#AMZN (Amazon.com, Inc.). Exchange rate and online charts.

Currency converter

04 Jul 2025 22:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AMZN is the shares of the American company Amazon.com Inc. Amazon.com has become one of the largest companies by turnover among those that sell commodities and services online. Besides, it is the first internet service oriented towards sales of mass-market actuals. The Amazon headquarters is located in Seattle, Washington.

The company was founded in 1994; in a year, its main site was launched. Originally, Amazon.com was focused only on selling books, however, at present time, the service takes in 34 types of goods including e-books, household appliances and electronics, toys, food, housewares, etc. The company works in two segments – the United States and international level. Amazon branches are situated not only in USA but also beyond them, for example, in Brazil, Canada, UK, Germany, Japan, France, Italy, India and China.

The company managed to use successfully two main advantages of internet trading - opportunity to address to the largest number of potential customers and availability of vast number of goods irrespectively of their physical presence in a storehouse.

According to the results of the fourth quarter of 2013, the company's earnings were $0.51 per share, which is much more than $0.21 logged in the previous year. However, analysts say that profits are going to grow further, though, at a slower pace. The total earnings for the same period made up $25.59 billion which is more than the figures of 2012 by more than 20%.

See Also

- Technical analysis / Video analytics

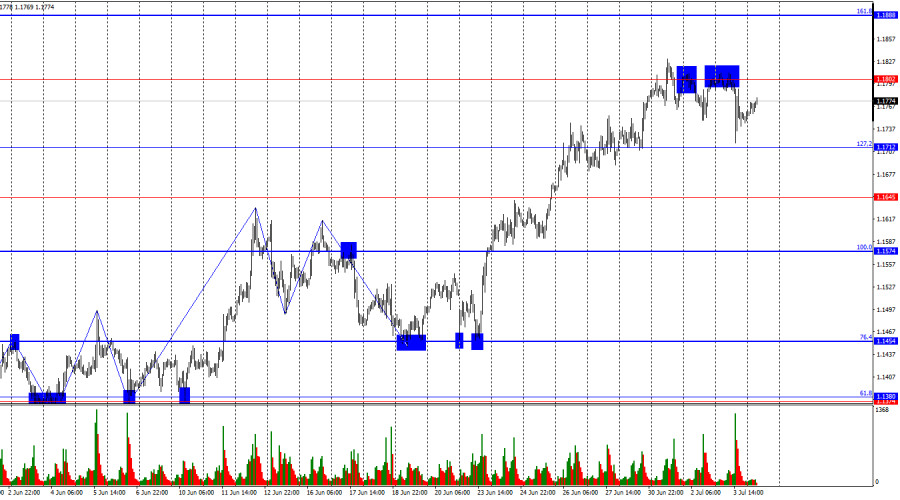

Forex forecast 04/07/2025: EUR/USD, GBP/USD, USD/JPY, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, SP500 and BitcoinAuthor: Sebastian Seliga

10:51 2025-07-04 UTC+2

2743

Bears remain on the runAuthor: Samir Klishi

10:53 2025-07-04 UTC+2

1288

NZD/USD. Analysis and ForecastAuthor: Irina Yanina

18:08 2025-07-04 UTC+2

1153

- The S&P 500 and Nasdaq stock indices rose by 0.83% and 1.02%, respectively, hitting new all-time highs. Index futures, however, retreated due to concerns over the potential introduction of new tariffs, which added to uncertainty in the global market

Author: Ekaterina Kiseleva

12:45 2025-07-04 UTC+2

1153

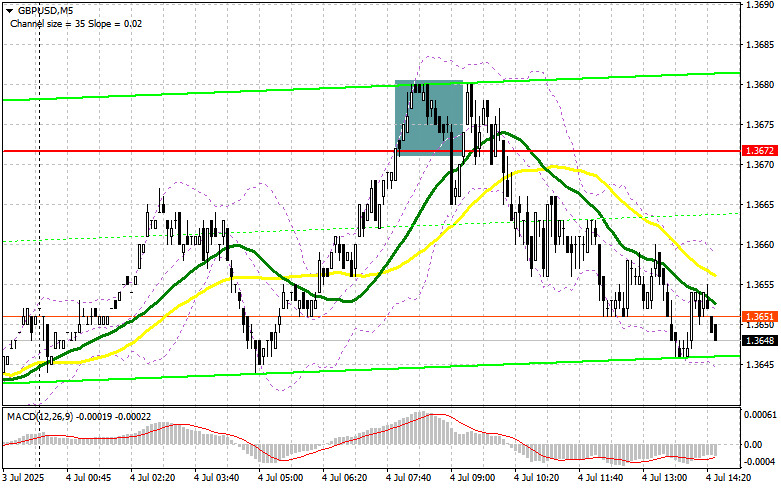

GBP/USD: Trading Plan for the U.S. Session on July 4th (Review of Morning Trades)Author: Miroslaw Bawulski

