CHFNOK (Swiss Franc vs Norwegian Krone). Exchange rate and online charts.

See Also

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1063

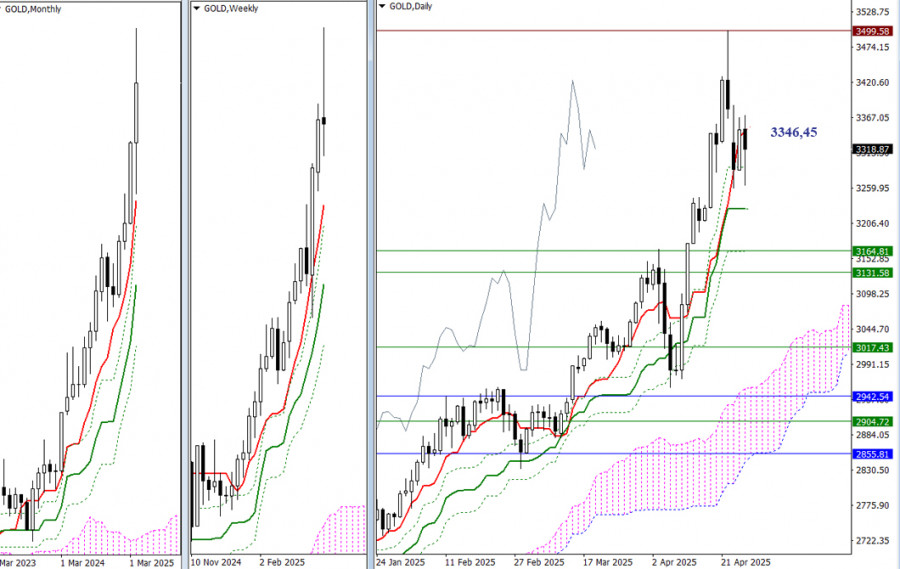

Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

928

The United States is facing an important week, but it is unlikely to be important for the U.S. dollarAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

