Lihat juga

28.03.2025 08:34 AM

28.03.2025 08:34 AMBitcoin and Ethereum are struggling to stay afloat. Another failed attempt by Bitcoin to cling to $88,000 led to its sell-off during today's Asian trading session. Ethereum had even worse luck, with its price dropping more than 4% at one point, ultimately falling back below the landmark $2,000, which is quite negative for short-term bullish strategies.

Yesterday, after updating $85,100, Bitcoin rose but is now trading around $86,000 again. Ethereum also collapsed, and after a failed attempt at recovery, it is trading at $1,922.

On the positive side, Bitcoin ETF funds in the US extended their positive streak of inflows on Thursday. This marks 10 consecutive days of growth, the longest winning streak since December of last year. This suggests that, although institutions are not prone to aggressive risk-taking, there is still demand for Bitcoin and Ethereum in the market. According to SoSoValue, the total daily net inflow into Bitcoin ETFs was $89 million on Thursday. Fidelity's FBTC fund contributed $97.14 million, while BlackRock's IBIT received around $4 million. On the other hand, the Invesco BTCO fund saw an outflow of about $7 million, and the WisdomTree BTCW fund reported an outflow of $5 million.

However, the cryptocurrency market is still dealing with high volatility, trading lower after US President Donald Trump first announced the launch of strict tariff policies on US established trade partners. This led to a sell-off of risk assets, in particular stocks. This, in turn, dragged down the cryptocurrency market.

As for intraday strategy in the cryptocurrency market, I will continue to trade during any significant dips in Bitcoin and Ethereum, expecting the bullish market in the medium term. I'm sticking to this long-term forecast.

As for short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy scenario Scenario 1: I will buy Bitcoin today when it reaches the entry point around $86,500, with the target for growth to $87,500. At around $87,500, I will exit buy positions and sell immediately on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price, and the Awesome Oscillator is in the positive zone.

Scenario 2: You can buy Bitcoin from the lower border at $85,600 if there is no market reaction to its breakout in the opposite direction to the levels of $86,500 and $87,500.

Sell scenario Scenario 1: I will sell Bitcoin today when it reaches the entry point around $85,600, reckoning a decline to $84,600. I will exit sell positions at around $84,600 and buy immediately on the dip. Before selling on a breakout, make sure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: You can sell Bitcoin from the upper border at $86,500 if there is no market reaction to its breakout in the opposite direction, aiming for the levels of $85,600 and $84,600.

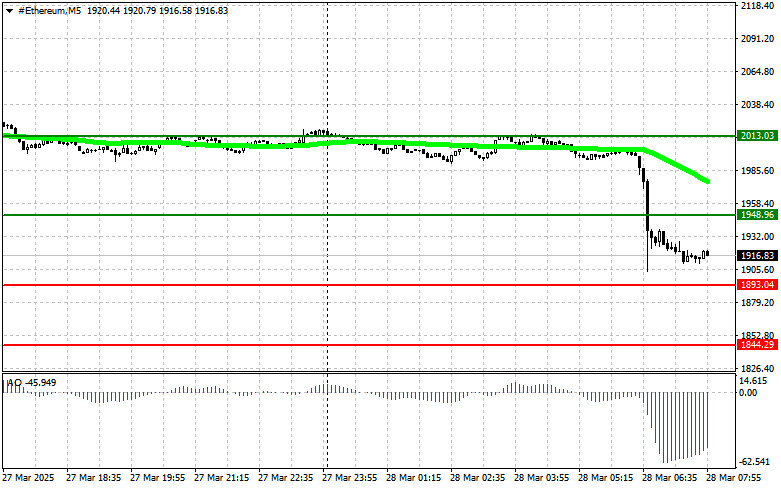

Ethereum

Buy scenario

Scenario 1: I will buy Ethereum today when it reaches the entry point around $1,948, with the target for growth to $2,013. At around $2,013, I will exit long positions and sell immediately on the rebound. Before buying on a breakout, make sure that the 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone.

Scenario 2: You can buy Ethereum from the lower border at $1,893 if there is no market reaction to its breakout in the opposite direction to the levels of $1,948 and $2,013.

Sell scenario

Scenario 1: I will sell Ethereum today when it reaches the entry point around $1,893, bearing in mind a decline to $1,844. At around $1,844, I will exit sell positions and buy immediately on the rebound. Before selling on a breakout, make sure that the 50-day moving average is above the current price and the Awesome Oscillator is in the negative zone.

Scenario 2: You can sell Ethereum from the upper border at $1,948 if there is no market reaction to its breakout. I will target the levels of $1,893 and $1,844.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada chart 4 jamnya, mata uang kripto Uniswap nampak terlihat munculnya pola Descending Broadening Wedge, sehingga meski pergerakan harga Uniswap tengah bergerak dibawah WMA (21) yang memiliki kemiringan menurun, namun

Bila Kita perhatikan chart 4 jamnya, mata uang kripto Ethereum nampak terlihat bergerak di atas WMA (21) yang menjadi support dinamis dimana WMA tersebut memiliki kemiringan yang menukik keatas, sehingga

Bitcoin telah naik di atas $100,000, sementara Ethereum mencoba untuk berkonsolidasi di atas $2,000. Setelah reli tajam kemarin, yang berlanjut selama sesi Asia hari ini, Bitcoin sekarang trading pada $103,000

Pada chart 4 jam dari mata uang kripto Bitcoin, nampak terlihat indikator Stochastic Oscillator sudah berada dalam kondisi Overbought dan kini tengah bersiap-siap Crossing SELL dan tembus kebawah level

Bila Kita perhatikan chart 4 jamnya dari mata uang kripto Ethereum, nampak pergerakan harganya bergerak diatas WMA (30 Shift 2) yang juga memiliki kemiringan slope menukik keatas, dimana artinya momentum

Sementara indeks saham tetap stagnan, emas berkonsolidasi mendekati titik tertingginya, dan Bitcoin kembali menarik perhatian. Aset utama pasar kripto ini mendekati level psikologis penting $100.000, bukan karena ledakan atau emosi

Bitcoin mencapai sedikit di bawah $100.000, sementara Ethereum mencapai $1.900. Pertumbuhan besar di pasar cryptocurrency ini sekali lagi mengonfirmasi prospek bullish-nya, yang belakangan ini banyak dibicarakan. Bitcoin saat ini diperdagangkan

Harga Bitcoin saat ini berada di dekat ambang batas psikologis yang signifikan, dan para pelaku pasar bersiap menghadapi lonjakan naik lainnya atau reversal mendadak yang dapat menghapus ekspektasi bullish jangka

Kontrak berjangka indeks saham AS melonjak tajam pada pembukaan sesi perdagangan hari ini setelah berita bahwa perwakilan dari AS dan Tiongkok telah melanjutkan konsultasi mengenai masalah perdagangan. Laporan media mengungkapkan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.