Lihat juga

04.04.2025 09:38 AM

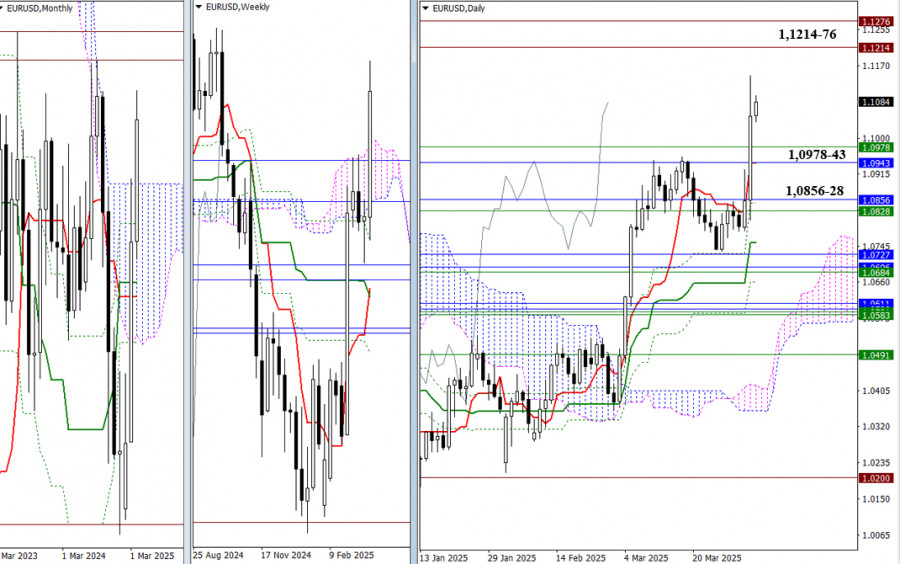

04.04.2025 09:38 AMAfter several attempts and three weeks of consolidation, the bulls finally launched a breakout, allowing them to close yesterday well above the resistance levels of the Ichimoku Cloud on the monthly (1.0943) and weekly (1.0978) timeframes. Today marks the weekly close, and the bulls need to hold on to these gains. If the upward move continues, the pair may test the previous highs (1.1214 – 1.1276). If the gains are lost, the levels that have been breached may now act as support. Potential downside targets include the zones around 1.0978 – 1.0943 and 1.0856 – 1.0828.

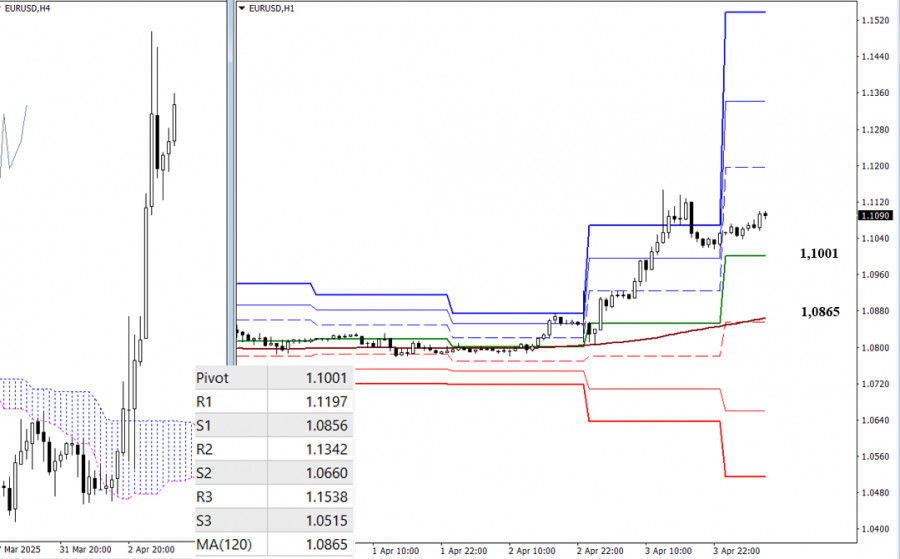

Yesterday's momentum significantly expanded the boundaries of the classic Pivot levels. The resistance levels are at 1.1197 – 1.1342 – 1.1538 for further upward movement. Should the bears opt for a corrective pullback, they will encounter key levels at 1.1001 (daily central Pivot level) and 1.0865 (weekly long-term trend). A break below and reversal of the trend would allow the bears to shift the current balance of power in their favor. Further development of bearish sentiment would lead the pair toward the support levels of the classic Pivot points (1.0856 – 1.0660 – 1.0515).