913

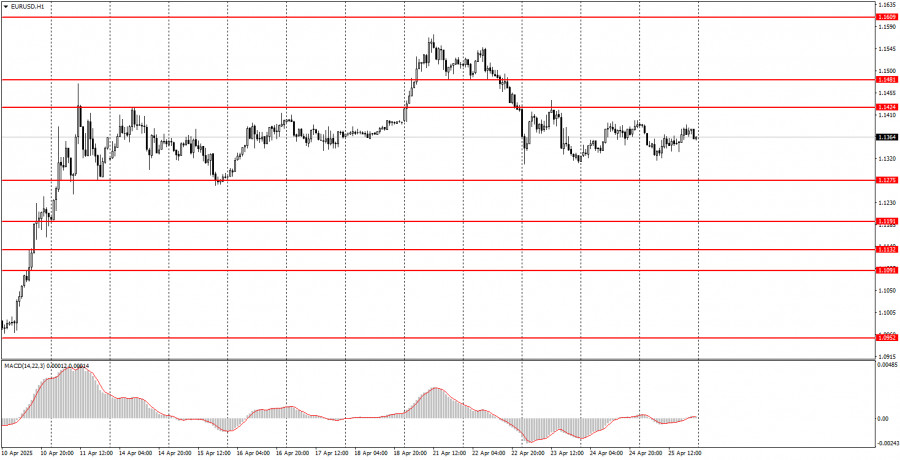

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

883

Fundamental analysisWhat to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

853

Fundamental analysisEUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

808

- Trading plan

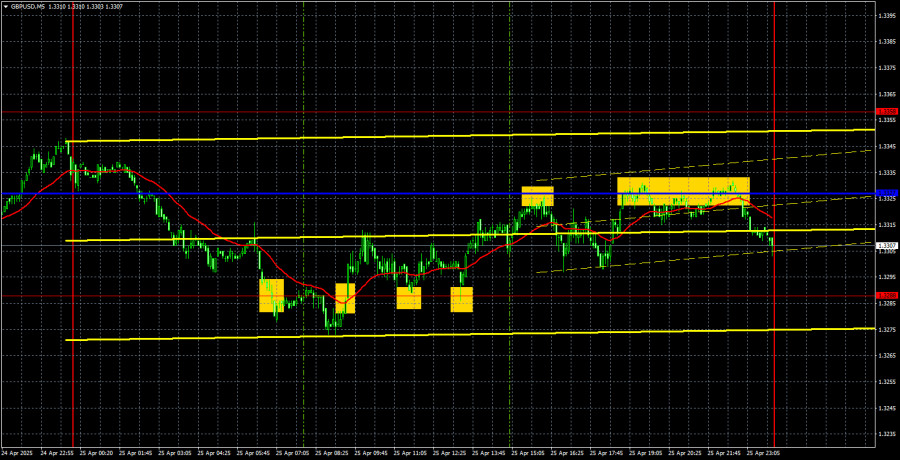

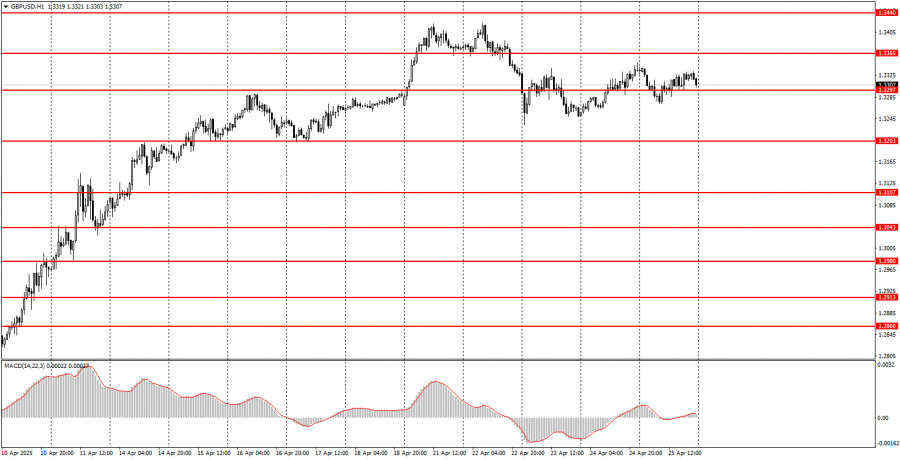

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

793

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

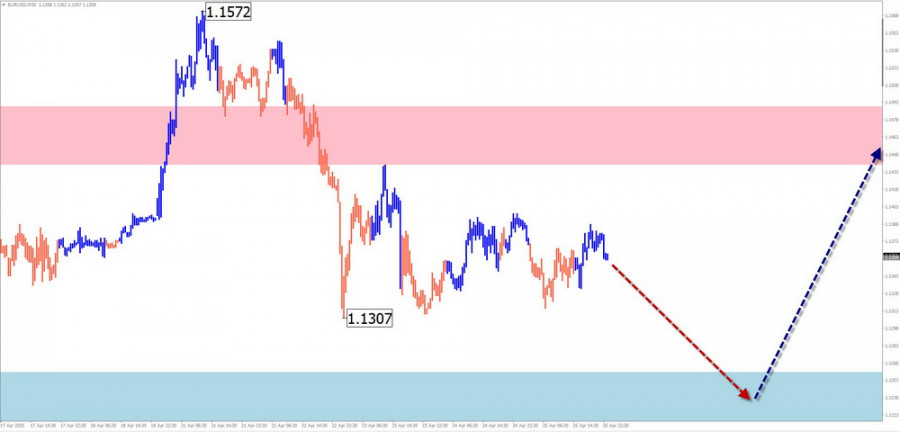

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

748

Trading planHow to Trade the GBP/USD Pair on April 28? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair also showed no interesting movements on FridayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

748

- Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforced by the monthly support level (141.96). Consequently, the decline was halted, and the pair began showing upward.

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

1063

- Last week, the bulls updated historical highs and formed a new maximum extremum at 3499.58. Afterward, gold entered a downward correction towards the support of the daily short-term trend at 3346.45. The market has taken a pause. If bearish sentiment receives a new impulse for development, the next.

Author: Evangelos Poulakis

06:49 2025-04-28 UTC+2

928

- The United States is facing an important week, but it is unlikely to be important for the U.S. dollar

Author: Chin Zhao

01:05 2025-04-28 UTC+2

913

- The EUR/USD currency pair continued trading sideways throughout Friday

Author: Paolo Greco

04:13 2025-04-28 UTC+2

883

- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for MondayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

853

- Fundamental analysis

EUR/USD. Weekly Preview. Eurozone Inflation, U.S. GDP, ISM Manufacturing Index, April Nonfarm Payrolls

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering strong volatility for the EUR/USD pair.Author: Irina Manzenko

06:49 2025-04-28 UTC+2

808

- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highsAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

793

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start of the week. Toward the weekend, we can expect increased volatility, a change in direction, and a resumption.Author: Isabel Clark

09:28 2025-04-28 UTC+2

748

- Trading plan

How to Trade the GBP/USD Pair on April 28? Simple Tips and Trade Analysis for Beginners

The GBP/USD pair also showed no interesting movements on FridayAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

748