Lihat juga

15.01.2022 12:02 PM

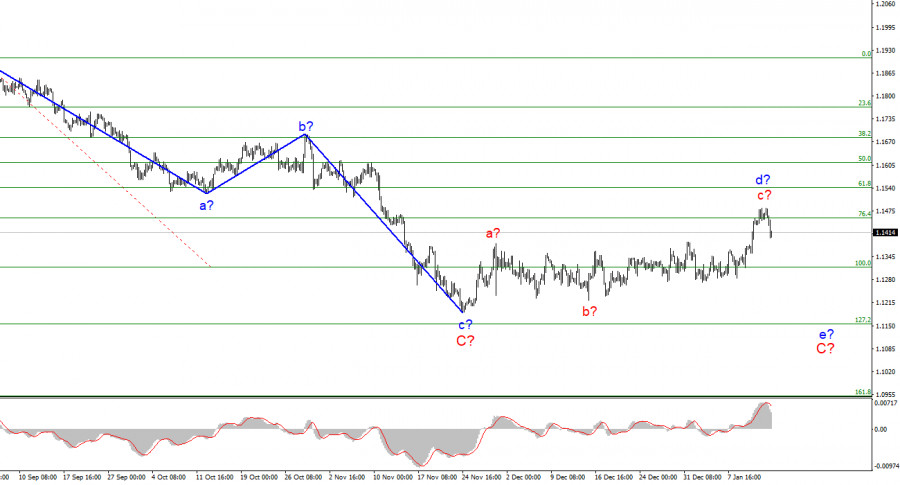

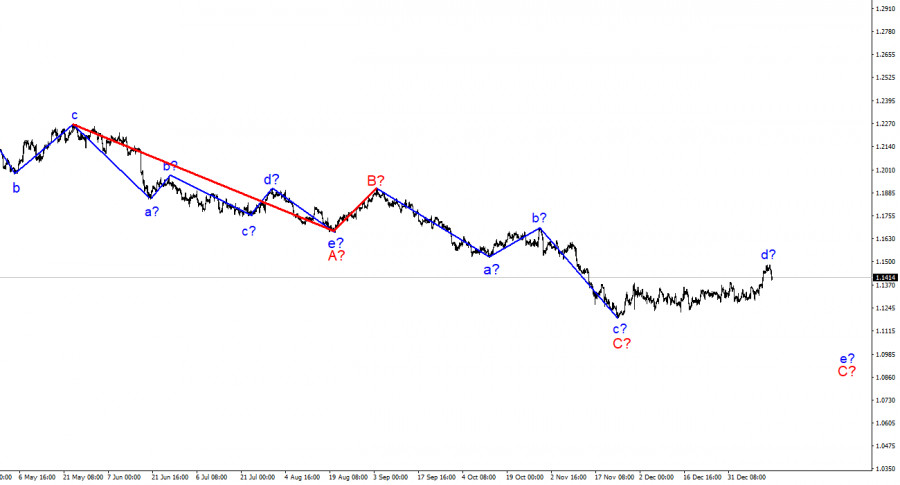

15.01.2022 12:02 PMThe wave marking of the 4-hour chart for the euro/dollar instrument still does not change. Over the past few days this week, the quotes of the instrument have been rising and have broken through the previous peak of the expected wave d. Thus, wave d turned out to be more extended than I originally expected. However, this change does not change the essence of the wave markup. I still believe that the current wave is corrective, not impulsive, as evidenced by its complex internal wave structure. Therefore, it cannot be wave 1 of a new upward trend segment. If so, the decline in quotes will resume within the framework of the expected wave e-C and Friday's departure of quotes from the reached highs may indirectly indicate the construction of a new downward wave. At the same time, a further increase in the quotes of the European currency may lead to the need to make adjustments to the current wave markup, since wave d will turn out in this case to be the longest wave in the composition of the downward trend section. An unsuccessful attempt to break through the 1.1455 mark also indicates that the market is not ready for further purchases of the instrument.

American inflation continues to accelerate.

The euro/dollar instrument fell by 50 basis points on Friday. Demand for the European currency began to decline, which corresponds to the current wave marking but does not correspond to Friday's news background. Christine Lagarde said on Friday that the ECB is ready to adjust monetary policy to reach the inflation target of about 2%. "We understand that the rise in prices worries the residents of the European Union. Our commitment to the goal of price stability remains unwavering, and we will take all necessary measures to stabilize price growth," the ECB president said. This speech was quite neutral since Lagarde did not say anything about raising the interest rate or ending the stimulus program. According to earlier information, it follows that the emergency asset purchase program will be completed in March 2022, but there is no new information about this. It is completely unknown what impact the winter wave of the pandemic will leave on the economy. Let me remind you that in the European Union, up to 50% of the population may become infected in the coming months. That's what the WHO thinks. With such a huge number of patients, it is unlikely that the economy will not suffer in any way. And if it suffers, the plans of the ECB may change. Also on Friday, a report on retail trade with America in December was released. The figures turned out to be sad. Instead of zero sales growth, the markets saw a decrease in volumes by 1.9% m/m. The report on industrial production was no better, it decreased by 0.1% m/m with market expectations of +0.2% m/m. The consumer sentiment index from the University of Michigan also turned out to be weak: only 68.8 with expectations of 70.0. Thus, all the most important reports in America turned out to be weak, but demand for the US currency still rose on Friday. From my point of view, this is evidence that the market is ready to build a downward wave, despite the weak news from the United States.

General conclusions.

Based on the analysis, I conclude that the construction of the ascending wave d can be completed. If this assumption is correct, then now it is possible to sell the instrument based on the construction of the wave e-C with targets located near the calculated marks of 1.1315 and 1.1154, which equates to 100.0% and 127.2% by Fibonacci. A successful attempt to break through the 1.1455 mark will indicate an even greater complication of the upward wave and cancel the sales option.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Struktur gelombang untuk GBP/USD terus menunjukkan perkembangan pola gelombang impuls bullish. Gambaran gelombang ini sangat mirip dengan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif yang meyakinkan tanpa menimbulkan

GBP/USD Analisis: Sejak Januari, pound Inggris telah mengalami tren naik. Segmen yang belum selesai saat ini dimulai pada 8 April. Dalam gelombang ini, segmen terakhir masih belum selesai. Harga telah

EUR/USD Analisis: Sejak bulan April, pasangan utama euro telah membentuk pola bendera horizontal menurun. Dari zona kuat yang berpotensi menjadi zona pembalikan pada timeframe harian di pertengahan Mei, harga mulai

Untuk pasangan GBP/USD, struktur gelombang terus menunjukkan perkembangan tren impulsif bullish. Pola gelombang hampir identik dengan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif yang jelas tanpa keraguan. Namun

struktur wave , sebagian besar dipengaruhi oleh Donald Trump. Pengaturan gelombang hampir identik dengan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif yang meyakinkan dan tidak menimbulkan kekhawatiran. Namun

Pola wave untuk GBP/USD terus menunjukkan pembentukan struktur wave impulsif bullish, berkat Donald Trump. Gambaran wave ini hampir identik dengan pasangan EUR/USD. Hingga 28 Februari, kami mengamati perkembangan struktur korektif

GBP/USD Analisis: Sejak 8 April, GBP/USD telah bergerak naik pada grafik harga. Dari batas bawah zona potensi pembalikan, koreksi balik telah terbentuk selama dua bulan terakhir. Kenaikan dari

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.