***

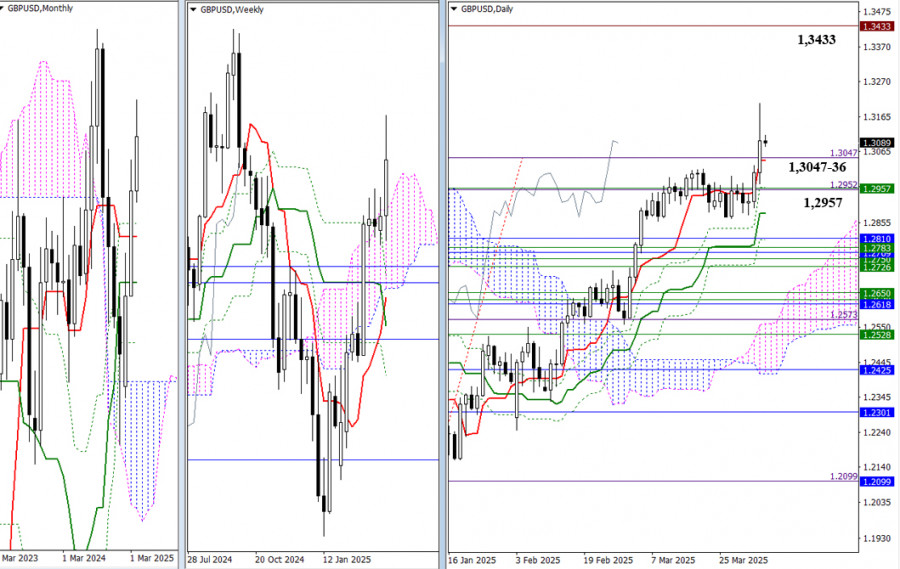

Out of the three weeks of uncertainty, the bulls were the first to break out. They pushed past the final daily target level (1.3047) without a retest. As the week draws to a close, holding on to the gains is crucial. If the upward movement continues, the bulls will aim for the previous high (1.3433). A breakout above that level would signal the end of the current monthly correction. If the bulls fail, their opponents could reclaim the advantage by breaking below the daily short-term trend support (1.3036) and quickly return the pair to the previous consolidation zone, centered around the upper boundary of the weekly Ichimoku cloud (1.2957).

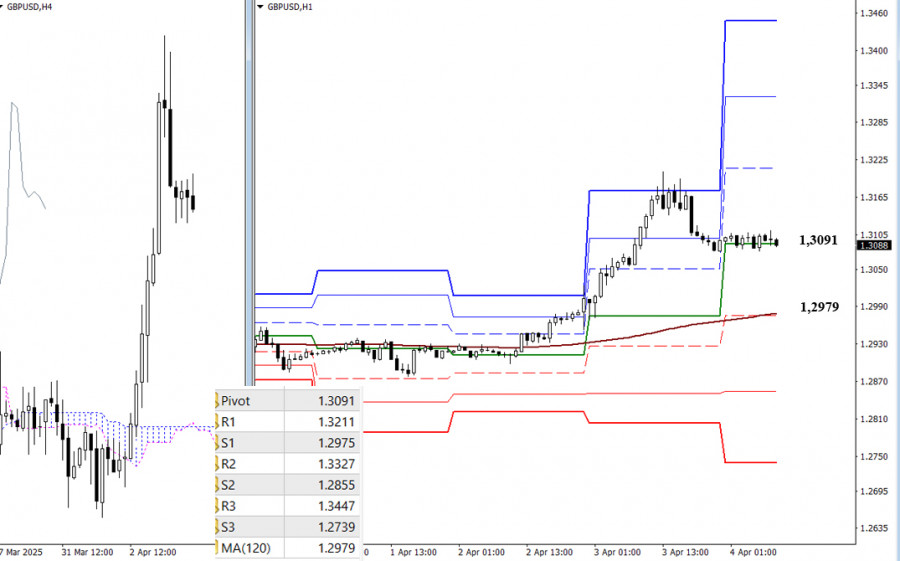

On the lower timeframes, the market is currently hovering around the central Pivot level (1.3091). Continuing the corrective pullback could lead the pair to test the weekly long-term trend level (1.2979), which currently reflects the existing balance of power. A break below this level would shift the main advantage to the bears. Further strengthening of bearish momentum could bring the pair down to the classic Pivot support levels at 1.2855 and 1.2739. If the bulls halt the correction at this stage, further upside potential would be realized through resistance levels at 1.3211 – 1.3327 – 1.3447.

***

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Selamat siang, para trader yang terhormat! Pada hari Rabu, pasangan EUR/USD melanjutkan pergerakan naiknya setelah memantul dari zona support 1,1374–1,1380. Pasangan ini berhasil berkonsolidasi di atas level retracement Fibonacci 76,4%

Pada chart 4 jam dari indeks Nasdaq 100, nampak terlihat Divergensi antara pergerakan harganya dengan indikator Stochastic Oscillator, terutama ditambah dengan konfirmasi saat ini dari pergerakan harga #NDX yang bergerak

Bila Kita perhatikan chart harian dari instrumen komoditi Minyak Mentah, nampak muncul Divergensi antara pergerakan harga #CL dengan indikator Stochastic Oscillator, dimana ini merupakan petunjuk kalau ada kemungkinan #CL dalam

Jika harga euro jatuh di bawah 1,1500 dalam beberapa jam ke depan, ini bisa dianggap sebagai kesempatan untuk menjual. Secara teknis, pasangan ini tampaknya sudah overbought pada grafik

Tren XAU/USD tetap bullish selama harga terkonsolidasi di atas 3,331. Oleh karena itu, akan bijaksana untuk membeli emas selama harga terkonsolidasi di atas 3,359, di mana level 7/8 Murray berada

Hari ini, fokus utama pasar adalah rilis laporan inflasi AS, yang diperkirakan akan menunjukkan tidak hanya penghentian penurunan baru-baru ini tetapi juga peningkatan inflasi tertinggi dalam empat bulan terakhir. Menurut

Pada hari Selasa, pasangan EUR/USD terus bergerak menyamping di antara level 1,1380 dan 1,1454. Rebound baru dari level retracement Fibonacci 61,8% di 1,1380 memungkinkan kenaikan lain dalam kisaran tersebut. Pantulan

Chart Forex

versi web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.