Lihat juga

15.05.2023 09:50 AM

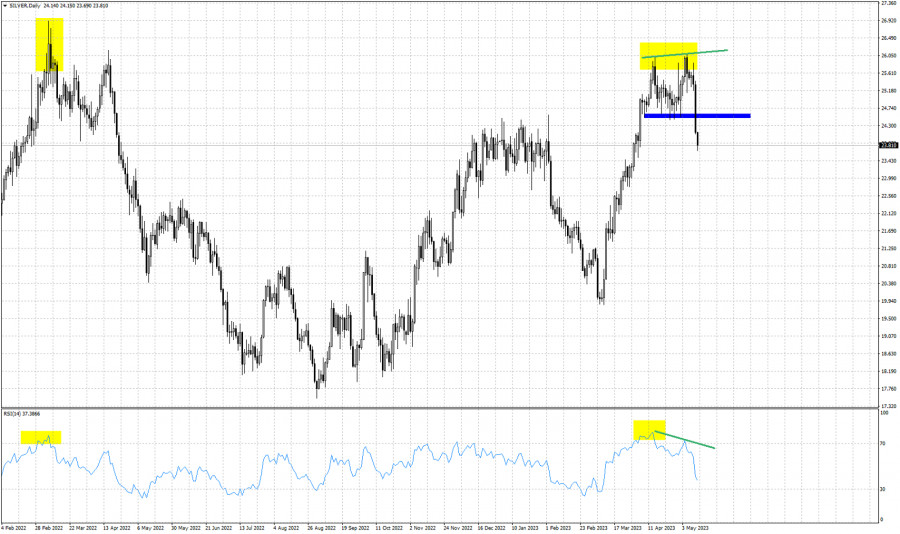

15.05.2023 09:50 AMYellow rectangles- overbought tops

Blue rectangle- key support

Green lines- bearish divergence in the RSI

Our analysis on Silver on May 5th explained the scenario of an important top and the chances of a bearish reversal in trend. Price was then trading around $25.60-$26 and is now falling below $24. The similarities to the previous top on February of 2022 have led us to expect a decline. We see now that history repeats as the similar technical conditions in Silver have the same result. The RSI reached similar overbought levels with February of 2022. The RSI provided a bearish divergence warning. Price is now under pressure as expected and is making lower lows and lower highs. We are in a corrective phase with Silver price approaching the 38% Fibonacci retracement of the entire rise from $19.85. Next key support is at $22.92 where we find the 50% Fibonacci retracement. The RSI is far from oversold levels so we continue to expect price to move even lower.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada hari Kamis, pasangan EUR/USD melanjutkan pergerakan naiknya dan berkonsolidasi di atas level retracement Fibonacci 100,0% di 1,1574. Namun, pada malam hari, terbentuk reversal tajam yang menguntungkan dolar AS, dengan

Selamat siang, para trader yang terhormat! Pada hari Rabu, pasangan EUR/USD melanjutkan pergerakan naiknya setelah memantul dari zona support 1,1374–1,1380. Pasangan ini berhasil berkonsolidasi di atas level retracement Fibonacci 76,4%

Pada chart 4 jam dari indeks Nasdaq 100, nampak terlihat Divergensi antara pergerakan harganya dengan indikator Stochastic Oscillator, terutama ditambah dengan konfirmasi saat ini dari pergerakan harga #NDX yang bergerak

Bila Kita perhatikan chart harian dari instrumen komoditi Minyak Mentah, nampak muncul Divergensi antara pergerakan harga #CL dengan indikator Stochastic Oscillator, dimana ini merupakan petunjuk kalau ada kemungkinan #CL dalam

Jika harga euro jatuh di bawah 1,1500 dalam beberapa jam ke depan, ini bisa dianggap sebagai kesempatan untuk menjual. Secara teknis, pasangan ini tampaknya sudah overbought pada grafik

Tren XAU/USD tetap bullish selama harga terkonsolidasi di atas 3,331. Oleh karena itu, akan bijaksana untuk membeli emas selama harga terkonsolidasi di atas 3,359, di mana level 7/8 Murray berada

Indikator pola

grafis.

Lihat hal-hal

yang belum pernah anda lihat!

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.