, at the level of $86.3 per barrel, a pullback followed. Currently, the bulls are trying to get back into the game and storm the $86.4 fair value resistance. If they succeed, the probability of implementing the target of $89 per barrel will increase. We will have the opportunity to increase the longs.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Penentangan domestik terhadap Donald Trump semakin mendapat momentum, yang boleh menjadi kejutan yang tidak menyenangkan bagi bekas presiden itu. Perkembangan ini mungkin akan mengehadkan usahanya untuk mengubah landskap ekonomi

Sangat sedikit laporan makroekonomi yang dijadualkan pada hari Khamis. Kalendar peristiwa makroekonomi untuk Jerman, United Kingdom, dan Zon Euro adalah kosong. Hanya Amerika Syarikat yang akan mengeluarkan laporan mengenai KDNK

Pada hari Rabu, pasangan mata wang GBP/USD diniagakan dengan sedikit penurunan, namun sukar untuk mempercayai pengukuhan lanjut dolar AS dalam keadaan semasa. Di satu pihak, dolar telah menyusut nilai dengan

Pasangan mata wang EUR/USD tidak berprestasi baik untuk dolar pada hari Rabu seperti mana ia lakukan dalam dua hari sebelumnya. Walau bagaimanapun, hari Isnin dan Selasa tidak boleh digambarkan sebagai

Seperti yang dijangkakan, Reserve Bank of New Zealand (RBNZ) telah menurunkan kadar faedah sebanyak 25 mata asas kepada 3.25% selepas mesyuaratnya pada bulan Mei. Ini menandakan pusingan keenam pelonggaran dasar

Pada hari Rabu, U.S. Dollar Index (DXY) meneruskan momentum kenaikannya untuk hari kedua berturut-turut, setelah bangkit dari paras terendah bulanan yang dicapai awal minggu ini. Indeks tersebut naik ke paras

Kita sebenarnya hidup pada zaman yang luar biasa, di mana prinsip klasik dalam menilai situasi pasaran diketepikan demi keadaan yang lebih mendesak dan, yang lebih penting lagi, keadaan yang tidak

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.