Lihat juga

04.04.2025 11:10 AM

04.04.2025 11:10 AMSomeone is not telling the truth. Donald Trump insists that everything is going well and that the markets will flourish. But the S&P 500 just posted its worst 10-week start after Trump's inauguration since 2001, wiping out $3 trillion in market capitalization. Investors are losing faith in the Republican leader, while Fitch Ratings warns that tariffs are changing the rules of the game. We have entered an entirely new macro landscape. The winning bet of "buy the dip" no longer works.

Following the White House's sweeping import tariffs, the average US tariff rate has jumped from 2.2% to over 20%, marking the sharpest increase since the 1950s. Back then, it triggered a recession. History risks repeating itself. UBS estimates that GDP cloud shrink by 2 percentage points in 2025. Nomura forecasts modest growth of just 0.6%, while Barclays offers a slightly brighter view of a 0.1% contraction. Notably, when Trump took office, the economy was growing at 2.8%. Unsurprisingly, investors are selling dollars and stocks, abandoning the notion of American exceptionalism.

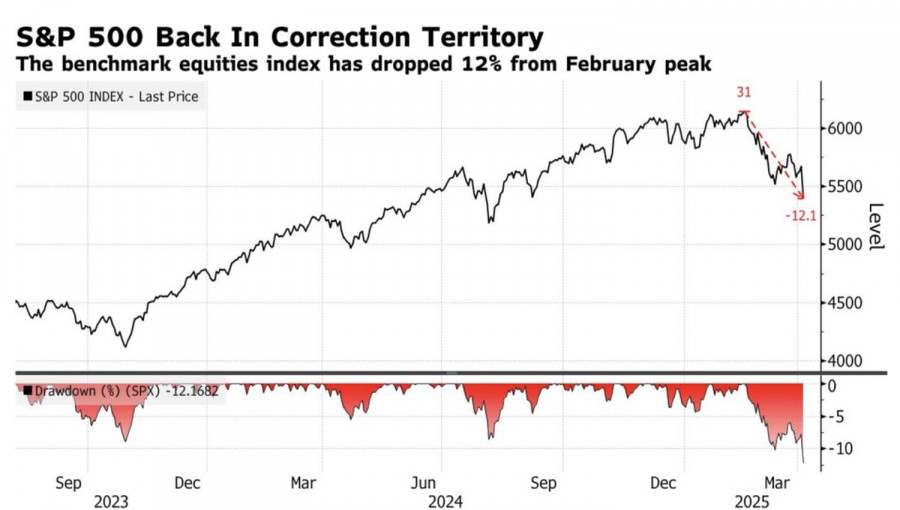

S&P 500 performance in absolute and percentage terms

The S&P 500 has entered correction territory again, although full-blown recessions have historically seen losses of 20% or more — still a long way off. Nonetheless, the index's downward trajectory signals recession risks ahead. Markets are currently pricing in a 48% chance of a downturn in the next 12 months, up from 38% before the White House tariff announcement on April 2, according to Polymarket.

UBS Global Wealth Management downgraded US equities to "neutral" from "most favored" and cut its year-end S&P 500 forecast to 5,800 from 6,400, citing tariff-induced volatility. Hedge funds dumped stocks in March at the fastest pace in 12 years, according to Goldman Sachs.

Wall Street analysts have trimmed their 2025 earnings growth forecasts for US corporates to 9.5% from 13% in January. Despite falling P/E multiples, the current valuation of the S&P 500 at 20 times earnings still looks stretched relative to historical norms.

