Lihat juga

11.07.2022 02:47 PM

11.07.2022 02:47 PMHello, dear traders!

Let's start today's review of the GBP/USD pair with the fact that the UK is expected to have serious problems in the coming winter period. The point is that energy prices are so high that the traditionally prosperous British will face tough times. While British Prime Minister Boris Johnson continues to dance to the tune of the United States, Great Britain risks being left without the necessary heating. In other words, Britain is braced for a cold winter, during which its citizens will have to hide under duvets and rugs. All this stems from the government's extremely aggressive policy regarding sanctions against Russia. Now let's consider the situation from a technical point of view, starting with the analysis of the previous trading week.

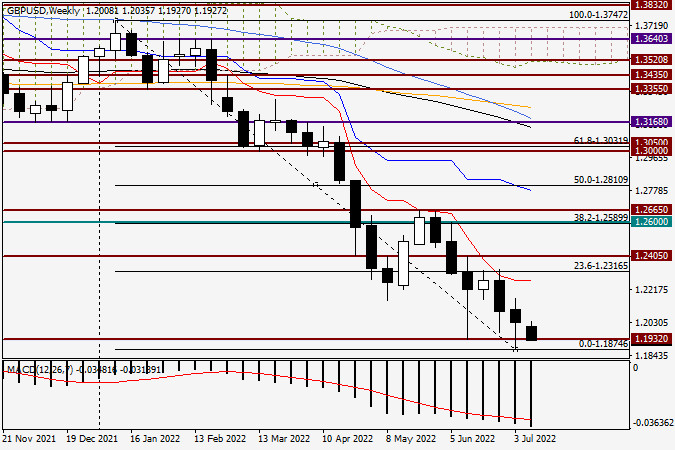

Weekly chart

Last week, pound bulls managed to turn the tide in their favor. This can be confirmed by the last weekly candlestick with a long lower shadow and a bullish body. After the formation of such candlesticks, the quote usually rises. However, this is not the case. The pound sterling is still trading under strong selling pressure against the US dollar. It is quite difficult to guess what will happen next. However, I still believe that the most likely scenario in the short term is bullish. If the pound sterling breaks through the support level of 1.1874, this scenario will be canceled. In the meantime, I expect the GBP/USD pair to form reversal candlestick signals at the bottom of the market. In this case, it will be possible to open long positions on the British pound. That's all for today. Tomorrow we will consider the pair's dynamics from a technical point of view on smaller time frames.

Have a good day!

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dengan kemunculan corak Ascending Broadening Wedge yang diikuti oleh kemunculan corak Bearish 123, ini memberikan petunjuk bahawa dalam masa terdekat, pasangan EUR/USD berpotensi untuk melemah, terutamanya dengan pengesahan kemunculan perbezaan

Pada carta 4 jam pasangan mata wang silang GBP/JPY, terdapat beberapa perkara menarik yang dapat diperhatikan. Pertama, pergerakan harga bergerak di atas WMA (21) yang mempunyai cerun yang bergerak

Awal sesi Amerika, emas didagangkan sekitar 3,317, melantun selepas mencapai paras rendah 3,294 semasa sesi Eropah. Pada carta H4, emas boleh terus meningkat dan boleh mencapai 21SMA yang terletak sekitar

Kami percaya euro boleh terus melemah memandangkan satu corak kesinambungan menurun sedang terbentuk, namun kita harus menjangkakan ia menembusi di bawah paras 1.1400, yang kemudiannya boleh mencapai dasar saluran arah

Dalam analisis yen sebelum ini, kami menyatakan bahawa paras 145.08 berfungsi sebagai halangan pertengahan kepada sasaran utama pada 146.11. Walau bagaimanapun, menjelang pagi ini, situasi bagi pergerakan menaik kelihatan kritikal

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.