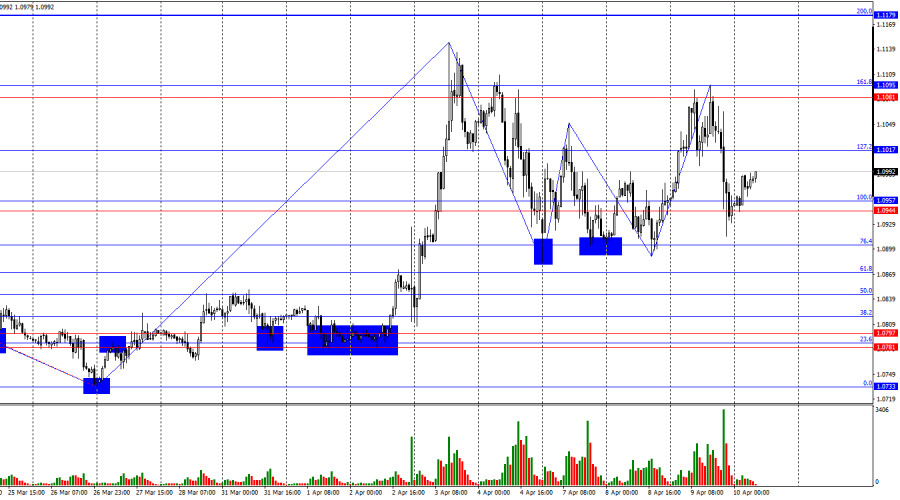

#CSCO (Cisco System, Inc.). Exchange rate and online charts.

Currency converter

10 Apr 2025 22:59

(-0.07%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

#CSCO is symbol of the shares of the U.S. global company Cisco Systems, Inc., whose main activity is focused on the development and sale of network equipment. The company's policy is aimed at providing customers with a wide range of network equipment.

Cisco Systems is the world's largest company specializing in high technology. The main activity of the company is divided into five areas, among which are a backbone routing, commutation and services, products for collaborative work, data centre virtualization and cloud computing, video technology and architecture for business transformation.

The company was established in 1984, and the first products entered the market two years later. Cisco headquarters is in San Jose, California. The total number of offices around the world is about 400. Products, produced by the company, have a wide range of implementation in various areas. The main industries are engineering, metallurgy, oil and gas, building, retail, banking sector, and so on.

Net sales in fiscal year 2013 came in at $48.6 billion. A significant increase by $12.4 billion compared to the previous period was recorded. The Cisco's profit amounts to $10 billion, 24.2% higher than the previous figures. Company’s cash funds reached $50.5 billion. Dividend payments on equity issues were held at the rate of 62 cents per one security. In general, $3.3 billion was spent on these needs. In addition, the purchase of 128 million of unfavoured shares at a cost of $2.8 billion was made according to the program of asset buyout. Thus, the total volume of redemption of shares came in at $78.9 billion.

Shares are securities representing the exclusive ownership in the company. Such a trading tool as contract for difference on shares gives the opportunity to investors to earn from quotations’ change of the companies’ liquid shares while not having a stake in ownership. However, dividend adjustment is added to or debited for client’s account. Usually, it equals to the value of the dividend itself depending on positions direction based on completed contracts.

The risk is compensated by a high yield.

See Also

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

778

Technical analysisTrading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

718

Technical analysis / Video analyticsForex forecast 10/04/2025: EUR/USD, SP500, NASDAQ, Dow Jones, USDX and Bitcoin

Technical analysis of EUR/USD, SP500, NASDAQ, Dow Jones, USDX and BitcoinAuthor: Sebastian Seliga

11:35 2025-04-10 UTC+2

703

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

703

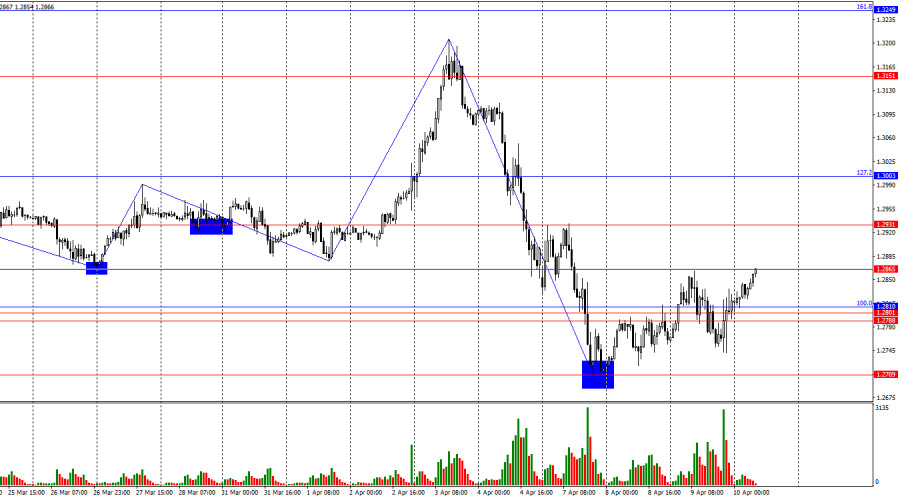

Forecast for GBP/USD on April 10, 2025Author: Samir Klishi

12:12 2025-04-10 UTC+2

703

The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

703

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

688

S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higherAuthor: Irina Maksimova

12:58 2025-04-10 UTC+2

673

Trump Suspends Tariffs for 90 Days but Raises Rates on China Even FurtherAuthor: Jakub Novak

11:57 2025-04-10 UTC+2

673

- Markets remain in shock because of Trump

Author: Samir Klishi

12:19 2025-04-10 UTC+2

778

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 10-12, 2025: sell below $3,145 (21 SMA - 8/8 Murray)

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target at 3,036.Author: Dimitrios Zappas

15:37 2025-04-10 UTC+2

718

- Technical analysis / Video analytics

Forex forecast 10/04/2025: EUR/USD, SP500, NASDAQ, Dow Jones, USDX and Bitcoin

Technical analysis of EUR/USD, SP500, NASDAQ, Dow Jones, USDX and BitcoinAuthor: Sebastian Seliga

11:35 2025-04-10 UTC+2

703

- China Plans Emergency Meeting and a Strong Response to the U.S.

Author: Jakub Novak

12:07 2025-04-10 UTC+2

703

- Forecast for GBP/USD on April 10, 2025

Author: Samir Klishi

12:12 2025-04-10 UTC+2

703

- The flagship cryptocurrency remains in a fragmented state, unable to establish a firm footing.

Author: Larisa Kolesnikova

14:38 2025-04-10 UTC+2

703

- U.S. Inflation Data: What to Know and What to Expect

Author: Jakub Novak

12:09 2025-04-10 UTC+2

688

- S&P 500 posts historic rally, but 5,669 remains key barrier. Temporary tariff suspension fuels gains: S&P 500 and Nasdaq close higher

Author: Irina Maksimova

12:58 2025-04-10 UTC+2

673

- Trump Suspends Tariffs for 90 Days but Raises Rates on China Even Further

Author: Jakub Novak

11:57 2025-04-10 UTC+2

673