18:20 2025-07-04 UTC+2

1108

The Market is Preparing for Another ShockAuthor: Jakub Novak

09:55 2025-07-04 UTC+2

1018

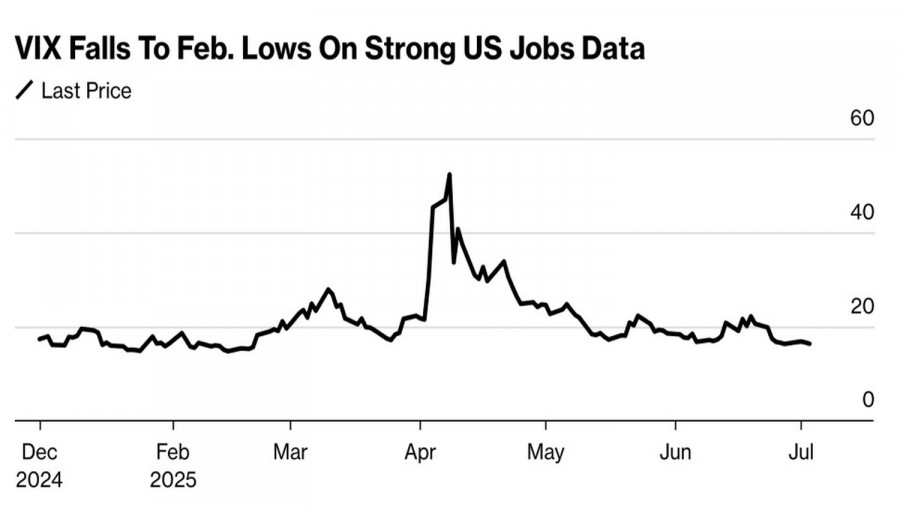

- June employment statistics mark a win for the S&P 500

Author: Marek Petkovich

10:15 2025-07-04 UTC+2

1018

The S&P 500 rose by 0.83%; the Nasdaq gained 1.02%; the Dow advanced by 0.77%. US job growth exceeded expectations in June. Tripadvisor rallied on Starboard Value's report. Synopsys and Cadence climbed as the US lifted restrictions on exports to China.Author: Gleb Frank

13:11 2025-07-04 UTC+2

1003

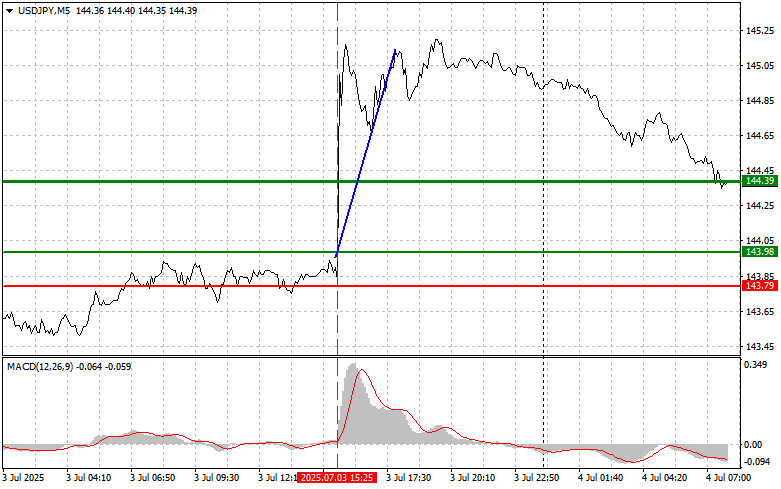

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on July 4. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on July 4. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

08:42 2025-07-04 UTC+2

988

- Technical analysis / Video analytics

Forex forecast 04/07/2025: EUR/USD, GBP/USD, USD/JPY, SP500 and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, SP500 and BitcoinAuthor: Sebastian Seliga

10:51 2025-07-04 UTC+2

2743

- NZD/USD. Analysis and Forecast

Author: Irina Yanina

18:08 2025-07-04 UTC+2

1153

- The S&P 500 and Nasdaq stock indices rose by 0.83% and 1.02%, respectively, hitting new all-time highs. Index futures, however, retreated due to concerns over the potential introduction of new tariffs, which added to uncertainty in the global market

Author: Ekaterina Kiseleva

12:45 2025-07-04 UTC+2

1153

- GBP/USD: Trading Plan for the U.S. Session on July 4th (Review of Morning Trades)

Author: Miroslaw Bawulski

18:20 2025-07-04 UTC+2

1108

- The Market is Preparing for Another Shock

Author: Jakub Novak

09:55 2025-07-04 UTC+2

1018

- June employment statistics mark a win for the S&P 500

Author: Marek Petkovich

10:15 2025-07-04 UTC+2

1018

- The S&P 500 rose by 0.83%; the Nasdaq gained 1.02%; the Dow advanced by 0.77%. US job growth exceeded expectations in June. Tripadvisor rallied on Starboard Value's report. Synopsys and Cadence climbed as the US lifted restrictions on exports to China.

Author: Gleb Frank

13:11 2025-07-04 UTC+2

1003

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on July 4. Analysis of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on July 4. Analysis of Yesterday's Forex TradesAuthor: Jakub Novak

08:42 2025-07-04 UTC+2

988