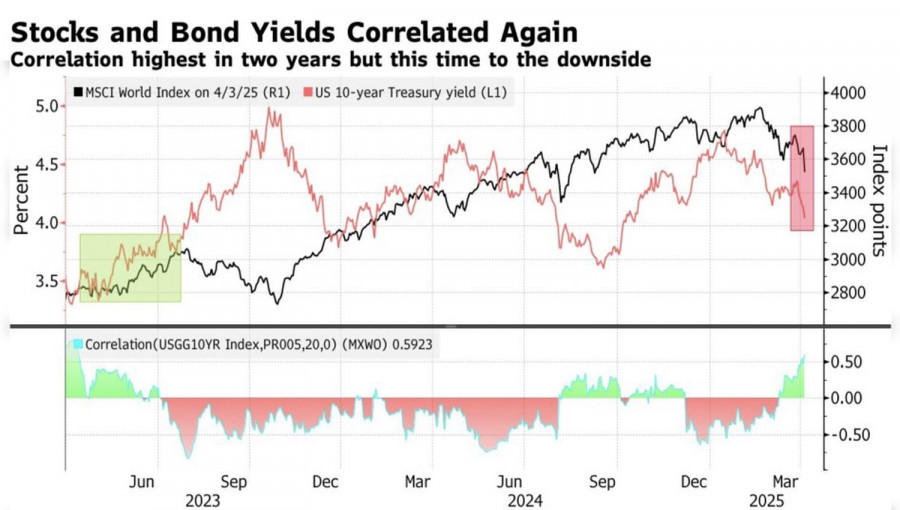

Global equities vs. bond yields

The White House's tariff blitz has not just rocked US markets — global equities are also reeling. Risk aversion has pushed up the correlation between MSCI's global index and 10-year US Treasury yields. At the same time, US equities are underperforming their international peers, putting pressure on the US dollar.

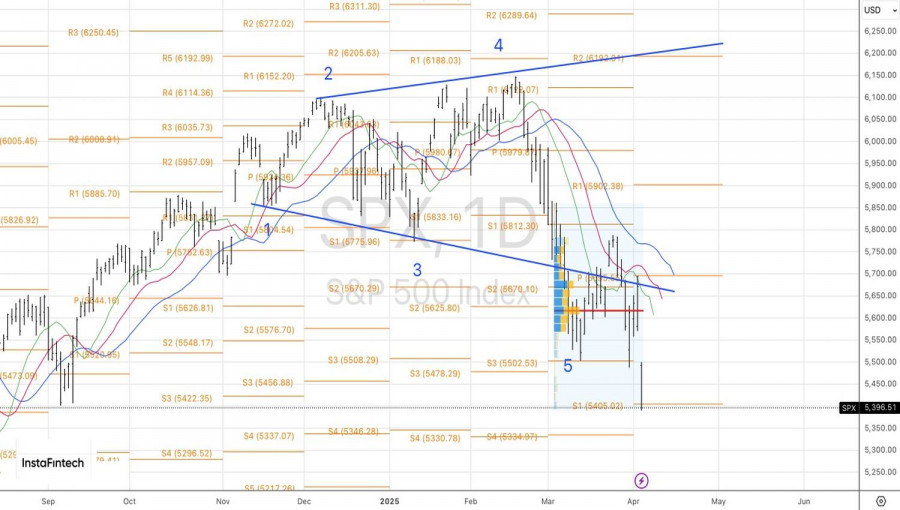

Technically, the daily chart shows that the S&P 500 is still in a correction from its broader uptrend. Both downside targets at 5,500 and 5,400 were hit on short positions. While a brief rebound in the broad index is possible, as long as it trades below 5,500, the bias remains towards selling.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Hanya sedikit peristiwa makroekonomi yang dijadwalkan pada hari Jumat, dan tidak lebih signifikan daripada laporan yang dirilis pada hari Kamis, yang tidak memicu reaksi pasar. Pada dasarnya, satu-satunya peristiwa penting

Pada hari Kamis, pasangan mata uang GBP/USD diperdagangkan mendatar dengan volatilitas rendah—perilaku khas untuk pound selama sebulan terakhir. Pertama, ada rentang datar klasik; sekarang, kita melihat "ayunan" dengan sedikit kecenderungan

Minggu lalu, Donald Trump mengumumkan penandatanganan kesepakatan pertama dengan Inggris di bawah kampanye "America's Liberation". Belakangan terungkap bahwa kesepakatan tersebut belum ditandatangani, dan negosiasi mungkin memakan waktu beberapa minggu lagi

Barang-barang Tiongkok telah membanjiri pasar Eropa, tetapi bullish EUR/USD tidak khawatir dengan hal ini. Sementara Amerika Serikat telah mengurangi tarif impor dari Tiongkok, tarif rata-rata tertimbang masih berada di angka

Laporan pertumbuhan ekonomi Inggris yang dirilis hari ini memberikan dukungan kepada pembeli GBP/USD, meskipun reaksi pasar cenderung tenang. Para trader enggan membuka posisi besar menjelang pidato Ketua Federal Reserve Jerome

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.